Crypto Exchange Compliance Checker

CASP Compliance Check

Check if your crypto exchange meets Philippines' CASP requirements as of May 2025.

Compliance Results

Since March 2024, Binance has been completely blocked in the Philippines. The country’s Securities and Exchange Commission (SEC) ordered internet service providers to cut off access to the platform after determining it was operating without a license. By May 2025, the rules got even stricter. The SEC introduced new regulations that apply to every crypto exchange serving Filipino users - including Bitget, even if it hasn’t been named yet in official enforcement notices.

Why Binance Was Blocked

The Philippines SEC didn’t act overnight. It started warning Binance in November 2023 that it wasn’t registered to operate in the country. Binance kept running its platform, running ads on social media, and even paying local influencers to promote trading. The SEC saw this as a direct threat to ordinary Filipinos who were depositing money into an unregulated system with no legal protection. By March 2024, the SEC teamed up with the National Telecommunication Commission (NTC) to block Binance’s website and app. Users trying to log in saw error messages. No warnings. No grace period. Just a hard stop. The SEC made it clear: if you’re not licensed to operate here, you’re not welcome.The New Rules: CASP Framework

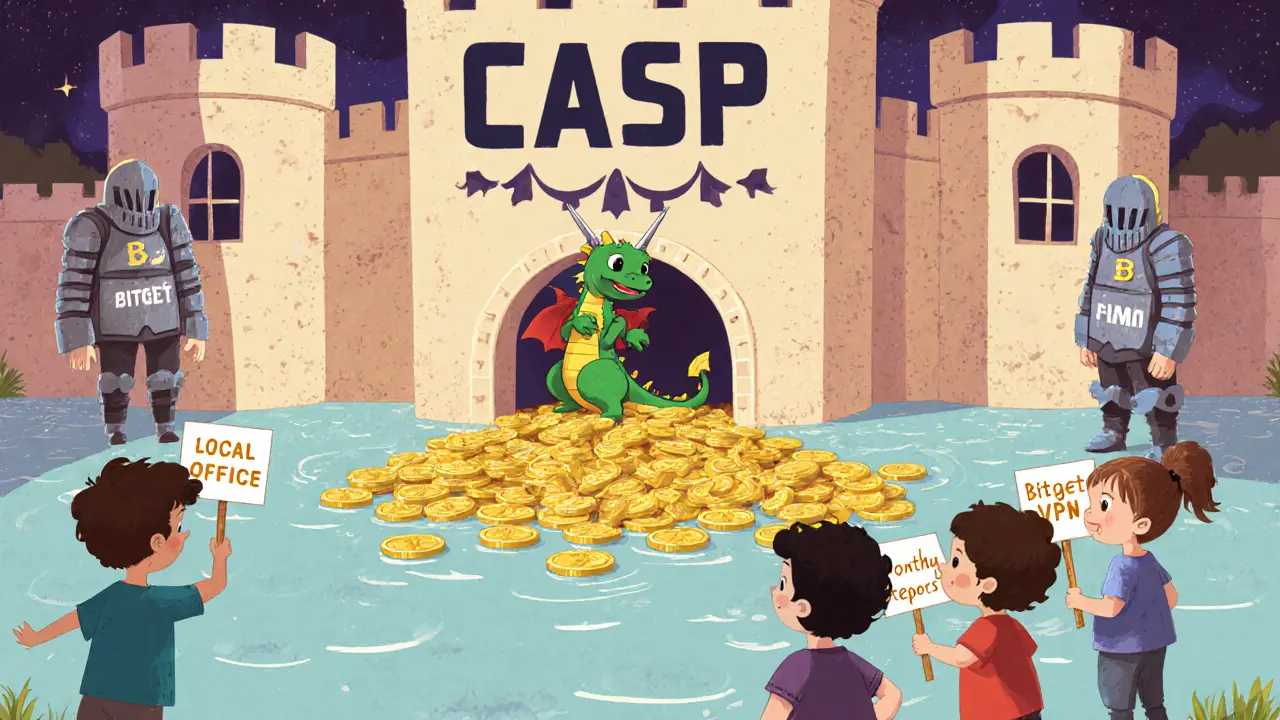

In May 2025, the SEC dropped its biggest move yet: Crypto Asset Service Provider (CASP) regulations. These rules don’t just target Binance - they target every foreign exchange serving Filipinos. To legally operate, any crypto platform must:- Be registered as a domestic corporation in the Philippines

- Hold at least 100 million pesos (around $1.8 million USD) in capital

- Have a physical office inside the country

- Submit monthly financial reports to the SEC

- Keep customer funds completely separate from company money

Is Bitget Blocked Too?

Bitget isn’t officially named in the August 2025 SEC advisory that listed OKX, Bybit, KuCoin, and Kraken. But that doesn’t mean it’s safe. The CASP rules apply to all exchanges serving Philippine users - no exceptions. If Bitget hasn’t registered, it’s operating illegally. The SEC has made it clear they’re not going after one exchange at a time. They’re going after the entire unlicensed market. The pattern is obvious: first Binance, then the big names, then everyone else. Bitget has the same structure as the others - no local office, no Philippine registration, no financial reporting. Unless it changes that, it’s just a matter of time before access is cut off.

What About VPNs?

Many Filipinos are using Virtual Private Networks (VPNs) to bypass the blocks. They connect to servers in Singapore, Japan, or the U.S. and access Binance or Bitget like nothing happened. VPN companies are even running ads in the Philippines promising “unrestricted crypto trading.” But here’s the problem: the SEC says using a VPN to access banned platforms could make you legally liable. If you’re actively trading on an unregistered exchange, you’re participating in an illegal activity. The SEC has warned that anyone promoting these platforms - even as a social media influencer - can face criminal charges. Using a VPN doesn’t make you safe. It just hides your IP address. The SEC still knows the platform you’re using. And if they decide to go after users, they can trace transactions through local bank transfers or e-wallets.What Are Your Legal Options?

There are only two legal paths:- Use a licensed Philippine-based exchange

- Wait for a foreign exchange to register under CASP rules

15 Comments

Eric Redman

November 2, 2025 AT 02:15 AMBro just use a VPN and keep trading. The SEC doesn’t even know who you are. They’re scared of crypto, not protecting anyone.

Phyllis Nordquist

November 2, 2025 AT 15:59 PMWhile I understand the desire for regulation, the SEC’s approach feels more like control than protection. Many Filipinos rely on these platforms for remittances and savings-shutting them down without accessible alternatives leaves people vulnerable in different ways.

Jason Coe

November 3, 2025 AT 11:23 AMLook, I get why the SEC is doing this-FTX was a nightmare, and nobody wants that here. But the problem isn’t Binance or Bitget being evil, it’s that local infrastructure is so underdeveloped. If you want people to use licensed exchanges, you need to make them actually usable-low fees, fast withdrawals, mobile-friendly. Right now? Coins.ph takes three days to process a withdrawal and charges $5. No wonder people risk it.

Brett Benton

November 4, 2025 AT 15:02 PMThis is why I love the Philippines’ crypto scene. People are taking financial sovereignty into their own hands. The SEC wants to lock it down, but you can’t un-invent the internet. If they ban one platform, ten more pop up. The real win is education-teach people how to self-custody, not how to beg for permission.

David Roberts

November 6, 2025 AT 05:59 AMThe CASP framework is a classic regulatory overreach. Capital requirements? Physical offices? This isn’t banking-it’s decentralized finance. You can’t regulate what’s inherently borderless. The SEC is trying to apply 19th century banking laws to 21st century tech. It’s like banning cars because horses are safer.

Monty Tran

November 7, 2025 AT 19:13 PMVPNs are illegal under Philippine law when used to access banned financial services. The SEC has made this clear. Anyone using them is complicit. End of story.

Beth Devine

November 8, 2025 AT 02:33 AMI’m glad someone is finally protecting people from predatory platforms. Too many Filipinos lost everything in 2022. This isn’t about stopping innovation-it’s about stopping exploitation.

Brian McElfresh

November 8, 2025 AT 09:53 AMThis is all a distraction. The SEC is working with Big Finance to crush crypto so traditional banks can keep their monopoly. They don’t care about safety-they care about control. Look at how fast they moved against Binance after it started offering higher yields than local banks. Coincidence? I think not.

Hanna Kruizinga

November 8, 2025 AT 20:37 PMWhy are we even talking about this? The SEC is just trying to look tough. They don’t have the resources to track 10 million users. Meanwhile, the real criminals are still running Ponzi schemes under the radar. This is performative regulation.

David James

November 10, 2025 AT 09:00 AMI think the SEC is doing the right thing. People need to be protected. If you want to trade crypto, use a local exchange. It’s not hard. Just move your money and be safe. No need to risk it.

Shaunn Graves

November 10, 2025 AT 13:45 PMYou call this protection? The SEC blocked Binance but let local exchanges charge 5% fees and freeze withdrawals for weeks. That’s not regulation-that’s corruption dressed up as policy. Who benefits? The ones with licenses. Not the users.

Elizabeth Melendez

November 10, 2025 AT 19:16 PMI’ve been using PDAX for a year now and honestly it’s been fine-deposits take a bit longer than Binance but at least I know if something goes wrong, I can call someone and they’ll answer. The SEC’s rules might seem overkill but after seeing friends lose everything in 2022, I’d rather have slow access than zero recourse. Also, I switched to a hardware wallet for long-term stuff. That’s the real win-owning your keys. No exchange can take that from you.

Debby Ananda

November 12, 2025 AT 11:45 AMHonestly, the fact that you’re even debating this shows how far we’ve fallen. Crypto was supposed to be about freedom, not bureaucratic compliance. The SEC wants to turn decentralized finance into a licensed franchise. Pathetic. 🤦♀️

Malinda Black

November 13, 2025 AT 18:22 PMTo everyone still using VPNs: I get it, you want to keep trading. But think about the people who don’t know the risks. Imagine a 65-year-old grandma who lost her pension because she trusted a platform that vanished overnight. That’s why these rules exist. It’s not about stopping you-it’s about protecting the ones who can’t fight back.

Eliane Karp Toledo

November 14, 2025 AT 19:18 PMThey banned Binance because it was too popular. They’re scared. If everyone used local exchanges, the banks would lose control. This isn’t about safety-it’s about power. And guess what? The moment someone builds a truly decentralized, unblockable wallet, all these laws become meaningless. They’re just delaying the inevitable.