If you’re new to cryptocurrency and looking for a simple way to buy Bitcoin or Ethereum without getting lost in complex charts and margin trades, you’ve probably heard of CoinFalcon. But here’s the real question: is it actually safe, or are those glowing reviews hiding something darker?

CoinFalcon launched in 2017 as a UK-based exchange built for one thing - making crypto buying feel like using a mobile banking app. No confusing order books. No leverage. No futures. Just buy, sell, and hold. It targets European users who want to use euros via SEPA transfers or credit cards and get straight into crypto without jumping through hoops. Sounds great, right? But the truth is more complicated.

What CoinFalcon Actually Offers

CoinFalcon supports around 30 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and XRP. That’s not much compared to Binance’s 350+ or even Coinbase’s 100+. But if you’re just starting out, you probably don’t need 300 coins. You need the big ones. And CoinFalcon gives you those.

The interface is barebones - in a good way. There’s no clutter. No advanced indicators. No margin trading. Just a clean screen with a “Buy” button, a “Sell” button, and your balance. You don’t need to learn what a limit order is. You just pick the coin, enter the amount in euros, and hit confirm. That’s it. Three steps. No jargon. That’s why some users call it “the easiest place to buy crypto.”

The mobile app, CoinFalcon 2.0, works smoothly on both iOS and Android. It’s not fancy, but it does what it promises: lets you check prices, send crypto, and top up your account with a card. No API access. No trading bots. No developer tools. If you’re looking to automate trades or build a strategy, look elsewhere. But if you just want to own some Bitcoin without a PhD in finance, this fits.

Fees and Spreads: The Hidden Cost

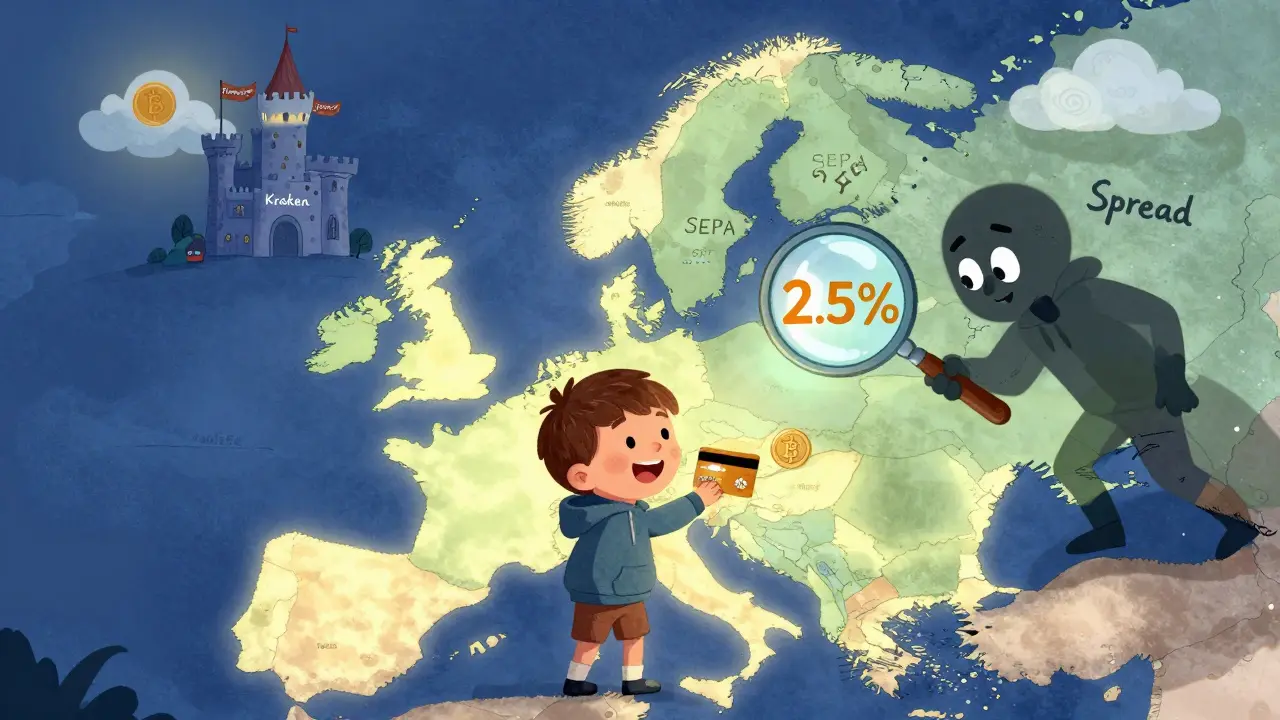

CoinFalcon charges a 0.20% taker fee - that’s lower than Coinbase’s 0.50% and not far off from Binance’s 0.10%. On paper, it looks fair. But here’s where things get tricky: spreads.

Spread is the difference between what you pay to buy and what you get when you sell. On CoinFalcon, during normal market conditions, spreads hover around 1.5%. During volatility - say, when Bitcoin jumps 10% in a day - they spike to over 2.5%. That’s huge. On Binance or Kraken, you’d see 0.1% to 0.5%. That means if you buy $1,000 worth of Ethereum on CoinFalcon during a spike, you’re already $25 in the hole before the price even moves. You’re not losing because the market went down. You’re losing because the exchange itself charged you extra.

This isn’t hidden. It’s just not shouted from the homepage. You’ll only notice it when you try to sell and realize you got less than you expected. Experienced traders call this a “sneaky fee.” Beginners? They think they got a bad deal on the market.

Security: Cold Storage and Trust

CoinFalcon claims 98% of user funds are stored in offline cold storage. That’s a solid number - better than many exchanges that brag about “bank-level security” but keep too much online. They also use two-factor authentication and email confirmations for withdrawals. No red flags there.

But here’s the problem: there’s no public audit. No third-party verification. No published report from a cybersecurity firm like CertiK or Hacken. Binance and Kraken publish these. CoinFalcon doesn’t. That’s not illegal, but it’s a red flag if you care about transparency.

And while they say they’re UK-regulated, they’re not licensed by the FCA as a crypto asset firm. That doesn’t mean they’re illegal - just that they operate under looser rules. If something goes wrong, you won’t get protection from the UK’s Financial Services Compensation Scheme.

User Experience: Love It or Hate It

This is where CoinFalcon splits in half.

On Affgadgets, 67% of users gave it five stars. One reviewer, Vladimir Stu, praised support rep Roel: “He answered all my questions within minutes.” Another, Max Lehmann, said they “remarkably quick to implement suggested features.” People love how fast deposits go through. SEPA transfers clear in under 24 hours. Card payments are instant. Verification takes 1-2 days - not weeks like on some US exchanges.

But flip over to Trustpilot. 41 reviews. 1.4 out of 5 stars. That’s not a typo. One user, kryptoknabe, wrote: “CoinFalcon is the best platform if you want to be relieved of your money.” Another, hendrikrommen, accused them of “illegal activities” and said they’d started legal proceedings. The pattern? People who lost money complain about sudden token delistings, slow support, and funds being locked without warning.

Joe Carew, a user on Affgadgets, said his XLM was removed from the platform without any email notice. He couldn’t trade it anymore. No explanation. No refund. Just gone. That’s happened to others too. CoinFalcon doesn’t publish a list of upcoming delistings. You find out when your coin disappears from your portfolio.

And if you’re from the US? You’re out of luck. CoinFalcon restricts access to most states since 2019. No exceptions. No workarounds. If you’re not in Europe, skip it.

Who Should Use CoinFalcon - And Who Should Avoid It

Use CoinFalcon if:

- You’re in Europe and want to buy crypto with euros via SEPA or card

- You’ve never traded before and find other platforms overwhelming

- You only want Bitcoin, Ethereum, or Litecoin - nothing exotic

- You don’t care about advanced tools, charts, or API access

Avoid CoinFalcon if:

- You trade frequently or use stop-losses - the spreads will eat your profits

- You hold altcoins like Solana, Polygon, or Dogecoin - they might vanish without notice

- You need customer support during a crisis - many report long waits or no replies

- You’re from the US or outside Europe - you can’t even sign up

- You value transparency - no audits, no public roadmap, no clear rules on delistings

The Bottom Line

CoinFalcon isn’t a scam. It’s real. It’s operational. It’s been around for eight years. But it’s also a gamble.

It’s like a fast-food burger joint that makes perfect fries but never tells you what’s in the meat. You get simplicity. You get speed. You get low fees - on paper. But you also get hidden costs, unpredictable delistings, and a reputation that’s falling apart.

If you’re a beginner in Germany, France, or the Netherlands and just want to buy your first Bitcoin without stress? CoinFalcon might work. It’s easy. It’s fast. It gets the job done.

But if you’re serious about crypto - even a little - you’re better off starting with Kraken or Coinbase. They have audits. They have transparency. They have better spreads. And yes, they’re a little more complex. But they won’t disappear your coins without warning.

CoinFalcon feels like a shortcut. And shortcuts often lead to dead ends.

Is CoinFalcon safe to use in 2026?

CoinFalcon uses 98% cold storage and two-factor authentication, which are good security practices. However, it lacks third-party audits, doesn’t publish security reports, and isn’t licensed by the UK’s FCA as a crypto asset firm. This means there’s no official oversight if something goes wrong. While it’s not a scam, the lack of transparency raises red flags for long-term safety.

Does CoinFalcon support US users?

No. CoinFalcon has restricted access to most U.S. states since 2019. Even if you’re a U.S. citizen living abroad, you likely won’t be able to sign up or deposit funds. The platform is designed exclusively for European users with SEPA bank accounts or Euro-denominated cards.

Why are CoinFalcon’s spreads so high?

CoinFalcon makes money by widening the gap between buy and sell prices - especially during market volatility. While their stated trading fee is 0.20%, the spread can jump to 2.5% or more during price swings. This means you lose money even if the coin’s price doesn’t move. It’s not a fee you pay upfront - it’s hidden in the price you’re given. This is common on smaller exchanges but rare on major ones like Binance or Kraken.

Can I lose my crypto on CoinFalcon?

Yes - not because of a hack, but because CoinFalcon can delist coins without warning. Multiple users reported their tokens (like XLM or LTC) disappearing from their portfolios overnight, with no email, no notice, and no way to withdraw them. The exchange doesn’t explain why they remove coins, and there’s no official list of upcoming delistings. If you hold lesser-known tokens, you’re at risk.

Is CoinFalcon better than Coinbase for beginners?

For European users, CoinFalcon is simpler and cheaper on fees - but Coinbase is safer. Coinbase has a 4.6/5 Trustpilot rating, full regulatory compliance, clear delisting policies, and better spreads. CoinFalcon’s 1.4/5 rating and hidden costs make it riskier, even if it feels easier. If you’re truly new, Coinbase’s customer support and transparency are worth the slightly higher fees.

What to Do Next

If you’ve already signed up on CoinFalcon and are holding crypto, monitor your balance closely. Check for any sudden changes in your coin list. If a token disappears, try to withdraw it immediately - before they lock it down.

If you’re thinking about signing up, start small. Deposit only what you’re willing to lose. Test the support by asking a simple question. See how fast they reply. Then, try a small buy and sell. Watch the spread. If you’re losing 2% just to move in and out, walk away.

For serious beginners, consider starting with Kraken or Coinbase. They’re not perfect, but they’re built to last. CoinFalcon feels like a temporary fix - and in crypto, temporary fixes often break.

12 Comments

Kaz Selbie

February 10, 2026 AT 22:40 PMThis exchange is a trap for beginners. I used it for a month and got burned by a sudden delisting. No warning. No email. Just poof - my XLM vanished. And the spread? 2.5% on a simple buy-sell cycle. That’s not a fee, that’s theft dressed up as convenience. Avoid like a phishing link.

Brittany Meadows

February 11, 2026 AT 22:59 PMLMAO they call it 'simple'... yeah, simple like a credit card scam. 98% cold storage? Cool. But no audits? No FCA license? 🤡 They’re not trying to be safe - they’re trying to be *invisible*. When the SEC comes knocking, who’s gonna bail out the 'beginners' who trusted this? 😂

krista muzer

February 12, 2026 AT 16:30 PMi mean... i get why people like it. it's easy. i bought my first btc here after being scared off by coinbase's interface. but then i tried to sell and realized i lost like 3% just from the spread. it's not that they're evil... they're just... really bad at being honest. i still use it for tiny buys but i keep 90% on kraken now. not perfect, but at least they tell you the rules.

Tammy Chew

February 13, 2026 AT 23:52 PMThe fact that you're even considering this platform is concerning. You're not a beginner - you're a liability. If you can't handle the complexity of Kraken or Coinbase, you shouldn't be in crypto at all. This isn't a banking app. It's a decentralized ecosystem. Stop treating it like a vending machine for 'easy money'.

Christopher Wardle

February 15, 2026 AT 12:34 PMThere’s truth in both sides. CoinFalcon delivers simplicity, yes. But simplicity without transparency is just opacity with a smile. The spreads are the real issue - they’re not listed, they’re embedded. That’s not user-friendly. It’s predatory. A regulated exchange doesn’t hide its costs. It explains them.

SAKTHIVEL A

February 17, 2026 AT 05:01 AMOne must acknowledge the structural asymmetry inherent in CoinFalcon’s operational model. The absence of third-party attestation, coupled with non-disclosure of delisting protocols, constitutes a violation of fiduciary transparency norms. Furthermore, the spread manipulation during volatility indices suggests a deliberate obfuscation of true pricing mechanisms, which is antithetical to the ethos of decentralized finance.

Ace Crystal

February 18, 2026 AT 13:15 PMLook, I get it. You want to buy crypto without a PhD. But this isn’t a shortcut - it’s a trapdoor. I started here too. Bought BTC, felt smart. Then I tried to sell ETH during a spike and got $40 less than I expected. I thought the market crashed. Turns out, CoinFalcon just ate my profit. Don’t be fooled. Simplicity is a sales tactic. Not a feature.

Lindsey Elliott

February 18, 2026 AT 21:36 PMi just tried to withdraw 0.1 ETH and it took 5 days. no updates. no emails. just silence. then i checked the app and my balance was gone. i called support. they said 'we don’t handle withdrawal issues'. like?? what do you do then? i’m done. this is why people get scammed. they think 'easy' means 'safe'.

Desiree Foo

February 19, 2026 AT 05:37 AMAs a US resident, I can't even sign up - and I'm glad. This platform preys on the naive. No FCA license? No audits? Delisting coins without notice? That’s not a crypto exchange. That’s a Ponzi scheme with a mobile app. I’ve seen too many people lose everything because they trusted 'easy'. Don’t be one of them.

Keturah Hudson

February 20, 2026 AT 11:57 AMI’m from the Philippines and I used CoinFalcon through a friend’s EU account. It worked... until they delisted my ADA. No warning. No refund. I didn’t even know it was gone until I checked my portfolio. I’ve since moved to Binance - yes, it’s more complex, but at least they tell you when they’re removing something. Culture matters. Transparency matters. This? This is just... lazy.

Santosh kumar

February 22, 2026 AT 09:40 AMI am not against simplicity. But simplicity without accountability is dangerous. CoinFalcon is like a bicycle with no brakes - fast, easy, but one wrong turn and you’re on the ground. I’ve used it for small purchases. I never hold more than I can afford to lose. But I don’t trust it. I respect it. And I keep my eyes open.

Robbi Hess

February 22, 2026 AT 16:16 PMI used to love CoinFalcon. Then I lost $1,200 in a single day because they delisted my LTC and locked it. No email. No warning. No apology. Just... gone. I contacted support. They said 'we’re not responsible for asset availability'. That’s not customer service. That’s corporate cowardice. I’m done. I’m moving to Kraken. And I’m telling everyone I know to do the same.