Trading Crypto in Vietnam Is Now Legal - But Only Under Strict Rules

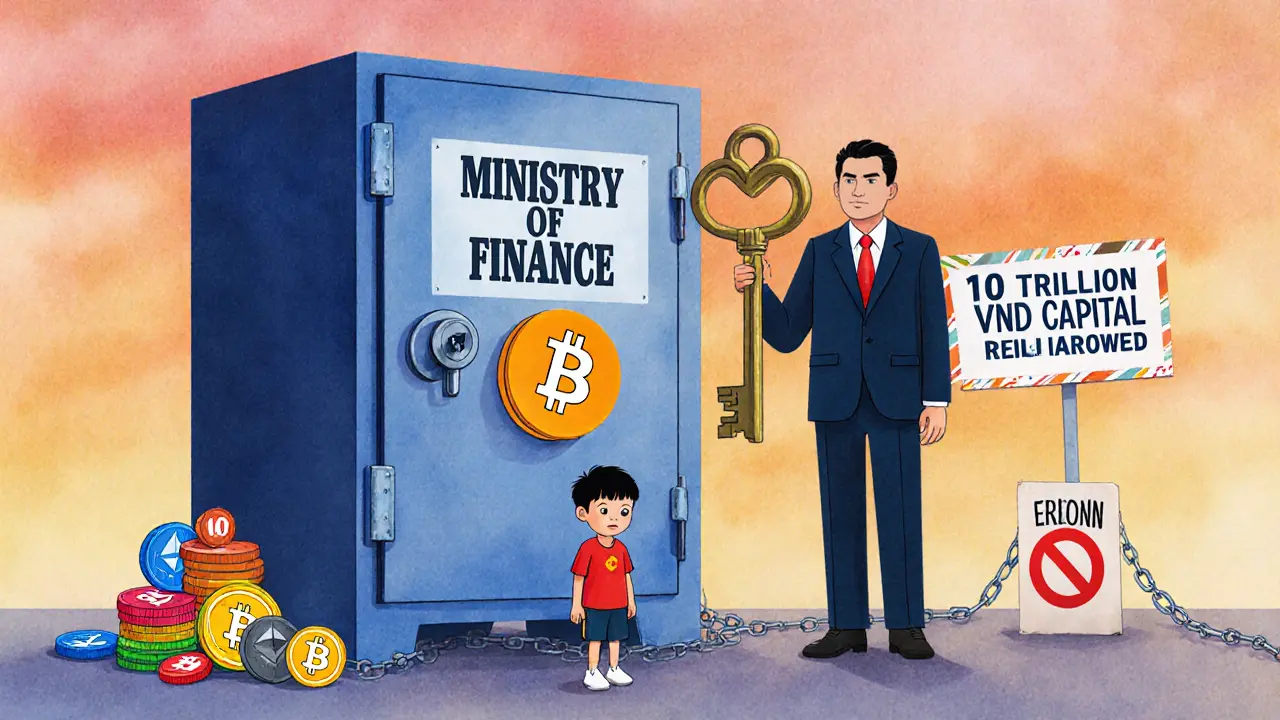

As of January 1, 2026, you can legally trade cryptocurrency in Vietnam - but not how you might expect. The government didn’t open the floodgates. Instead, it built a cage. Under Resolution No. 05/2025/NQ-CP and the Digital Technology Industry Law, crypto trading is now permitted, but only on platforms licensed by the Ministry of Finance. And those platforms? They need at least 10 trillion VND (about $379 million USD) in capital. Most of that - 65% - must come from Vietnamese institutional investors. Foreign companies can own no more than 49% of these exchanges. This isn’t just regulation. It’s a state-controlled market.

The law doesn’t just set rules. It redefines what crypto even is. Under Vietnam’s new definition, crypto assets are digital tokens authenticated through encryption, separate from securities, fiat currency, or in-game currencies. Bitcoin, Ethereum, and even stablecoins like USDT now have legal status - but only as assets you can trade, not as money you can spend. That’s the key split: trading and payment are treated as two completely different things.

Why You Can’t Use Bitcoin to Buy Coffee - Yet

Here’s the catch: while trading crypto is allowed under strict conditions, using it to pay for goods or services? That’s still a gray zone. The law says all crypto transactions must be conducted in Vietnamese dong (VND). That means if you want to trade Bitcoin for Ethereum, you can’t do it directly. You have to convert Bitcoin to VND first, then use VND to buy Ethereum. The same rule applies to any exchange between crypto assets. This isn’t about convenience - it’s about control. The government wants every dollar of value to pass through its system, tracked and taxed.

So can you pay your landlord in Bitcoin? Can a Vietnamese online store accept Dogecoin? The law doesn’t say. There are no rules yet for peer-to-peer crypto payments, business-to-consumer crypto transactions, or even crypto remittances. That silence isn’t an accident. It’s intentional. The government is waiting to see how trading plays out before deciding if payments are safe to allow. Until then, using crypto as money remains legally risky - even if it’s technically possible.

What Happens If You Trade on an Unlicensed Platform?

Before January 1, 2026, Vietnam’s crypto market operated in the shadows. Millions of people used Binance, Bybit, and other global exchanges. Now, those platforms are effectively illegal for Vietnamese users. After the first licensed exchange opens, there’s a six-month grace period. After that, any trading on unlicensed platforms becomes a legal violation. You won’t go to jail - at least not yet - but you could face fines, asset freezes, or account blocks. The Ministry of Finance has not released full penalty details, but they’ve made it clear: compliance is mandatory.

That means 20 million Vietnamese crypto users must switch platforms. Most won’t even know how. There are no public lists of approved exchanges yet. The first licenses are expected to go to state-backed financial institutions, not startups. Expect the market to be dominated by a handful of big players - maybe just two or three. Competition will be low. Innovation will be slow. And for users? It means less choice, higher fees, and slower service.

Why the 9 Million Minimum Capital Matters

Why does Vietnam demand $379 million just to run a crypto exchange? It’s not about security. It’s about exclusion. That number is higher than any other country’s requirement - even in the U.S. or EU. It’s designed to keep out small players, foreign firms, and speculative startups. Only deep-pocketed Vietnamese banks or conglomerates can afford it. That’s the point. The government doesn’t want a wild west of crypto startups. It wants a controlled, predictable, state-approved financial product.

This rule also means crypto trading won’t become a mass-market service anytime soon. It’ll be treated like a luxury financial instrument - something only the wealthy or well-connected can access. Retail investors might be able to trade, but they’ll be forced through a narrow, expensive funnel. And if you’re not using a licensed platform? You’re already breaking the law, even if you don’t realize it.

What’s Missing? Mining, Taxes, and Payment Rules

For all its detail, the law leaves big gaps. No one knows if crypto mining is legal. No one knows how crypto profits will be taxed. No one knows if you can use crypto to send money to family overseas. The Ministry of Finance says guidance is coming before January 2026, but so far, there’s nothing concrete.

That uncertainty is dangerous. Businesses are holding off on accepting crypto. Investors are waiting to see if their holdings will be taxed at 20% or 35%. Freelancers who get paid in crypto don’t know if they need to report it as income. And for people using crypto as a hedge against inflation? They’re left in the dark.

The law also doesn’t mention NFTs or utility tokens in any practical way. While they’re legally recognized as digital assets, there’s no guidance on how they’re taxed, transferred, or enforced. Are NFTs inheritable? Can they be seized in a lawsuit? The answer? Unknown.

Is This a Step Forward or a Step Back?

On paper, Vietnam’s move is historic. For the first time, crypto has legal status. Ownership rights are protected. Smart contracts can be enforced. That’s huge. But the reality is more like a high-security prison than a marketplace. The government didn’t just regulate crypto - it domesticated it. It took the decentralized, permissionless nature of blockchain and forced it into a state-run financial system.

Compare this to Thailand or Singapore, where crypto exchanges operate with more freedom. Vietnam chose control over innovation. It chose stability over disruption. And while that might prevent scams and money laundering, it also kills the very spirit that made crypto appealing in the first place.

For users, it means less risk of fraud - but also less freedom. For entrepreneurs, it means no room to build. For investors, it means higher barriers and fewer options. The five-year pilot program gives the government time to adjust. But if the rules stay this tight, Vietnam’s crypto market could become a ghost town - full of regulation, empty of activity.

What Should You Do Right Now?

- If you’re trading on Binance or another foreign exchange: Stop. You’re already in violation once the first licensed platform opens. Start preparing to move your assets.

- If you’re using crypto to pay for goods: Pause. There’s no legal protection. If a dispute arises, you have no recourse.

- If you’re a business: Don’t start accepting crypto yet. Wait for official payment rules from the Ministry of Finance.

- If you’re holding crypto: Keep records. When tax rules come, you’ll need proof of purchase, sale, and transfers.

- If you’re thinking of launching a crypto service: Don’t. The capital requirement makes it impossible for startups. The market is closed.

The clock is ticking. January 1, 2026, isn’t far off. The government has given you a warning. Now you have to decide: adapt, or get left behind.

18 Comments

Liz Watson

November 13, 2025 AT 19:52 PMSo let me get this straight - they’re letting you trade crypto but not spend it? Like, you can own a digital gold bar but can’t buy a sandwich with it? This isn’t regulation, it’s performance art. 🤡

Gavin Jones

November 14, 2025 AT 20:14 PMI mean, i get why they're doing it. Vietnam's been burned by crypto scams before. But locking it down this hard? Feels like putting a lock on a door that's already been kicked in. 20 million users are gonna find a way. Always do.

Hamish Britton

November 15, 2025 AT 12:37 PMThe 10 trillion VND cap is wild. That’s more than what some national banks have. They’re not building a marketplace - they’re building a country club. And the membership fee is a billion dollars.

Katherine Wagner

November 15, 2025 AT 15:10 PMWho even needs NFTs anyway??

Hannah Kleyn

November 16, 2025 AT 05:14 AMI think the real question is whether the government actually believes crypto is dangerous or if they just want to control the narrative. The fact that they didn’t ban it outright but made it so hard to use… that’s political theater. It’s not about safety. It’s about power.

Robert Astel

November 18, 2025 AT 00:23 AMyou know what this reminds me of? like when the government tried to regulate the internet in the 90s and everyone just used p2p and tor and stuff? this is the same energy. people are gonna find ways to trade and pay and mine and send money overseas even if the law says no. because humans are wired to bypass walls. its not about legality its about human nature. and if you try to cage a bird it just learns to fly quieter. and then you get black markets and overpriced middlemen and no one wins. except maybe the state bank. but even theyll be stuck with a dead system.

Kevin Hayes

November 18, 2025 AT 18:48 PMThe irony is that by forcing all trades through VND, they’re not eliminating volatility - they’re just shifting it. Every conversion is a taxable event. Every trade becomes a financial transaction subject to oversight. They think they’re creating stability, but they’re just creating friction. And friction kills adoption. Crypto thrives on speed, permissionlessness, and liquidity. This? This is a slow-motion chokehold.

gary buena

November 20, 2025 AT 09:02 AMlol so now you need 379 million to run an exchange? bro if you're that rich why are you even doing crypto? just buy a small island and start your own country. at least then you'd have real freedom. also i bet the first license goes to vietcombank or something. imagine having to log in to your bank's crypto portal like it's online bill pay. 'welcome to your regulated crypto vault. please enter your 7-digit pin and confirm your mother's maiden name.'

tom west

November 20, 2025 AT 13:37 PMThis isn’t regulation. It’s economic suicide. You don’t control innovation by raising capital requirements. You kill it. Vietnam is turning its crypto market into a museum exhibit - shiny, empty, and completely irrelevant to the real world. Meanwhile, Thailand is building DeFi hubs. Singapore is onboarding institutional capital. And Vietnam? They’re making people convert BTC to VND to buy ETH. That’s not finance. That’s medieval accounting.

Andrew Parker

November 21, 2025 AT 10:27 AMI just… I feel so sad. 😔 Like, crypto was supposed to be about freedom. About breaking chains. And now? Now it’s just another bureaucratic nightmare. They took the soul of decentralization and put it in a suit. And now it has to file quarterly tax forms. I don’t know if I can even look at my portfolio anymore. It’s like watching your child become a corporate drone. 💔

Johanna Lesmayoux lamare

November 22, 2025 AT 19:14 PMI just hope they clarify taxes before 2026. I’ve been holding since 2021 and have no idea what I owe.

Mauricio Picirillo

November 23, 2025 AT 14:14 PMHonestly? I’m impressed they didn’t just ban it outright. At least now there’s a path. Even if it’s narrow. The key is to play the long game. Build relationships with the licensed exchanges. Keep records. Stay quiet. And when the rules loosen - maybe in 3-5 years - you’ll be the one who didn’t panic and got in early. Patience wins.

Rachel Everson

November 25, 2025 AT 09:36 AMIf you’re holding crypto right now, don’t panic. Just start documenting everything - dates, amounts, platforms. When the tax rules drop, you’ll thank yourself. And if you’re trading on Binance? Start moving your stuff slowly. Don’t wait till the last minute. The first licensed exchange might be slow as molasses. Better to get ahead of it.

Debraj Dutta

November 25, 2025 AT 12:39 PMVietnam has always been pragmatic. They saw the chaos in other markets and chose control. It’s not perfect, but it’s sustainable. The real winners will be the banks and state-backed firms. The rest of us? We’ll adapt. Or we’ll leave. Simple as that.

ty ty

November 26, 2025 AT 12:13 PMSo you can’t use crypto to pay for coffee? Then why even bother? It’s not money. It’s a video game currency with extra steps. I’d rather just use cash. At least cash doesn’t make me do 3 tax forms every time I buy a burrito.

ratheesh chandran

November 28, 2025 AT 01:50 AMi think this is good because now no more scam coins right? like no more dogecoin or shiba or whatever? and the government will protect us from bad people. also i think mining should be allowed because it uses electricity and vietnam has lots of power. but maybe they will ban it because they are scared. i dont know. but i trust the government. they know better than me.

BRYAN CHAGUA

November 29, 2025 AT 14:47 PMThe long-term vision here might be clearer than it appears. By forcing all crypto activity through state-monitored channels, they’re laying the groundwork for a digital currency infrastructure. This isn’t just about controlling Bitcoin - it’s about preparing for a state-backed CBDC. The restrictions today are the foundation of tomorrow’s financial architecture. It’s not anti-innovation. It’s infrastructure planning.

Rachel Anderson

December 1, 2025 AT 04:55 AMI mean… if I can’t even buy a latte with my ETH, then what’s the point? It’s like having a VIP pass to a concert that’s been canceled. The velvet rope is still there. The bouncer is still smiling. But the stage? Empty. And now I have to pay $200 just to stand in line. I’m not mad. I’m just… deeply disappointed. 🎻