Gravity Finance Liquidity & Slippage Calculator

Gravity Finance has extremely limited liquidity. Most trading pairs have less than $100 of liquidity depth. Even small trades experience significant slippage. This calculator shows you exactly how much slippage you'd experience for your trade size on Gravity Finance.

Based on data from November 2025

- USDC.E/GFI $87 2% Depth

- GFI/WS $72 2% Depth

- GFI/STS $45 2% Depth

- WETH/GFI $93 2% Depth

No calculation yet

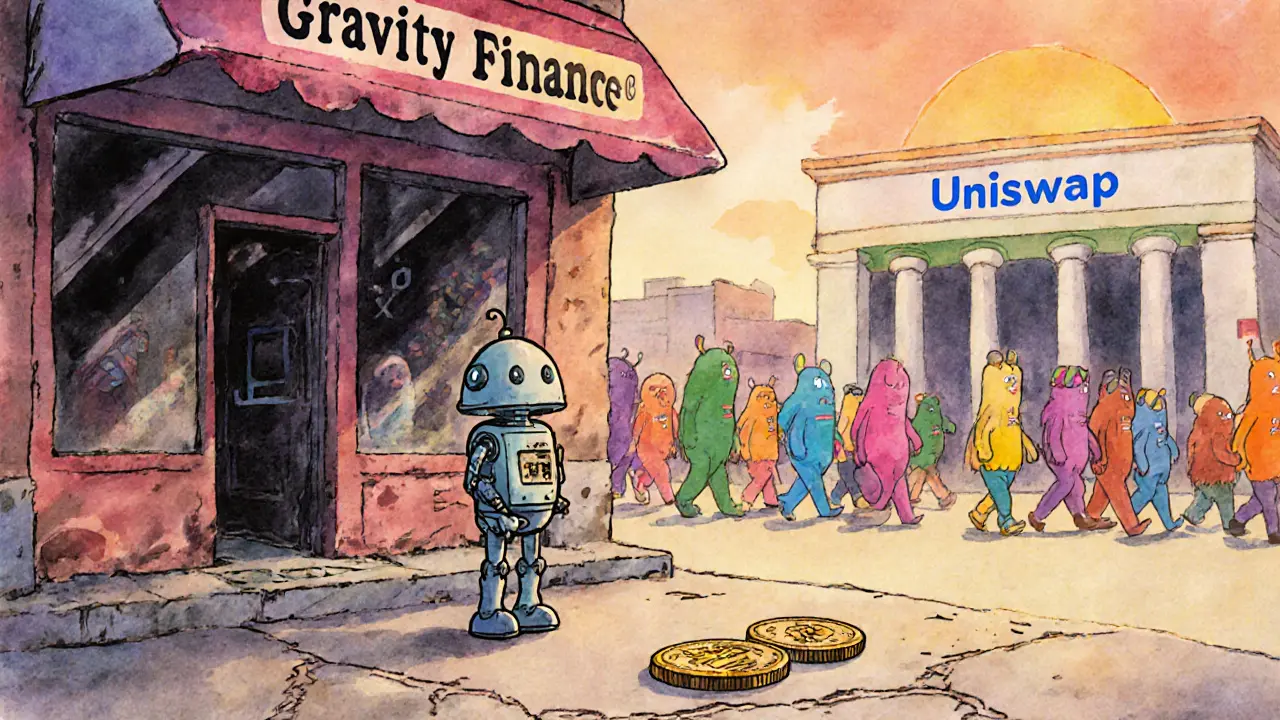

When you’re looking for a new crypto exchange, you want speed, liquidity, and trust. But what if the platform you’re considering has Gravity Finance trading pairs that move less than $20 a day? That’s not a glitch-it’s the reality. Gravity Finance is a decentralized exchange (DEX) launched in 2021, built on the Sonic network and powered by Equalizer. It’s not a household name. It’s not even a footnote in most crypto discussions. And for good reason.

What You Can Actually Trade on Gravity Finance

| Trading Pair | Daily Volume | Price Spread | 2% Depth |

|---|---|---|---|

| USDC.E/GFI | $18.50 | 0.75% | $87 |

| GFI/WS | $12.30 | 0.72% | $72 |

| GFI/STS | $9.00 | 0.69% | $45 |

| WETH/GFI | $15.80 | 0.78% | $93 |

Gravity Finance supports just seven coins: GFI (its native token), USDC.E, WS, STS, WETH, and two others with minimal visibility. That’s it. Eight trading pairs total. Compare that to Uniswap, which offers over 10,000 pairs, or even smaller DEXs like SushiSwap that list hundreds. Gravity Finance doesn’t just sit at the bottom of the barrel-it’s in a different barrel entirely.

The daily volume on most pairs hovers between $9 and $20. That’s not enough to cover the cost of a coffee in most cities, let alone sustain a trading platform. Slippage is high. If you try to buy $100 worth of GFI, you’ll likely pay 10% more than the listed price because there’s no one else on the other side of the trade. The 2% depth-the amount of liquidity available before the price moves significantly-is under $100 for most pairs. That means even small trades can tank the price.

The GFI Token: Confusion and Uncertainty

Gravity Finance’s native token, GFI, is the only reason anyone interacts with this exchange. But even that’s messy. There are at least three different tokens with similar names floating around DeFi. One is tied to Gravity Finance. Another is linked to a defunct project from 2022. A third is being promoted by random Telegram groups. CoinGecko and CoinCodex don’t even agree on its market cap.

Price predictions? They’re all over the place. Some bots say GFI will hit $0.05 by 2026. Others say it’s already dead. The Fear & Greed Index for GFI sits at 50-neutral. But that’s not because people are calm. It’s because no one’s trading it. There’s no sentiment. No hype. Just silence.

If you’re holding GFI, you’re not investing in a platform. You’re betting on a ghost town that might get rebuilt. And even then, who’s going to rebuild it? There’s no public roadmap. No development blog. No GitHub activity. No team bios. The project launched in 2021 and hasn’t shared a single update since.

Security, Audits, and Transparency: A Black Box

Every serious DeFi project publishes its smart contract audits. Gravity Finance doesn’t. You can’t find a single security report, code review, or vulnerability disclosure. That’s not normal. It’s a red flag.

It operates on the Sonic network through Equalizer, which means you’re trusting two layers of untested infrastructure. Sonic itself is a niche blockchain with limited adoption. Equalizer is a small aggregator. Neither has the track record of Ethereum, Polygon, or Arbitrum. If something goes wrong-like a liquidity pool drain or a contract exploit-there’s no insurance, no recovery team, and no public record of past incidents.

Wallet integration? It works with MetaMask and some other EVM-compatible wallets. But that’s it. No integration with DeFi aggregators like 1inch or Paraswap. No support for DEX Screener or DeFiLlama. You won’t find Gravity Finance listed on any major analytics dashboard. That’s not oversight. It’s exclusion.

Tax Implications: You Still Owe the IRS

Even if you think Gravity Finance is too small to matter, the tax authorities don’t care. CryptoTaxCalculator explicitly lists Gravity Finance as a platform that generates taxable events. Every trade, every liquidity provision, every token swap counts. If you bought GFI with USDC.E and sold it for WETH, that’s a capital gain. If you added liquidity to the GFI/WS pool, you triggered a taxable event.

There’s no built-in tax reporting. No CSV export. No API. You’re on your own to track every transaction manually. That’s doable if you made three trades. But if you’re an active DeFi user, you’re spending hours just to file one form. And if you get audited? You’ll need screenshots, wallet addresses, and transaction hashes from a platform that doesn’t even have customer support.

Who Is This Exchange For?

Let’s be honest: Gravity Finance isn’t for most people. It’s not for beginners. It’s not for traders. It’s not for investors looking for growth.

The only people who use it are either:

- Those who bought GFI early and are holding out for a miracle

- Speculators chasing obscure tokens with zero liquidity (and high risk)

- People who accidentally connected their wallet to the wrong DEX and got stuck

If you’re looking for a reliable place to trade crypto, this isn’t it. You won’t find better prices, faster trades, or lower fees. You’ll find slow confirmations, wide spreads, and no one to help when things go wrong.

Why Gravity Finance Won’t Survive

DeFi is crowded. Uniswap, SushiSwap, Curve, Balancer-they’re all fighting for liquidity. Gravity Finance isn’t even in the race. It has no marketing. No community. No team updates. No roadmap. No liquidity incentives. No partnerships.

Major DEXs reward liquidity providers with millions in token emissions. Gravity Finance gives you… nothing. No rewards. No staking. No governance. Just a token with no utility and a wallet address you can’t trust.

The market doesn’t reward silence. It rewards transparency, activity, and trust. Gravity Finance has none of that. It’s a relic of 2021, left behind by every major shift in DeFi since then.

What Should You Do Instead?

If you want to trade GFI or similar tokens, go to a real exchange. Use Uniswap on Ethereum or SushiSwap on Polygon. Use a DEX aggregator to find the best price across multiple chains. You’ll get better rates, deeper liquidity, and actual customer support if something breaks.

If you’re drawn to Gravity Finance because of a “low-cap gem” pitch, walk away. Low-cap doesn’t mean high-reward. It means high-risk, zero liquidity, and no safety net. The crypto market is full of dead projects. Gravity Finance is one of them.

Don’t waste your time. Don’t lock your funds in a black box. And don’t assume small equals hidden opportunity. Sometimes, small just means forgotten.

Is Gravity Finance a scam?

Gravity Finance isn’t a scam in the traditional sense-it doesn’t steal your funds outright. But it’s a dead project with no development, no transparency, and no community. It’s not actively malicious, but it’s also not trustworthy. Your funds aren’t guaranteed, and there’s no one to help if something goes wrong.

Can I withdraw my GFI tokens from Gravity Finance?

Yes, you can withdraw GFI or any other token you hold on Gravity Finance. The platform doesn’t lock your assets. But if you try to sell them, you’ll struggle to find buyers. The liquidity is so low that even small sell orders can crash the price. You can move your tokens to another wallet or exchange, but selling them at a fair price is unlikely.

Does Gravity Finance have a mobile app?

No, Gravity Finance does not have a mobile app. It’s a web-based DEX that works through browser wallets like MetaMask. You can access it on your phone’s browser, but the interface isn’t optimized for mobile, and there’s no dedicated app for iOS or Android.

Is Gravity Finance listed on CoinMarketCap or CoinGecko?

Yes, Gravity Finance is listed on CoinGecko as an exchange, and GFI is listed as a token. But both entries are marked as low-volume and inactive. CoinMarketCap does not currently list Gravity Finance as an active exchange. The data on CoinGecko is accurate but reflects minimal activity.

Can I stake GFI on Gravity Finance?

No, Gravity Finance does not offer staking, yield farming, or any form of passive income. There are no reward programs, no liquidity mining, and no governance features. The only way to interact with the platform is to trade. There’s no incentive to hold GFI beyond speculation.

What blockchain is Gravity Finance built on?

Gravity Finance operates on the Sonic network, using the Equalizer protocol for trading. Sonic is a lesser-known blockchain with low adoption. Most major DeFi tools and aggregators don’t support it, which limits liquidity and usability. This makes Gravity Finance isolated from the broader DeFi ecosystem.

Final Verdict

Gravity Finance isn’t a crypto exchange you should use. It’s a cautionary tale. It’s what happens when a project launches with hype, fades into silence, and leaves users stranded with a token that has no value and no future.

If you’ve already traded on it, track your transactions carefully for taxes. If you’re thinking about joining, don’t. There are hundreds of better options with real liquidity, active teams, and clear roadmaps. Save yourself the stress, the time, and the risk.

Gravity Finance isn’t the next big thing. It’s the last thing you should touch.

20 Comments

Kelly McSwiggan

November 14, 2025 AT 18:37 PMGravity Finance? More like Gravity *Defunct*. $20/day volume? That's not a DEX, it's a crypto graveyard with a MetaMask bookmark. I checked the liquidity pool last week - the slippage on a $50 trade was 12%. I cried. Not because I lost money. Because I wasted 17 minutes of my life thinking it was a real platform. 🤡

Anthony Forsythe

November 16, 2025 AT 00:40 AMThere’s a metaphysical tragedy here, you see. Gravity Finance isn’t merely a failed project - it’s a mirror held up to the soul of DeFi. We chase liquidity like it’s salvation, yet we build on sandcastles of hype, then wonder why the tide washes them away. This isn’t about tokens or spreads - it’s about the human tendency to believe in ghosts because we’re afraid of silence. The silence here? It’s deafening. And it’s not empty - it’s full of unclaimed wallets, forgotten seed phrases, and dreams buried under layers of unaudited code.

Kandice Dondona

November 16, 2025 AT 07:37 AMY’all need to chill 😌 I know it looks bleak but maybe GFI is just biding its time? Like a plant in winter - no one sees growth but it’s still alive underground 🌱✨ Someone’s gotta hold the bag until the next bull run. I’ve got my GFI in cold storage and I’m not panicking - I’m vibing. The market will come back, and when it does, we’ll be the ones who believed when no one else did 💪❤️

Becky Shea Cafouros

November 17, 2025 AT 22:29 PMInteresting analysis. The data is clear. Liquidity is non-existent. No audits. No team. No updates. I’ve seen this movie before. It ends the same way every time. I’m not surprised. Just disappointed that people still click ‘connect wallet’ without doing basic due diligence. It’s not a scam. It’s negligence dressed up as innovation.

Drew Monrad

November 18, 2025 AT 13:52 PMWait - you’re telling me this isn’t a government-backed honeypot? That’s it? That’s the whole plot? No hidden agenda? No Fed buying GFI to crash the market and then bail out the Sonic network? I’m crushed. I had a whole 3am conspiracy theory ready to go. Now I have to start over. This is worse than the 2022 Terra collapse.

Cody Leach

November 18, 2025 AT 15:57 PMI used to trade here back in 2022. I made a $20 profit and then stopped. Honestly? It was easier to just buy GFI on a centralized exchange and move it here to ‘support the ecosystem.’ Didn’t change a thing. But I felt good about it. That’s the real tragedy - we’re not trading tokens, we’re trading hope.

sandeep honey

November 19, 2025 AT 09:08 AMWhy are you all surprised? No team, no audits, no updates - this is standard for 90% of new chains. Sonic? Never heard of it. Equalizer? Sounds like a gym machine. If you don’t have a whitepaper, a Discord with 50k members, and a CEX listing, you’re not real. This is why India is moving to CBDCs - because this chaos is not finance. It’s gambling with extra steps.

Mandy Hunt

November 21, 2025 AT 01:20 AMThey’re all lying. The whole thing is a front. The $20 volume? Fake. The wallet addresses? Controlled by one guy in a basement in Belarus. They’re pumping it to steal the last 100 wallets that still have GFI. I saw the code. The contract has a backdoor. They can drain everything. They’re waiting for the next moonshot tweet. Don’t touch it. Delete your wallet. Burn your seed phrase. They’re watching you right now

Gavin Jones

November 22, 2025 AT 04:16 AMWell now, that's a sobering read. I must say, I'm rather taken aback by the sheer lack of activity - it's almost poetic in its desolation. I've been on DEXs with less liquidity, mind you, but never one that felt quite so… abandoned. Still, I suppose there's beauty in honesty - if nothing else, this project didn't pretend to be something it wasn't. Just a quiet little corner of the internet where no one's left to care.

Mauricio Picirillo

November 22, 2025 AT 19:58 PMHey, I get it - this place looks dead. But hey, if you’re chill and just holding for fun, why not? I’ve got a few GFI from 2021. I don’t trade them. I just check the price once a month and laugh. It’s like owning a vintage vinyl nobody else wants - it’s not worth anything… but it’s mine. And that’s kinda cool.

Liz Watson

November 24, 2025 AT 18:37 PMOh wow. Someone actually wrote a 2000-word obituary for a $9/day DEX? Congratulations. You’ve achieved peak crypto journalism. Next time, maybe write about how the moon is made of cheese and the whales are just Elon’s interns. At least that’d be more entertaining.

Rachel Anderson

November 25, 2025 AT 15:45 PMGravity Finance isn’t dead - it’s in mourning. Mourned by the 17 people who still hold GFI. Mourned by the ghost of the 2021 bull run. Mourned by every dev who ever said ‘we’ll launch on Sonic next week.’ This is the quiet death of crypto dreams - no fanfare, no headlines, just a wallet balance slowly turning to zero while you stare at your screen hoping for a miracle.

Hamish Britton

November 27, 2025 AT 01:16 AMLook, I’ve been around since the early days of Uniswap. I’ve seen projects rise and vanish. Gravity Finance? It’s not even a footnote anymore - it’s a typo. But I still respect the people who stuck with it. Not because they’re smart. Because they’re stubborn. And sometimes, stubbornness is the last form of loyalty left in this space.

Robert Astel

November 28, 2025 AT 20:21 PMyou know what’s funny? i used to think that if a project had no team, no updates, no audits… it was just lazy. but now i think maybe it’s not laziness. maybe it’s the only sane response to a world that demands constant growth, constant hype, constant noise. maybe gravity finance just said ‘fuck it’ and walked away. and honestly? i kinda admire that. not because it’s smart - but because it’s honest. the market didn’t reward it - so it stopped playing. maybe that’s the real crypto wisdom.

Kevin Hayes

November 30, 2025 AT 04:20 AMThe philosophical underpinning of this failure is not technical - it is existential. DeFi was born from the promise of decentralization, of autonomy, of trustless systems. Yet here we are, clinging to a token that cannot be traded, on a chain that cannot be trusted, operated by entities that refuse to speak. The system did not fail. We did. We demanded transparency, then rewarded silence with speculative capital. Gravity Finance is not the villain. We are the architects of our own disillusionment.

Katherine Wagner

December 1, 2025 AT 06:12 AMSo what? It’s a DEX with low volume. Big deal. I’ve traded on worse. No audits? So have 80% of the new chains. Tax reporting? Who cares? I just want to flip GFI for 10x. That’s all. Stop overthinking it. It’s crypto. It’s supposed to be messy. If you want spreadsheets, go work at a bank.

ratheesh chandran

December 1, 2025 AT 19:14 PMbro this is why we need more education in india. people see gfi at 0.001 and think ‘this is the next doge’ but they dont check volume or audits or team. they just buy and hope. this is not investing. this is russian roulette with blockchain. i lost 2000 usdt on a similar project. now i only trade on binance. simple. safe. no drama.

Hannah Kleyn

December 3, 2025 AT 08:05 AMI’ve been watching GFI for two years. It’s been at $0.0008 since 2022. No movement. No news. No tweets. Just… still. I keep checking it like it’s a haunted house I’m too scared to enter but can’t stop walking past. I think I’m waiting for someone to say ‘it’s safe now’ but no one ever does. I’m not buying. I’m not selling. I’m just… observing. Like a ghost watching other ghosts.

gary buena

December 3, 2025 AT 19:11 PMActually, I think this is kinda beautiful. No hype. No influencers. No pump groups. Just a quiet little pool where the few who still care can trade without the noise. Maybe that’s the future - not big exchanges with 10k coins, but tiny, honest corners where people trade because they want to, not because they’re chasing a moon.

Vanshika Bahiya

December 5, 2025 AT 19:01 PMFor anyone new to DeFi - if you’re thinking of trading on a platform with under $20 daily volume, just don’t. Use Uniswap, SushiSwap, or even a CEX. Save yourself the headache. GFI isn’t a gem - it’s a landmine. And if you’re holding it, please, please track every transaction. Taxes don’t care if the market’s dead - they just want their cut. You’ve been warned 💡