IRS Crypto Tax Calculator: Form 8949 & 1099-DA Compliance

Form 8949 Note: You must report all transactions on Form 8949 regardless of whether you had a gain or loss. The IRS requires full transparency for all crypto disposals.

Every time you sell Bitcoin, trade Ethereum for Solana, or use crypto to buy a coffee, the IRS sees a taxable event. Not because they’re watching your wallet - but because you’re legally required to report it. Starting in 2025, the rules got tighter. And if you’re using Form 8949 to report your crypto gains and losses, you need to know exactly what changed - and why it matters.

What Is Form 8949 and Why Does It Matter for Crypto?

Form 8949 is the IRS form used to report every sale, trade, or disposal of capital assets, including cryptocurrency. It’s not optional. Even if you didn’t make a profit, even if you only traded $50 worth of crypto, you still have to file it.

The IRS treats crypto as property, not currency. That means every time you sell, trade, or spend it, you trigger a capital gain or loss - just like selling stocks. Form 8949 captures the details of each transaction: when you bought it, when you sold it, how much you paid, how much you got, and what you made or lost.

This form doesn’t stand alone. It feeds into Schedule D, where your total gains and losses get summed up and moved to your main tax return, Form 1040. Skip Form 8949, and you’re skipping the foundation of your crypto tax report.

What Transactions Must You Report on Form 8949?

You don’t just report when you cash out crypto for dollars. You report every single disposal. That includes:

- Selling crypto for U.S. dollars (fiat)

- Trading one cryptocurrency for another (e.g., BTC for ETH)

- Using crypto to buy goods or services

- Gifting crypto (if over $18,000 in value)

- Receiving crypto from a hard fork or airdrop - then later selling it

Even if you didn’t get a 1099 form, you still have to report it. Many exchanges don’t send 1099-Bs for crypto-to-crypto trades - but that doesn’t mean the IRS doesn’t care. They do. And they’re getting better at catching mismatches.

2025 Changes: The Big Shift with Form 1099-DA

Starting January 1, 2025, crypto exchanges are required to issue Form 1099-DA - the first-ever IRS form designed specifically for digital assets. This is a game-changer.

For 2025, Form 1099-DA will report the gross proceeds from your sales and trades. That’s the total dollar amount you received when you sold or traded crypto. But here’s the catch: it won’t include your cost basis yet. That’s coming in 2026.

That means for 2025, you’re still responsible for tracking your own cost basis - how much you originally paid for each coin. Exchanges won’t do it for you. You still need to know exactly when you bought each Bitcoin, how much you paid, and which wallet it came from.

This creates a messy transition. You’ll get a 1099-DA from your exchange, but you’ll still need to manually calculate gains and losses to fill out Form 8949 correctly. If you use multiple wallets or platforms, this gets complicated fast.

Wallet-by-Wallet Accounting: No More Averaging

Before 2025, some people used the “universal accounting” method - averaging the cost of all their Bitcoin across all wallets. It was easy. And it was wrong.

Starting January 1, 2025, the IRS requires wallet-by-wallet accounting. You must track cost basis for each wallet separately. If you bought 0.5 BTC in January 2023 for $30,000 in Wallet A, and another 0.5 BTC in June 2024 for $55,000 in Wallet B, you can’t average them to $42,500.

If you sell 0.6 BTC from Wallet B, you have to use the $55,000 cost basis for those coins - not the average. This can significantly increase your tax bill if you bought at different prices over time.

It also means you need to know which wallet you used for each transaction. If you moved crypto from Coinbase to MetaMask, then sold from MetaMask, you need to track the original purchase date and cost from Coinbase.

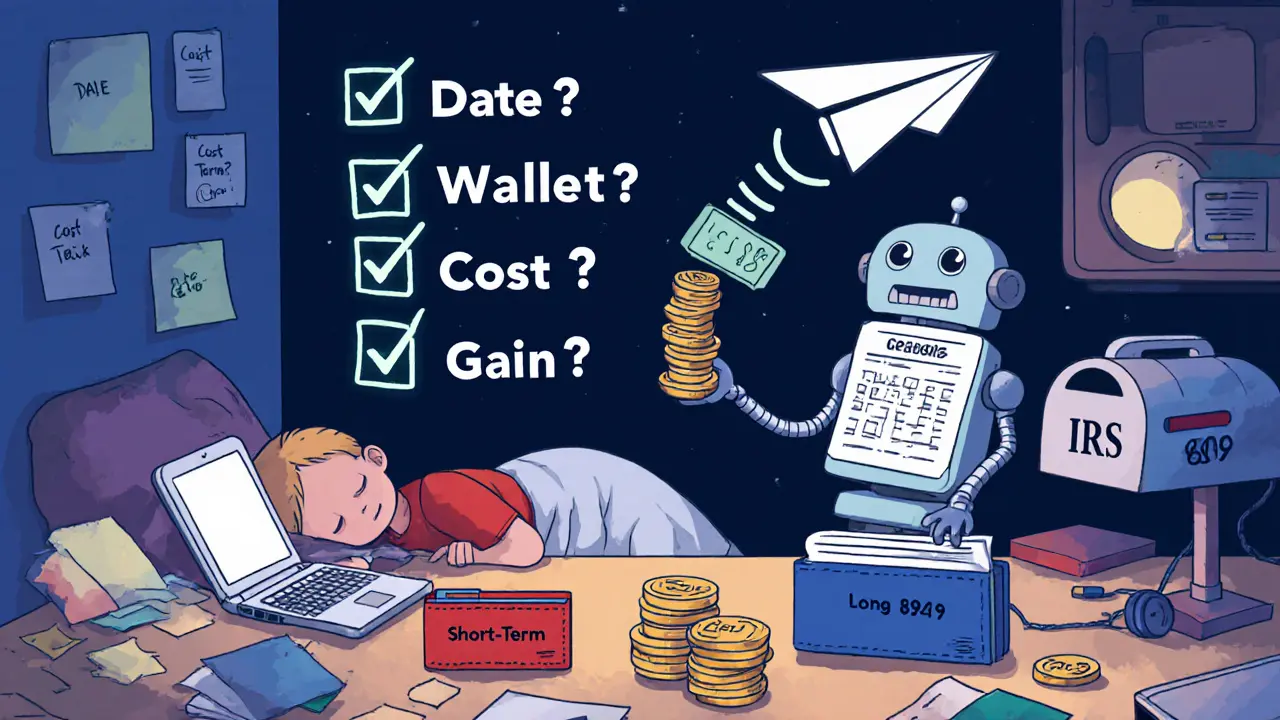

How to Fill Out Form 8949 for Crypto

There are two sections on Form 8949: short-term and long-term. The difference? How long you held the asset.

- Short-term: Held one year or less. Gains are taxed at your regular income rate.

- Long-term: Held more than one year. Gains are taxed at lower capital gains rates (0%, 15%, or 20%, depending on income).

For each transaction, you must report:

- Description of property (e.g., “Bitcoin,” “Ethereum”)

- Date acquired

- Date sold or disposed

- Gross proceeds (amount received in USD)

- Cost basis (original purchase price + fees)

- Gain or loss (proceeds minus basis)

Use adjustment codes (like “D” for basis not reported to IRS) if you’re reporting a transaction that wasn’t included on a 1099-DA. This tells the IRS you’re providing the cost basis yourself.

Common Mistakes People Make

Most errors aren’t about math - they’re about missing data.

- Forgetting crypto-to-crypto trades: Trading ETH for SOL is a taxable event. Many people think it’s “just swapping,” but it’s a sale of ETH and a purchase of SOL.

- Ignoring staking rewards and airdrops: If you earned 10 SOL from staking, that’s taxable income at the time you received it. If you later sell it, you report a capital gain based on that initial value.

- Using the wrong cost basis: Did you buy BTC at $20,000 and later get another at $45,000? Don’t use $32,500 as your average. Use the actual purchase price of the coins you sold.

- Not keeping records: If the IRS asks for proof and you can’t show transaction history from 2023, you could be hit with penalties.

One user on Reddit spent 37 hours compiling 187 transactions from three exchanges, three wallets, and three DeFi platforms. He missed one airdrop - and ended up owing $1,200 extra in taxes.

Tools That Help (and Where They Fall Short)

Most people use crypto tax software to avoid manual errors. Tools like CoinTracker, Koinly, and TaxBit connect to exchanges and wallets, auto-import transactions, and generate Form 8949.

But they’re not perfect. They can:

- Miss DeFi transactions (like liquidity pool trades or yield farming rewards)

- Use the wrong cost basis method if you didn’t configure it correctly

- Fail to recognize wallet transfers as taxable events

Always double-check the output. Run a sample transaction manually. If your software says you sold 0.3 BTC from Wallet A at $50,000, but you actually bought it at $42,000, make sure the gain is $2,400 - not $3,000.

What Happens If You Don’t Report?

The IRS isn’t guessing anymore. In 2023, they sent out over 10,000 crypto audit letters. By 2025, they’re using data from exchanges, blockchain analysis firms, and cross-referencing 1099-DA forms with your tax return.

If you underreport or skip Form 8949:

- You could owe back taxes + interest

- You may face a 20% accuracy-related penalty

- For willful evasion, penalties can hit 75% of the underpaid tax

There’s no statute of limitations on fraud. If the IRS thinks you hid crypto income on purpose, they can go back 10+ years.

How to Stay Compliant in 2025 and Beyond

Start now. Don’t wait until April.

- Collect all your transaction history from every exchange, wallet, and DeFi platform.

- Identify every disposal event - sales, trades, spending.

- Record the date, amount, and USD value at the time of each transaction.

- Track your cost basis for every coin you own - down to the wallet.

- Use tax software, but verify the results manually.

- Keep records for at least seven years.

Set a monthly reminder to log new trades. Even five minutes a week saves you 40 hours in April.

What’s Next After 2025?

In 2026, Form 1099-DA will start including cost basis. That’s a big step toward matching what brokers do for stocks. But even then, you’ll still need Form 8949 - because not all crypto activity happens on exchanges. DeFi, peer-to-peer trades, and NFT sales won’t be fully tracked by brokers.

There’s talk of new rules for staking, lending, and DeFi. The IRS has already signaled they’re watching liquidity pools and yield farming. Don’t assume those are “tax-free.” They’re not.

The bottom line: crypto tax reporting is no longer optional. It’s not a gray area. It’s a legal requirement with real consequences. Form 8949 isn’t a suggestion - it’s the backbone of your crypto tax compliance. Get it right, or pay the price later.

Do I have to report crypto losses on Form 8949?

Yes. You must report every crypto disposal, even if you lost money. Reporting losses can offset your capital gains and reduce your tax bill. The IRS requires full transparency - no hiding losses to avoid scrutiny.

What if I only traded crypto and never cashed out to USD?

Trading one crypto for another is still a taxable event. For example, selling Bitcoin to buy Ethereum counts as a sale of Bitcoin. You must report the gain or loss based on the USD value at the time of the trade. Not cashing out to dollars doesn’t make it tax-free.

Do I need to report crypto I received as a gift?

You don’t pay tax when you receive crypto as a gift. But when you later sell it, you must report the gain or loss. Your cost basis is the same as the donor’s original cost - not the value when you received it. Keep records of the gift and the donor’s purchase details.

Can I use FIFO, LIFO, or specific identification for crypto cost basis?

The IRS allows specific identification - meaning you can choose which coins you’re selling (e.g., the oldest, the most expensive). You must document your choice clearly. FIFO (first-in, first-out) is the default if you don’t specify. LIFO is not permitted for crypto under current IRS guidance.

What if I lost access to a wallet with crypto inside?

If you lost access to a wallet and can’t recover the crypto, you may be able to claim a capital loss. But you need proof: transaction history, wallet backup files, or a notarized statement showing you no longer control the assets. The IRS doesn’t accept “I forgot my password” alone. Documentation is critical.

Do I need to report crypto mining income?

Yes - but not on Form 8949. Mining income is reported as ordinary income on Schedule C (if you’re a business) or as other income on Form 1040. When you later sell the mined crypto, that’s when Form 8949 comes in - to report the capital gain on the sale.

Final Tip: Don’t Guess. Document.

The IRS doesn’t care how complicated crypto is. They care if you followed the rules. The best way to avoid trouble? Keep a simple spreadsheet. Write down every transaction - date, type, amount, USD value, cost basis, and wallet. Do it weekly. It takes 10 minutes. And it could save you thousands.

18 Comments

Ali Korkor

October 28, 2025 AT 12:25 PMMan, I just used crypto to buy my buddy a pizza last week and totally forgot to log it. Thanks for the wake-up call - gonna set a weekly reminder now. Five minutes now saves a nightmare later.

madhu belavadi

October 29, 2025 AT 15:16 PMUSA always making things complicated. In India we just ignore and hope for the best. Why do they care how much I traded?

Dick Lane

October 29, 2025 AT 16:23 PMI’ve been tracking everything since 2021 but man the wallet-by-wallet thing is brutal. I got coins in Coinbase, MetaMask, and a cold wallet I forgot about until last month. Took me three days to reconcile. The IRS ain’t playing.

Norman Woo

October 31, 2025 AT 13:20 PMForm 1099-DA? That’s just the beginning. They’re gonna start tracking your IP addresses next. Blockchain is decentralized but the IRS? Nah they’re building a centralized surveillance grid. They already know you bought Dogecoin in 2021. They’re just waiting to pounce.

Serena Dean

November 1, 2025 AT 05:38 AMYou got this! I know it feels overwhelming but just start with one wallet and one month. Write it down. Use a free spreadsheet. You don’t need to be perfect - just consistent. And hey, if you lost money, that’s actually good news - it lowers your tax bill. You’re not behind, you’re just getting started.

James Young

November 2, 2025 AT 22:13 PMAnyone who doesn’t report crypto trades is either lazy or trying to cheat. The IRS has algorithms that spot mismatches faster than your ex texts you after a breakup. If you think averaging cost basis is smart, you’re not just wrong - you’re a walking audit target. Stop making excuses and get your records straight.

Chloe Jobson

November 3, 2025 AT 00:32 AMCost basis tracking is non-negotiable. FIFO default = bad if you bought low early. Specific identification requires documentation. DeFi rewards = ordinary income on 1040. 1099-DA = gross proceeds only. No basis yet. Layered compliance. Start now.

Andrew Morgan

November 3, 2025 AT 17:49 PMI used to think crypto was freedom until I realized the IRS was the new bank. Now I log every trade like it’s a diary entry. Bought BTC on Jan 15 2023 for $32k - sold it in May for $45k. Took me 10 minutes. Now I sleep better. You don’t need fancy software. Just a notebook and honesty.

Michael Folorunsho

November 5, 2025 AT 01:50 AMAmericans think they’re so special with their tax forms. In Europe they just tax you on income and call it a day. This overcomplicated Form 8949 nonsense? Pure bureaucratic overreach. If you’re not rich enough to afford a CPA, you’re being punished for being middle class. The system’s rigged.

Roxanne Maxwell

November 6, 2025 AT 02:57 AMI just started using Koinly and it’s been a game-changer - but I still double-check the big trades by hand. One time it missed a staking reward and I caught it before filing. So grateful for this community sharing tips. You’re not alone in this mess.

Jonathan Tanguay

November 7, 2025 AT 19:35 PMOkay so let me get this straight you’re telling me I have to track every single coin I ever bought across every wallet ever used since 2017 because the IRS suddenly cares? And if I forgot one airdrop from 2020 I owe 1200 extra? And you’re telling me to use a spreadsheet? Bro I got 187 transactions from 3 exchanges and 2 wallets and you think I’m gonna manually type in 500 entries? I’m gonna get audited and I’m gonna be fine because I’m not the one who created this mess the system did. I’m just trying to survive.

Ayanda Ndoni

November 9, 2025 AT 09:53 AMYo you got a minute? I just got back from a trip to Bali and I used crypto to pay for my Airbnb. Did I just owe taxes? Can you help me? I don’t even know where to start. I just wanna know if I’m in trouble.

Elliott Algarin

November 11, 2025 AT 08:05 AMIt’s funny how we treat money as abstract until the government says it’s property. Crypto’s just a mirror - it shows how much we’ve outsourced our financial responsibility to apps and exchanges. Now the bill comes due. Maybe this is the universe’s way of forcing us to become more aware.

John Murphy

November 11, 2025 AT 20:07 PMWhat if you bought crypto on a now-defunct exchange? Like Mt. Gox? Do you just write off the whole thing? I’ve got coins I can’t prove I owned. I don’t want to lie but I don’t want to pay taxes on ghosts either.

Zach Crandall

November 11, 2025 AT 20:42 PMIt is imperative that individuals adhere to the regulatory framework established by the Internal Revenue Service. Non-compliance constitutes a material breach of fiduciary responsibility under U.S. tax law. The use of unregulated digital asset platforms introduces significant fiscal risk. One must maintain rigorous documentation to mitigate potential liability.

Akinyemi Akindele Winner

November 13, 2025 AT 03:47 AMIRS? More like I Ruled Soon. These forms are just a fancy way to say ‘pay up or get crushed.’ Meanwhile, the rich buy offshore wallets and laugh. But hey - if you’re gonna get taxed on your pizza crypto, at least make it a good pizza. That’s the real ROI.

Patrick De Leon

November 14, 2025 AT 14:00 PMForm 8949 is a joke. The U.S. tax code is a colonial relic. If you’re smart you use a crypto-friendly jurisdiction. Ireland doesn’t tax crypto-to-crypto. Why are you letting them squeeze you? Get your passport ready. This isn’t finance - it’s oppression.

Ali Korkor

November 16, 2025 AT 12:27 PMThat’s exactly what I did last week - bought coffee with ETH and forgot. Now I’m logging every single one. Even the tiny ones. You’re right - it’s not about the money, it’s about the habit.