Leverage Calculator: Understand Your Risk with MGBX

Calculate Your Risk

Understand how high leverage affects your potential profits and losses

Your Results

When you hear MGBX crypto exchange, you might think of a flashy platform with crazy leverage and no ID checks. And you’d be right - mostly. But what does that actually mean for your money? If you’re looking to trade Bitcoin, Ethereum, or altcoins without handing over your passport, and you’re okay with trading at 200x leverage, then MGBX might seem like a dream. But here’s the truth: this isn’t for everyone. It’s not even for most people.

What Is MGBX, Really?

MGBX is the rebranded version of Megabit, a crypto exchange that started back in 2019. It relaunched in early 2025 with a new name, a new look, and a lot more aggressive features. It’s not trying to be the next Binance or Coinbase. It’s not aiming for regulation. It’s built for one thing: fast, high-risk trading by people who don’t want to be tracked. It supports over 136 cryptocurrencies, including the big ones like BTC, ETH, and USDT. You can trade spot pairs - like BTC/USDT - or go all-in with futures contracts. The real draw? You can trade with up to 200x leverage. That means if you put in $100, you can control a $20,000 position. Sounds insane? It is. And that’s exactly why some traders love it.No KYC? Here’s What That Actually Lets You Do

Most exchanges make you upload a photo of your ID, proof of address, and sometimes even a selfie holding your passport. MGBX doesn’t. Not for basic trading. Not for deposits. Not even for withdrawals up to $100,000. That’s not a glitch. It’s by design. This appeals to privacy-focused traders in countries where crypto regulations are tightening. It’s also popular with people who just don’t want to deal with bureaucracy. But here’s the catch: no KYC means no legal protection. If your account gets hacked, there’s no customer service team that can verify it’s you. If you get scammed, you have zero recourse. No chargebacks. No dispute process. Just a blockchain transaction that’s final. The platform uses SSL encryption and stores 95% of funds in cold storage. It also has a $50 million insurance fund - but again, that’s not regulated insurance. It’s a reserve pool managed by the exchange itself. There’s no government watchdog watching over it.Trading Features: Spot, Futures, and Copy Trading

MGBX gives you three main ways to trade:- Spot trading - Buy and sell crypto at current market prices. Over 100 trading pairs available.

- Futures trading - Bet on price movements with leverage up to 200x. You can choose USDT-margined or coin-margined contracts. Cross-margin and isolated margin options help you control risk - if you know how to use them.

- Copy trading - Follow experienced traders automatically. You pick someone whose strategy you like, and your account mirrors their trades. Sounds easy? It’s not. If they lose 80% of their portfolio, so do you.

Fees: Free? Or Hidden?

This is where things get messy. Some sources say MGBX charges 0.1% per trade. Others say maker and taker fees are 0.00%. Why the contradiction? The truth? MGBX uses a tiered, incentive-based fee model. New users might see 0% fees to lure them in. Active traders with high volume get rebates. But if you’re trading small amounts, you might still pay hidden costs through wider spreads or funding rates on futures. There’s also an “experience fund” feature - a simulated trading account where you can test strategies without risking real money. If you make profits here, you can withdraw a portion of them. It’s a clever way to hook beginners. But don’t confuse simulated wins with real skill.Who Should Use MGBX?

Let’s be blunt: MGBX is not for beginners. Not for long-term investors. Not for anyone who can’t afford to lose everything they put in. It’s designed for:- Experienced traders who understand leverage risk

- People in countries where crypto is restricted or heavily taxed

- Those who prioritize anonymity over security

- Traders who want to scalp or swing trade with high leverage

- U.S. or Hong Kong residents (blocked outright)

- Anyone storing large amounts of crypto long-term

- People who expect customer support to fix their mistakes

- Investors looking for regulated, insured platforms

Performance and Traffic: A Small Player

MGBX isn’t big. Not by any measure. It ranks 439th out of 612 crypto exchanges in traffic, with only about 1,600 monthly visits. Over 99% of those come from organic search - meaning almost no marketing budget. No celebrity endorsements. No TV ads. The mobile app (iOS only, App Store ID 6737500828) has just four reviews. One user wrote: “Trading is still very smooth, more other cryptocurrencies would be even better.” That’s it. No major Reddit threads. No YouTube tutorials. No community buzz. The bounce rate is 36%, which is decent for a niche platform. People stay for 1 minute and 6 seconds - enough to check prices, not enough to explore features. That tells you something: most visitors come for one thing - high leverage - and leave quickly.

Is MGBX Safe? The Scamadviser Paradox

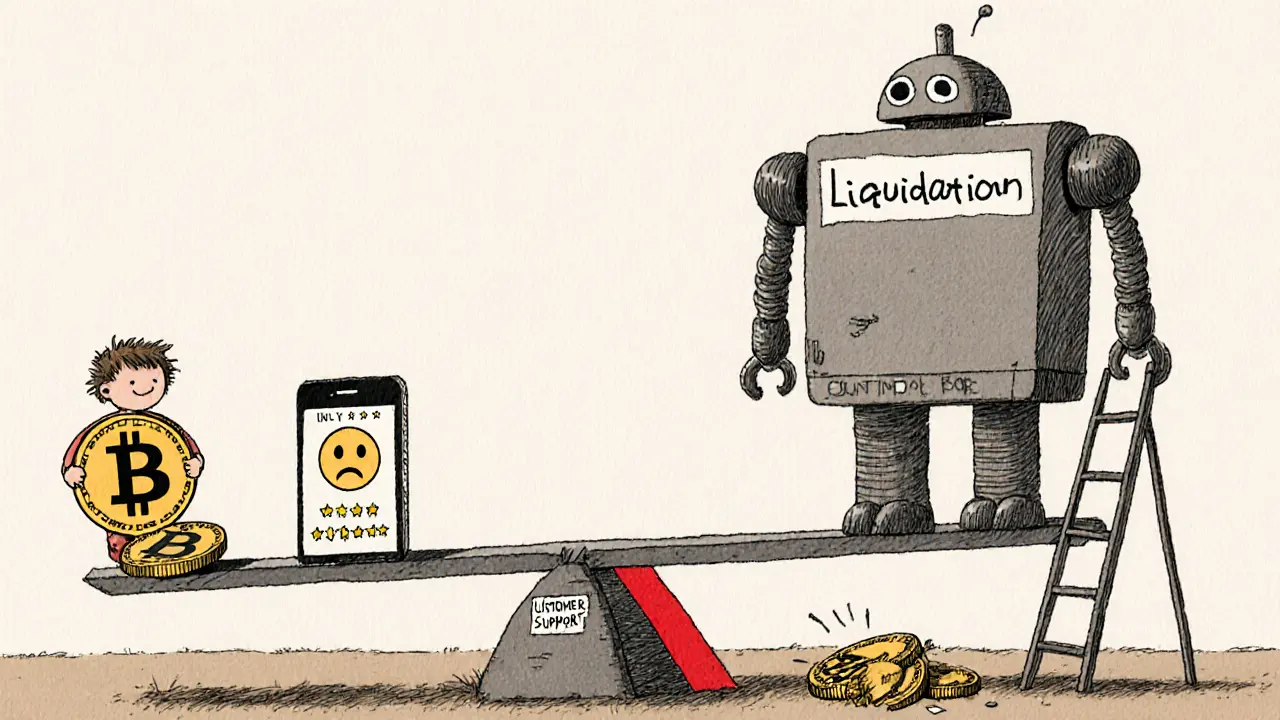

Scamadviser gives MGBX a “relatively high legitimacy score.” Why? Because the website has a valid SSL certificate. The domain is registered. The server isn’t flagged for malware. DNSFilter says it’s safe to visit. But here’s the problem: safety ≠ security. A website can be technically “safe” and still be a disaster for your portfolio. There’s no regulatory license. No audit reports. No proof of reserves published regularly. No transparency about who runs it. CoinCodeCap’s review puts it bluntly: “The responsibility for risk management falls entirely on the trader.” With 200x leverage, one wrong move can wipe out your account in seconds. And if you’re not watching your position 24/7, you’ll get liquidated - no warning, no grace period.The Future of MGBX: Regulatory Pressure Looms

Global regulators are cracking down on high-leverage crypto trading. The EU just capped leverage at 10x for retail traders. The U.K. did the same. Even Dubai, where MGBX joined Token2049 in May 2025, is tightening rules. MGBX’s no-KYC, high-leverage model is a legal time bomb. If any jurisdiction decides to block it - or pressure payment processors to cut off access - the platform could vanish overnight. There’s no safety net. No backup servers in a regulated country. Just one company, one server farm, one set of rules. Its future depends on one thing: staying under the radar. If it grows too big, regulators will notice. If it gets hacked, the fallout could be catastrophic. If it starts requiring KYC to survive, it loses its entire reason for existing.Final Verdict: High Risk, High Reward - But Mostly Risk

MGBX isn’t a scam. It’s a high-risk tool for high-risk traders. It works exactly as advertised: fast, anonymous, with insane leverage. But that’s also why it’s dangerous. If you’re experienced, understand the math of leverage, and treat this like gambling - not investing - then MGBX might fit your style. But if you’re looking for a safe place to hold Bitcoin, or you want to trade without constant stress, walk away. The crypto world has plenty of regulated, insured, user-friendly exchanges. You don’t need MGBX. You just think you do - because it promises something easy: big wins with little effort. The truth? It’s the opposite. Big wins are rare. Big losses? They happen every day.Is MGBX a scam?

No, MGBX isn’t a scam in the traditional sense - the website works, deposits go through, and withdrawals are processed. But it operates without regulation, lacks transparency, and offers extreme risk through 200x leverage. It’s not fraudulent, but it’s far from safe. Treat it like a casino with crypto.

Can I use MGBX if I’m in the U.S.?

No. MGBX explicitly blocks users from the United States and Hong Kong. If you try to access the platform from those regions, you’ll get a geo-restriction message. Using a VPN won’t help - the exchange monitors IP patterns and may freeze accounts that appear to be circumventing restrictions.

What’s the highest leverage MGBX offers?

MGBX offers up to 200x leverage on futures contracts. This is among the highest available on any crypto exchange. For comparison, Binance caps leverage at 125x for most users, and Coinbase doesn’t offer futures above 10x for retail traders. 200x means even a 0.5% price move against your position can trigger liquidation.

Do I need to verify my identity on MGBX?

No, not for basic trading or withdrawals under $100,000. MGBX allows anonymous trading, which is rare among exchanges. However, if you’re flagged for suspicious activity or request a withdrawal above $100,000, they may ask for verification. There’s no guarantee they’ll approve it.

Is MGBX’s mobile app reliable?

The iOS app (MGBX: Buy Bitcoin & Crypto) works for placing trades and checking balances, but it’s basic. With only four reviews and no Android version, it’s clearly not a priority for development. Don’t expect advanced charting or notifications. Use the web platform for serious trading.

How does copy trading work on MGBX?

Copy trading lets you automatically replicate the trades of selected users. You choose a trader, set how much to allocate, and your account mirrors their actions. But there’s no performance history or risk rating shown. You’re copying someone you know nothing about - and if they lose, you lose too. Use this feature with extreme caution.

Are there fees for withdrawing crypto from MGBX?

Yes, withdrawal fees apply and vary by cryptocurrency. For example, Bitcoin withdrawals typically cost around 0.0005 BTC, while Ethereum withdrawals are about 0.01 ETH. These fees go to the blockchain network, not MGBX. The exchange doesn’t add extra charges, but you’ll still pay network gas fees.

Can I earn passive income on MGBX?

MGBX doesn’t offer staking, savings, or lending products. Its main incentives are trading competitions, referral bonuses, and fee rebates. If you’re looking to earn interest on your crypto holdings, you’ll need to use another platform. MGBX is built for active trading, not passive income.