Blockchain Evolution Timeline

Stuart Haber and W. Scott Stornetta published a paper describing a system where digital documents were chained together using cryptography. Each document was stamped with a unique code tied to the previous one, creating an immutable chain.

Haber and Stornetta team up with Dave Bayer to add Merkle trees to their system, allowing multiple documents to be bundled into single blocks, making the system faster and more efficient.

Hash values of certified documents were published weekly in The New York Times, creating a real-world test of their cryptographic chaining concept.

On October 31, 2008, Satoshi Nakamoto published the Bitcoin whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System," solving the double-spending problem without a central authority.

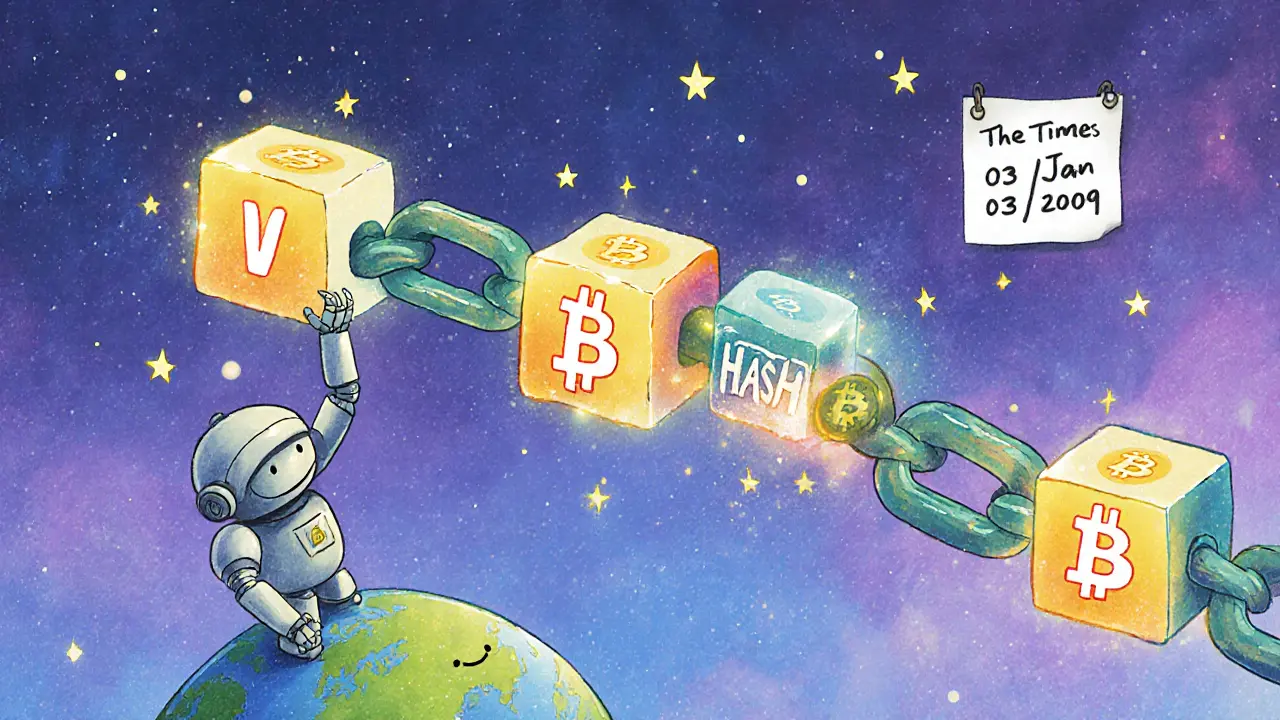

On January 3, 2009, the first Bitcoin block was mined with a hidden message: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

On May 22, 2010, 10,000 BTC was used to purchase two pizzas. At today's prices, this would be worth over $600 million.

At age 19, Vitalik Buterin published a paper proposing a blockchain that could run smart contracts—self-executing agreements written in code.

Ethereum launched in July 2015, enabling developers to build decentralized applications (DApps) on the blockchain.

The DAO (Decentralized Autonomous Organization) was hacked, leading to the Ethereum community splitting into Ethereum (new chain) and Ethereum Classic (original chain).

Non-fungible tokens became mainstream with digital art, music, and even tweets selling for millions. Blockchain established true ownership in the digital world.

Platforms like Uniswap and Aave enabled lending, borrowing, and trading without banks. Total value locked in DeFi jumped from $1B to over $100B in 18 months.

Ethereum completed its major upgrade to proof-of-stake, reducing energy consumption by 99.95% and making the network sustainable.

Blockchains like Polkadot and Cosmos enabled different networks to communicate. Central banks began piloting digital currencies like China's digital yuan and ECB's digital euro.

Before blockchain became a buzzword in boardrooms and tech conferences, it started as a quiet idea in academic papers - not meant to change the world, but to solve a tiny, stubborn problem: how do you prove a document hasn’t been altered? In 1991, two researchers at Bellcore, Stuart Haber and W. Scott Stornetta, published a paper describing a system where digital documents were chained together using cryptography. Each new document was stamped with a unique code tied to the one before it. If someone tried to change an old record, the whole chain would break. It was elegant. It was practical. And for nearly two decades, almost no one noticed.

The Quiet Foundations (1991-2008)

The real building blocks of blockchain were laid long before Bitcoin. In 1982, cryptographer David Chaum wrote about systems where mutually distrustful parties could still trust a shared record - an idea that later became core to blockchain. Then in 1992, Haber and Stornetta teamed up with Dave Bayer to add Merkle trees to their system. That tweak let them bundle dozens of documents into a single block, making the whole thing faster and more efficient. By 1995, they were publishing hash values of certified documents in The New York Times every week - a real-world test of their idea, long before the internet was mainstream. In the early 2000s, others picked up the thread. Stefan Konst proposed a working model of cryptographic chains in 2000. In 1998, Nick Szabo imagined "b-money," a digital currency based on cryptographic proof and decentralized consensus. It never launched, but the blueprint was there. Then came Hal Finney in 2004, who built "Reusable Proof of Work," a system that reused computational work to prevent digital currency fraud. Around the same time, Adam Back’s Hashcash - originally designed to stop spam - became a key ingredient. These weren’t blockchain as we know it, but they were the pieces that fit together.The Bitcoin Breakthrough (2008-2013)

On October 31, 2008, a person or group using the name Satoshi Nakamoto posted a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." It didn’t just describe a new currency - it solved the double-spending problem without a central authority. The secret? A decentralized network of computers, each keeping a copy of a public ledger. Every transaction was grouped into blocks, cryptographically sealed, and chained to the last. The system used Hashcash-style proof-of-work to validate blocks, but added a dynamic difficulty adjustment to keep the pace steady. On January 3, 2009, the first Bitcoin block - called the Genesis Block - was mined. Inside it was a hidden message: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." It was a timestamp, a protest, and a declaration: this system didn’t need banks. By May 2010, the first real-world transaction happened: 10,000 BTC bought two pizzas. At today’s prices, that’s over $600 million. Back then, it was just a quirky experiment. By 2011, Bitcoin had competitors. Namecoin tried to build a decentralized domain name system. Litecoin tweaked Bitcoin’s algorithm for faster transactions. The blockchain was no longer just a ledger for Bitcoin - it was becoming a platform. By 2013, the Bitcoin network’s total value passed $1 billion. The ledger had grown from a few gigabytes to over 30 GB. People were starting to realize: this wasn’t just digital cash. It was a new kind of trust machine.

The Smart Contract Revolution (2013-2017)

In late 2013, a 19-year-old Russian-Canadian named Vitalik Buterin published a paper proposing Ethereum - a blockchain that could run code. Not just record transactions, but execute programs. Smart contracts. These were self-executing agreements written in code, triggered when conditions were met. No lawyers. No middlemen. Just rules enforced by the network. Ethereum launched in July 2015. It changed everything. Suddenly, developers could build decentralized apps - DApps - on top of blockchain. No company owned them. No server could shut them down. In 2016, the DAO - a decentralized venture fund - raised $150 million in Ether. Then it got hacked. The community split. Ethereum forked into two chains: Ethereum (the new one) and Ethereum Classic (the original). It was messy, but it proved one thing: code is law - and code can break. The next two years exploded. Hundreds of new tokens flooded the market through ICOs - Initial Coin Offerings - where startups sold digital tokens to raise money. Some projects were scams. Others were brilliant. EOS, Cardano, and NEO emerged as alternatives to Ethereum, each promising faster speeds or better scalability. By 2017, the total market cap of all cryptocurrencies passed $800 billion. Blockchain wasn’t just for money anymore. It was for apps, voting, supply chains, even digital art.Maturation and Mainstream (2018-Present)

The hype crashed in 2018. ICOs turned into regulatory crackdowns. Many projects vanished. But the real innovation was happening quietly. Institutions started paying attention. In 2015, the Linux Foundation launched Hyperledger - a suite of open-source tools for enterprise blockchain. Banks, insurers, and logistics companies began testing private blockchains to track goods, verify identities, and automate paperwork. Then came DeFi - Decentralized Finance. By 2020, platforms like Uniswap and Aave let people lend, borrow, and trade crypto without banks. Total value locked in DeFi jumped from $1 billion to over $100 billion in just 18 months. People weren’t just speculating - they were using blockchain to do real finance. In 2020, NFTs went viral. Digital art sold for millions. Music, virtual real estate, even tweets became unique, verifiable assets. The technology behind them - non-fungible tokens on Ethereum - proved blockchain could establish true ownership in the digital world. In September 2022, Ethereum completed its biggest upgrade: the Merge. It switched from energy-hungry proof-of-work to proof-of-stake. Mining rigs disappeared. Electricity use dropped by 99.95%. It wasn’t just an upgrade - it was a rebirth. Blockchain was finally becoming sustainable. By 2023, interoperability became the next frontier. Blockchains like Polkadot and Cosmos let different networks talk to each other. A token on Ethereum could move to Solana without needing a bridge. Supply chains, governments, and healthcare systems began testing cross-chain systems. Central banks started piloting digital currencies - China’s digital yuan, the ECB’s digital euro. Blockchain was no longer a fringe experiment. It was becoming infrastructure.

13 Comments

Patrick De Leon

October 28, 2025 AT 12:18 PMThis is what happens when you let academics play with math instead of doing real work. Blockchain is just a glorified database. The whole thing was built on a lie that trust can be algorithmic. We don't need this. We need accountability. And accountability comes from people, not code.

And don't even get me started on Ethereum. A 19-year-old kid changed the world? Please.

MANGESH NEEL

October 28, 2025 AT 16:07 PMYou think this is about technology? No. This is about control. Every single person who promoted blockchain was either a scammer or a central banker in disguise. The Merge? A distraction. The real power is still in the hands of the same elites who printed the money during the bailout they mocked in the Genesis Block. Wake up. This isn't liberation. It's rebranding.

Sean Huang

October 29, 2025 AT 16:20 PMThey say Satoshi was a person... but what if it was a joint operation between the NSA and the IMF? Think about it. The timing. The message in the genesis block. The fact that no one ever found him. And now look - every blockchain project is being quietly monitored by the same agencies that tracked WikiLeaks. This isn't decentralization. It's surveillance with a crypto veneer.

And don't tell me about 'trustless systems' - if you trust the code, you're already compromised.

Ali Korkor

October 29, 2025 AT 21:27 PMSeriously though - this is one of the coolest stories in tech history. From a tiny paper nobody read to changing how we think about trust? Wild. Keep building. Even if it's messy, it's real. You're making something that actually matters.

madhu belavadi

October 31, 2025 AT 05:42 AMI read this whole thing and now I feel empty. Like I just watched a documentary about a dream that never happened. All that potential... and still just people trying to get rich. Again.

Dick Lane

November 1, 2025 AT 04:07 AMI never understood cryptography until I read this. It's not about the tech. It's about the idea that you don't need someone in a suit to tell you what's real. That's powerful. Even if the execution is messy. Even if it breaks sometimes. The fact that we tried this? That's the win.

Norman Woo

November 2, 2025 AT 21:38 PMso like... what if the new york times thing was a test run? like they knew it would work and just waited for the world to catch up? and now they're sitting on all the private chains? i mean... who really owns the data now?

Serena Dean

November 4, 2025 AT 15:16 PMThe real hero here isn't Satoshi. It's the thousands of devs who kept building even when everyone called them crazy. DAO hack? They learned. Merge? They improved. NFT crash? They kept coding. This isn't magic. It's persistence. And it's beautiful.

James Young

November 5, 2025 AT 15:59 PMYou people are delusional. Blockchain isn't revolutionary - it's overhyped garbage. The only reason it survived is because hedge funds needed a new bubble to pump. Bitcoin is digital gold? No. It's digital tulips. And Ethereum? A casino with smart contracts as the house edge. Stop pretending this is innovation. It's financial engineering for the gullible.

Chloe Jobson

November 7, 2025 AT 08:19 AMThe shift from PoW to PoS wasn't just technical - it was philosophical. We moved from energy-intensive validation to stake-based consensus. That’s a cultural evolution. It reflects a maturing ecosystem. And the interoperability protocols? That’s the real next frontier - not scaling, but symbiosis.

Andrew Morgan

November 9, 2025 AT 02:42 AMI remember when I first heard about Bitcoin. I thought it was a joke. Then I saw a guy in a coffee shop pay for his latte with it. No card. No app. Just a QR code. And the barista didn't even blink. That moment? That was the turning point. Not the price. Not the whitepaper. Just a quiet transaction between two strangers who didn't need to trust each other. That's the magic.

Michael Folorunsho

November 9, 2025 AT 10:44 AMLet’s be honest - this whole narrative is written by Western technocrats who think their version of decentralization is universal. Meanwhile, in the Global South, people are using mobile money and community ledgers that work better than blockchain ever has. This isn’t progress. It’s cultural imperialism wrapped in cryptographic jargon.

Roxanne Maxwell

November 10, 2025 AT 00:53 AMI work in healthcare. We just started using blockchain to track vaccine batches. No more lost records. No more fake certificates. A rural clinic in Ghana verified a shipment in seconds. No bank. No middleman. Just truth on a chain. This isn't hype. This is healing.