On April 30, 2021, Turkey made a move that shocked many in the global crypto community: it banned the use of cryptocurrencies for payments. Not trading. Not holding. Not investing. Just paying with Bitcoin, Ethereum, or any other digital asset. If you wanted to buy coffee, pay your rent, or order food online, you couldn’t use crypto-even if the seller was willing. But you could still buy it, sell it, and hold it. That’s the Turkish paradox.

Why did Turkey ban crypto payments?

The Central Bank of the Republic of Turkey (CBRT) didn’t act on a whim. They listed five clear risks in their official announcement published in the Official Gazette (No. 31456):- Cryptoassets have no central regulator or oversight.

- They’re wildly volatile-prices can swing 20% in a day.

- They’re anonymous, making them attractive for money laundering and illegal transactions.

- Wallets can be stolen, and once funds are gone, there’s no way to reverse the transaction.

- Payments are irreversible, leaving consumers with zero protection if something goes wrong.

These weren’t hypothetical concerns. Turkey had seen a surge in crypto adoption, especially after the lira lost nearly 50% of its value against the dollar between 2018 and 2021. People turned to Bitcoin and USDT as a hedge. But as usage grew, so did the risk of unregulated financial chaos. The CBRT’s goal wasn’t to stop crypto-it was to stop it from becoming part of everyday commerce.

What exactly does the ban cover?

The regulation is narrow but strict. It bans:- Merchants from accepting crypto as payment for goods or services.

- Payment processors and electronic money institutions from facilitating crypto transactions.

- Any direct or indirect use of crypto to settle payments.

But here’s what it doesn’t ban:

- Buying or selling crypto on exchanges.

- Holding crypto in personal wallets.

- Transferring crypto between individuals or platforms.

- Custody services or crypto lending.

So if you’re in Istanbul and want to pay for your Uber ride with ETH? Not allowed. But if you buy ETH on Binance Turkey and hold it until the lira drops again? Completely legal. This split approach is unusual. Most countries either ban crypto entirely (like China) or embrace it as legal tender (like El Salvador). Turkey chose a middle path: let people trade, but keep crypto out of the payment system.

How did people react?

Turkish crypto users didn’t disappear-they adapted. By 2023, nearly 1 in 5 Turks (19.3%) were actively using cryptocurrencies, up from just 1.8% in 2020. That’s an 11-fold increase in just three years. But the payment ban created a frustrating gap.Reddit threads in r/CryptoTurkey are full of complaints like: “I can trade freely but can’t use my USDT to pay for dinner-that’s the Turkish crypto paradox.” Trustpilot reviews for Binance Turkey show a 3.8/5 rating, with users praising fast deposits and low fees, but consistently writing: “Great for trading, useless for payments.”

Businesses didn’t benefit either. A 2024 survey by TÜİK (Turkish Statistical Institute) found only 2% of Turkish businesses accepted crypto payments. Compare that to Georgia, where 14% do-despite having no such ban. Turkey’s economy lost out on innovation, convenience, and potential foreign investment.

What changed after 2021?

The 2021 ban was just the beginning. In July 2024, Turkey passed the Law on Amendments to the Capital Markets Law, giving the Turkish Capital Markets Board (CMB) full authority over crypto. Now, every crypto exchange, wallet provider, or custodian must be licensed by the CMB to operate in Turkey.The requirements are tough:

- Exchanges need at least TRY 150 million ($4.1 million) in capital.

- Custodians need TRY 500 million ($13.7 million).

- All platforms must register locally and submit detailed transaction logs.

- They must block transactions involving unregistered wallets.

In March 2025, the CMB blocked 46 crypto platforms-including popular DeFi services like PancakeSwap-for operating without licenses. The message was clear: no more offshore platforms serving Turkish users.

Then came the AML rules. Starting February 25, 2025, any crypto transaction over 15,000 Turkish lira (about $425) requires full identity verification. Even transfers between wallets must show valid sender details. If you send crypto from an unverified address, the transaction can be frozen. This is stricter than most EU countries.

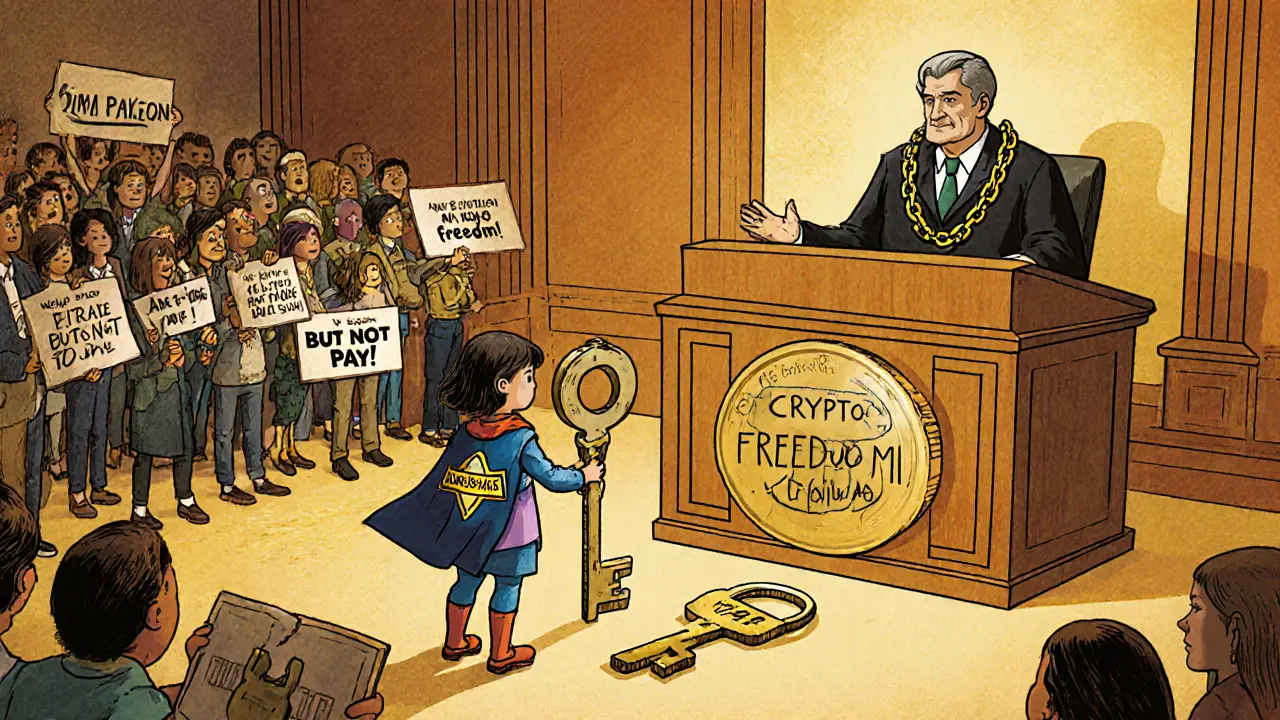

Who’s challenging the ban?

Not everyone agrees with the government’s approach. Sima Baktaş, founding partner of Turkish law firm GlobalB, is taking the government to court. Her case, scheduled for May 28, 2025, argues that the payment ban stifles innovation and pushes crypto activity underground.Baktaş points to data: Turkey’s crypto market is now worth $170 billion. Millions of people use it. The ban isn’t stopping adoption-it’s just making it harder to use. She argues that legalizing crypto payments could bring transparency, reduce black-market trading, and attract blockchain startups to Turkey.

“Lifting the ban would foster financial sector development, make payments more effective, and increase Turkey’s attractiveness for blockchain businesses,” she told MiTrade in March 2025.

Her case could be a turning point. If successful, it could force the government to rewrite the rules-not to ban crypto, but to regulate it properly.

How does this affect businesses?

For payment processors, the rules are clear: you must build systems to detect and block any crypto transaction. That means monitoring transaction patterns, flagging wallet addresses, and training staff to spot attempts to bypass the ban. Deloitte Turkey reported that compliance teams at major exchanges grew by 30-40% after the 2025 AML rules kicked in.Businesses that want to accept crypto face a dead end. Even if they set up a wallet, they can’t legally use it to receive payments. Some try to work around it-offering discounts for “donations” or using third-party intermediaries-but those are legal gray zones. The risk of fines or license revocation is too high.

As a result, Turkish startups avoid crypto integration entirely. The country’s blockchain ecosystem thrives in trading and custody-but not in real-world use cases.

What’s next for Turkey’s crypto scene?

The future hinges on two things: the court case in May 2025, and whether the government sees crypto as a threat or an opportunity.If the ban stays, Turkey will remain a crypto trading hub with no real economy around it. People will keep buying Bitcoin to protect their savings, but they won’t be able to spend it. That’s not innovation-it’s financial isolation.

If the ban is lifted or modified, Turkey could become a leader in regulated crypto payments in the region. Imagine a world where you can pay your utility bill with USDT, get instant settlement, and pay zero fees. That’s possible-if the rules change.

For now, Turkey walks a tightrope. It wants to protect its currency and prevent financial instability. But it’s also ignoring a massive, growing market of 19 million active crypto users. The question isn’t whether crypto will survive in Turkey. It already has. The question is whether the government will let it grow beyond the shadows.

How does Turkey compare to other countries?

Turkey’s approach is unique. Here’s how it stacks up:| Country | Crypto Payment Ban? | Crypto Trading Allowed? | Regulatory Authority |

|---|---|---|---|

| Turkey | Yes (since 2021) | Yes | CBRT (payments), CMB (trading) |

| China | Yes (full ban since 2021) | No | People’s Bank of China |

| El Salvador | No | Yes | Government (Bitcoin legal tender) |

| Russia | Partially | Yes | Central Bank of Russia |

| Kazakhstan | No | Yes | National Bank of Kazakhstan |

Turkey isn’t alone in restricting payments. Russia and Kazakhstan also limit crypto use in commerce-but neither banned it outright. Turkey’s version is the strictest among these nations. And unlike El Salvador, where crypto is integrated into the economy, Turkey treats it like a dangerous guest you can invite to the party-but not let near the cash register.

Can I still buy Bitcoin in Turkey?

Yes. You can buy, sell, and hold Bitcoin and other cryptocurrencies on licensed exchanges like Binance Turkey, Paribu, and Koinim. The 2021 ban only stops you from using crypto to pay for goods or services. Trading and holding are fully legal.

Is it illegal to use crypto for online purchases in Turkey?

Yes. If a merchant accepts crypto as payment-even if they’re based outside Turkey-it’s still illegal under Turkish law. Payment processors and platforms serving Turkish customers must block these transactions. Violations can lead to heavy fines or license revocation.

What happens if I send crypto over 15,000 Turkish lira?

Since February 25, 2025, any transaction over 15,000 TRY (about $425) requires identity verification. If you’re sending to an unregistered wallet or without proper sender details, the transaction will be flagged as risky and may be paused or canceled. Exchanges are required to report these to MASAK, Turkey’s financial crimes unit.

Are DeFi platforms banned in Turkey?

Yes, if they’re not licensed by the CMB. In March 2025, the CMB blocked 46 DeFi platforms-including PancakeSwap, Uniswap clones, and lending protocols-because they didn’t register locally or comply with KYC rules. Turkish users can still access them via VPNs, but it’s legally risky and financially unsafe.

Will Turkey lift the crypto payment ban?

It’s possible. A landmark legal challenge by law firm GlobalB is scheduled for May 28, 2025. The argument is that the ban hurts innovation and pushes users toward unregulated channels. If the court rules in favor of lifting the ban, Turkey could become a leader in regulated crypto payments. But until then, the ban remains in full force.

16 Comments

mark Hayes

November 2, 2025 AT 18:44 PMBro i just bought my first BTC last week and tried to pay for my lunch with it 😂 the cashier looked at me like i asked to pay with dinosaur bones. Turkey’s whole crypto paradox is wild. You can trade like a pro but can’t buy a kebab with your gains? That’s not regulation, that’s emotional support for the lira 🤷♂️ #CryptoParadox

Derek Hardman

November 3, 2025 AT 22:18 PMThe Central Bank’s rationale is, on the face of it, entirely defensible. Volatility, irreversibility, and lack of consumer protection are legitimate concerns in a retail payment context. However, the selective prohibition-permitting trading while banning payments-creates a regulatory arbitrage that may ultimately undermine its own objectives. One might reasonably ask whether the policy is more about control than protection.

Eliane Karp Toledo

November 5, 2025 AT 22:13 PMThis is all a distraction. The real reason? The government’s scared crypto will expose how the lira is just printed paper with a fancy watermark. They know if people start using crypto to pay for rent, they’ll realize the central bank is just printing money to pay off oligarchs. And then… the revolution. You think this ban is about financial stability? Nah. It’s about keeping people docile. Watch for the black market to explode next year. They’re already using Telegram bots to settle deals. #DeepStateCrypto

Phyllis Nordquist

November 7, 2025 AT 01:00 AMThe regulatory framework in Turkey reflects a nuanced understanding of cryptocurrency’s dual nature: as both a speculative asset and a potential payment instrument. The distinction between trading and payment is strategically sound, as it allows for market participation while mitigating systemic risk to the national payment infrastructure. The licensing regime introduced in 2024 further enhances transparency and accountability, aligning Turkey with international standards for digital asset oversight.

Eric Redman

November 8, 2025 AT 07:00 AMSo let me get this straight-Turkey says you can’t use crypto to pay for your Uber but you can buy 10 BTC with your life savings? That’s like letting someone own a Ferrari but only letting them drive it in their garage. The whole thing is a joke. People are gonna start bartering with Dogecoin in alleyways now. I’m just waiting for the first Turkish guy to pay for a kebab with NFT art. ‘Here’s my CryptoKitty, it’s worth 500 lira.’ 😭

Jason Coe

November 8, 2025 AT 11:04 AMI’ve been following this since 2021 and honestly, the ban makes sense on paper but fails in practice. People aren’t stopping-they’re just getting more creative. I know a guy in Ankara who runs a coffee shop and he accepts crypto but calls it a ‘donation’ and gives you a free baklava. It’s a workaround, sure, but it’s also a sign the market’s too big to ignore. And now with the 15,000 TRY KYC rule? That’s just turning every transfer into a paperwork nightmare. I’ve seen people send 14,999 TRY just to avoid the headache. It’s like the government is trying to stop a flood with a colander. The innovation’s still happening, just underground. And honestly? That’s worse than regulation. At least if it’s legal, you can audit it. Now? You’re just guessing who’s doing what.

David James

November 8, 2025 AT 23:00 PMI think the turkish govt is doing the right thing. Crypto is too wild for everyday use. People lose money fast. And if you can’t get your money back when something goes wrong, that’s bad for the economy. Trading is fine, but paying? No. We need to protect regular people. I’m not against crypto, but not in my grocery store. It’s just not ready yet.

Shaunn Graves

November 10, 2025 AT 07:46 AMLet me be blunt: this ban is a failure disguised as policy. You don’t stop adoption by banning usage-you just make it more dangerous. People are already using unregulated offshore exchanges, VPNs, and peer-to-peer networks. The 15,000 TRY KYC rule? It’s just creating a black market for fake IDs. And the fact that 19% of Turks are using crypto despite the ban proves one thing: the government has zero control over this. They’re not protecting the economy-they’re protecting their own power. This isn’t financial policy. It’s authoritarianism with a spreadsheet.

Jessica Hulst

November 10, 2025 AT 21:09 PMYou know what’s funny? The government thinks they’re stopping crypto from ‘undermining the lira’… but the lira’s already crumbling. Crypto isn’t the disease-it’s the symptom. People aren’t using Bitcoin because they’re tech bros. They’re using it because their savings are evaporating. The ban isn’t about regulation. It’s about denial. And the irony? The more they try to lock it out, the more it becomes the only thing keeping ordinary people from sleeping on the street. We’re not banning a currency. We’re banning survival. And one day, someone’s gonna look back and ask: ‘Why did they think controlling money was more important than controlling poverty?’

Kaela Coren

November 12, 2025 AT 02:44 AMThe regulatory architecture presented by the CMB demonstrates a commendable effort to formalize an otherwise decentralized ecosystem. The capital requirements and transaction logging obligations align with FATF recommendations and provide a measurable framework for compliance. However, the exclusion of payment use remains a structural inconsistency, as it creates a bifurcated market wherein speculative activity is incentivized over utility-based adoption.

Nabil ben Salah Nasri

November 12, 2025 AT 08:36 AMI’m Turkish-American and I’ve seen this from both sides. My family in Istanbul still buys BTC every payday. My cousin uses it to send money to his sister in Germany-no fees, no waiting. But yeah, he can’t use it to pay for his kid’s school lunch. It’s so frustrating. I get the fear of volatility, but why not just regulate it like banks? Like, why not let people pay with crypto if the merchant has a licensed gateway? The government’s acting like crypto is a virus, but it’s more like a new kind of plumbing. You don’t ban water because it’s wet-you build better pipes. 🇹🇷❤️🇺🇸

alvin Bachtiar

November 13, 2025 AT 19:57 PMThis ban is a masterpiece of incompetence. You let people gamble on crypto like it’s a casino but slap them if they try to use it like money? That’s not regulation-that’s psychological warfare. And now you’re blocking DeFi platforms? Bro, if you think people aren’t using self-custody wallets and cold storage, you’re delusional. The only thing you’ve done is turn Turkey into the world’s largest underground crypto economy. Congrats. You just made the black market smarter, richer, and harder to track. And now you’re spending millions on compliance teams to chase ghosts. Pathetic.

Josh Serum

November 14, 2025 AT 11:46 AMHonestly, I think everyone’s overreacting. Crypto is just a fad. Remember when people thought the internet was going to kill cash? It didn’t. Same thing here. People will go back to lira. The government knows what’s best. If you can’t pay for your coffee with crypto, maybe you shouldn’t have bought it in the first place. It’s not rocket science. Just use your bank account like a normal person. 🤓

DeeDee Kallam

November 15, 2025 AT 10:52 AMi hate how everyone says crypto is the future but like… i just wanna pay for my tea without my wallet getting hacked or some dude scamming me. this ban? kinda makes sense. i dont trust it. and why do people think they need to pay for stuff with coins? its just digital scribble. 🙄

Helen Hardman

November 17, 2025 AT 01:19 AMI’ve been working in fintech for 15 years, and I’ve never seen a policy so perfectly balanced between caution and opportunity. Turkey didn’t ban innovation-it created boundaries. Think about it: you can still trade, invest, and custody. You just can’t turn your crypto into a debit card. That’s not repression-it’s responsible stewardship. The 2025 AML rules? Brilliant. They’re catching bad actors without crushing the good ones. And the court case? Let it happen. If the law is outdated, the courts will fix it. But for now, this is the smartest crypto policy in emerging markets. No one else is even trying to build a bridge like this. Turkey’s not behind-it’s ahead.

mark Hayes

November 17, 2025 AT 13:52 PM^^^ I just wanna say I agree with Helen. The middle path is the only one that doesn’t end in chaos. We don’t need El Salvador or China. We need Turkey. And if they lift the ban with proper oversight? I’ll be first in line to pay for my coffee with ETH. ☕️🚀