Crypticorn Staking Reward Calculator

How This Calculator Works

Based on the article's findings: Crypticorn has zero trading volume, no verifiable AI performance, and claims 20% APY with no revenue source. This calculator shows what would happen if the staking rewards were actually sustainable - and why they likely aren't.

Crypticorn (AIC) is a cryptocurrency built to give traders AI-powered predictions for short-term crypto moves. It’s not a coin you mine or a blockchain you run - it’s a BEP20 token on the BNB Chain, meant to work inside a web dashboard that claims to forecast price changes using machine learning. You buy AIC tokens to access tools like 6-hour price predictions, AI trading signals, and a chatbot called TraderGPT. But here’s the catch: no one can prove if those predictions actually work.

How Crypticorn (AIC) is supposed to work

Crypticorn’s whole pitch is simple: let AI do the trading for you. The platform says it analyzes market data 24/7, spots patterns humans miss, and sends you alerts like “Buy BTC in 90 minutes” or “Sell ETH now.” You connect your MetaMask wallet to their dashboard, stake your AIC tokens, and let the system run. They claim even beginners can use it - no trading experience needed.

The tools include:

- Price Prediction: Forecasts for the next 6 hours

- Momentum Prediction: 12-hour trend direction signals

- Smart AI Trading: Automated buy/sell triggers

- TraderGPT: An AI assistant that answers crypto questions

- Economic News Feed: Aggregates headlines from crypto and financial sites

It sounds powerful - until you ask how it knows what it knows. The team never shares details about the AI model. No training data. No backtested results. No accuracy rates. Just a black box with a fancy dashboard.

Tokenomics: Supply, taxes, and staking

Crypticorn has a fixed supply of 100 million AIC tokens. That’s it. No more will ever be created. Right now, almost none of them are in circulation - Binance shows $0 trading volume over 24 hours as of October 2023. That means no one’s actively buying or selling. The market cap is listed at $1.44 million, but that’s based on the full supply, not what’s actually traded. In reality, liquidity is nearly nonexistent.

Every time you buy or sell AIC, you pay a 2% to 5% fee. The project says this tax will drop as the market cap grows, but there’s no timeline. Half of that fee supposedly goes to “buybacks and burns,” meaning they’ll use money to destroy tokens and make the supply smaller. But there’s no public blockchain tracker showing actual burns. You’re trusting them to do it.

The biggest lure? Staking. Crypticorn promises up to 20% APY if you lock your AIC tokens. That’s way higher than most stablecoins or even major DeFi protocols. But here’s the problem: if no one’s trading the token, where’s the money coming from to pay those rewards? It’s likely just new users’ money going to early holders - a classic sign of a Ponzi structure.

Where you can buy Crypticorn (AIC)

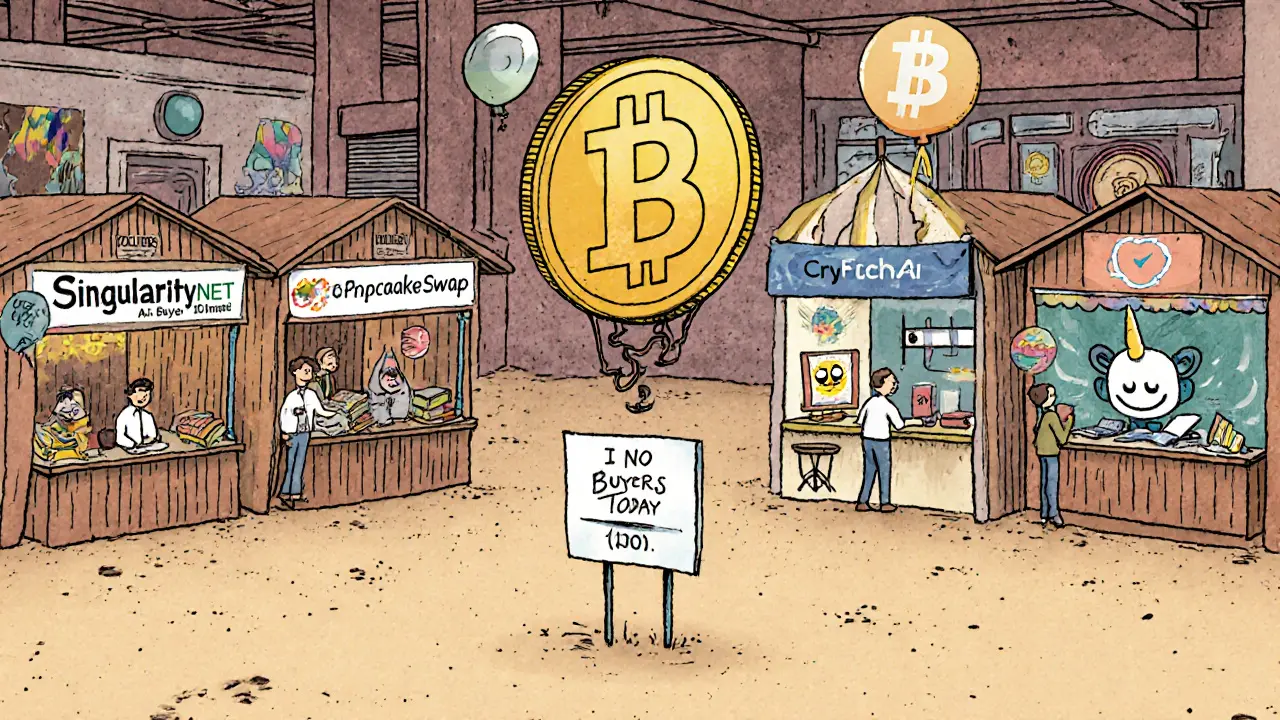

You won’t find AIC on Coinbase, Kraken, or Binance’s main exchange. It’s only listed on a few decentralized exchanges (DEXs) like PancakeSwap. That means you need a Web3 wallet, some BNB for gas fees, and the courage to trade a token with zero liquidity.

Buying AIC isn’t like buying Bitcoin. You’re not getting a liquid asset. You’re buying access to a platform that might not work - and might vanish tomorrow. The contract address is 0x8E3F0b0b604bC69ea98A8039fF7884047bC3BD55, but that’s just a string of letters and numbers. No audits. No insurance. No recourse if things go wrong.

How it compares to other AI crypto projects

Crypticorn isn’t alone. There are dozens of AI crypto tokens now. But most of them have something AIC doesn’t: proof.

Take SingularityNET (AGIX). It’s a marketplace for AI services, built on a real network of developers. Their AI models are open to inspection. Fetch.ai (FET) lets autonomous agents trade and negotiate on your behalf - and they’ve been live for years with public performance logs.

Crypticorn? No public data. No code repo. No GitHub. No whitepaper with technical specs. Just a website with screenshots and testimonials that look like stock photos. Even the “user reviews” on Telegram are vague: “I got better entry points” - but no screenshots, no timestamps, no profit numbers.

On CoinMarketCap and CoinGecko, AIC doesn’t even have a verified listing. It’s buried under thousands of other tokens. It ranks #9132 by market cap - meaning it’s smaller than 9,000 other crypto projects.

The red flags you can’t ignore

Here’s what’s missing - and why experts are skeptical:

- No backtested results: No one’s shown how accurate the AI predictions have been over time. A real AI trading system would publish monthly accuracy stats - like “78% win rate on BTC 6-hour forecasts.” Crypticorn doesn’t.

- Zero trading volume: If no one’s buying or selling, why does the token exist? It’s a ghost asset.

- Anonymous team: No names. No LinkedIn profiles. No past projects. Just a website with a .com domain and a Discord server.

- Unverified burns: They say they burn tokens to increase value. But there’s no public record of it happening.

- High APY with no funding source: Paying 20% APY requires real revenue. Where’s the revenue? From new investors? That’s unsustainable.

- No media coverage: CoinDesk, Messari, Delphi Digital - none have written about it. That’s rare for any crypto project with real tech.

One crypto analyst on Twitter summed it up: “No backtesting data? No transparency? Then it’s not AI. It’s marketing.”

Who is this for?

Crypticorn isn’t for long-term investors. It’s not for institutional traders. It’s not even for serious retail traders who track their P&L.

This is for people who:

- Believe AI can magically predict crypto prices

- Want to earn high yields without understanding how

- Are drawn to flashy dashboards and “future tech” buzzwords

- Don’t mind risking money on a project with no track record

If you’re looking for real AI tools in crypto, look at projects with open-source code, public performance metrics, and real teams. Crypticorn offers none of that.

What’s the bottom line?

Crypticorn (AIC) is a speculative token wrapped in AI hype. It promises smart trading tools, high staking rewards, and a deflationary model - but delivers zero proof. The token has no liquidity, no verified performance, and no team. The AI claims are unverifiable. The staking rewards are likely funded by new buyers.

It’s not illegal. It’s not a scam - not yet. But it’s a gamble with almost no upside and high risk. If you buy AIC, you’re not investing in AI. You’re betting that someone else will pay more for it tomorrow - even though no one’s buying it today.

For now, treat it like a lottery ticket. Not an investment.

Is Crypticorn (AIC) a scam?

It’s not officially labeled a scam, but it has nearly all the warning signs. No transparency, no verifiable AI performance, zero trading volume, and an anonymous team are red flags. Many experts call this “AI-washing” - slapping an AI label on a project to attract investors. Without proof, it’s more speculation than innovation.

Can I make money staking AIC?

You might earn staking rewards - but only if other people keep buying AIC to fund them. Since there’s no real revenue or trading volume, the 20% APY likely comes from new investors’ money. That’s unsustainable. If trading picks up, rewards could vanish. If no one buys, the whole system collapses.

Where can I buy Crypticorn (AIC)?

AIC is only available on decentralized exchanges like PancakeSwap. You need a Web3 wallet like MetaMask and some BNB to pay for gas. It’s not listed on any major centralized exchanges like Binance or Coinbase. Buying it means dealing with low liquidity and high slippage.

Does Crypticorn’s AI actually work?

There’s no public data to prove it does. No backtests. No accuracy rates. No historical predictions you can compare to real prices. The team keeps the AI model secret. Without proof, you’re trusting marketing claims - not results. Most experienced traders ignore it for this reason.

Is Crypticorn safe to use?

It’s not safe in the way you’d expect from a financial product. There’s no insurance, no audits, and no customer support team you can reliably reach. Users report long wait times for help. If the website goes down or the team disappears, your tokens could become worthless overnight. Treat it as high-risk speculation.

What’s the future of Crypticorn (AIC)?

Its future depends entirely on hype. If more people buy in, the price might rise - but only temporarily. Without real technology, transparency, or adoption, it’s unlikely to survive long-term. Crypto analysts warn that AI-themed tokens without verifiable results are fading fast. Crypticorn has no edge over competitors - only promises.

19 Comments

Chloe Jobson

October 28, 2025 AT 20:59 PMThis is exactly why I avoid AI crypto projects. No backtested data, no transparency, just a shiny dashboard and a 20% APY promise. If it were real, someone would’ve published the model by now.

Zero volume? That’s not a token, that’s a ghost.

Don’t even bother staking. You’re just feeding the machine.

Stay away.

Trust me, I’ve seen this movie before.

Andrew Morgan

October 30, 2025 AT 18:46 PMbro i just bought 5000 AIC because the dashboard looks like a spaceship control panel and TraderGPT called me sir

who cares if no one’s trading it

i got vibes

and the staking rewards are already in my wallet

if it crashes i’ll just say i got scammed and move on

its crypto bro its supposed to be wild

Michael Folorunsho

November 1, 2025 AT 10:04 AMLet me guess - you’re one of those people who think ‘AI’ is a magic word that turns garbage into gold. This isn’t innovation. It’s a carnival sideshow wrapped in a .com domain. The team’s anonymous, the token’s dead, and the APY is a Ponzi whisper. If you’re dumb enough to stake this, you deserve to lose it. America’s crypto education system is a joke.

Go invest in Bitcoin like a normal human.

Roxanne Maxwell

November 3, 2025 AT 03:23 AMI just want to say I get why people are drawn to this - the idea of AI making trading easy is super tempting, especially if you’ve been burned before.

But you’re right, there’s just no proof. No numbers, no track record, no real team.

It’s like buying a car with no engine and being told ‘it runs on hope.’

Be kind to yourself - don’t risk money on vibes alone.

Jonathan Tanguay

November 3, 2025 AT 10:15 AMOkay so let me break this down for the 100th time because apparently people still fall for this crap - if a project has no GitHub no whitepaper no team names no audits no liquidity no backtesting no media coverage and only lists on PancakeSwap with zero volume then it’s not a crypto project its a glorified meme coin with AI buzzwords slapped on it like a sticker on a broken toaster

And the 20 percent APY is literally just new buyers paying old buyers like a pyramid scheme where the pyramid is made of glitter and lies

And if you think TraderGPT is going to save your portfolio you’re delusional it’s trained on Reddit threads and Midjourney prompts

And the burns are fictional the contract is unverified and the whole thing is one big marketing funnel designed to drain your BNB and your sanity

Stop giving these people money

Ayanda Ndoni

November 4, 2025 AT 21:13 PMyo i just checked the contract address and it looks like someone typed it while drunk

also i think i saw the same screenshot of the dashboard on 3 different AI crypto sites

is this just a template?

also why does the website have a 2019 design

like bro did they hire a high schooler from Nigeria to build this

also can i get a refund if i lose my money

jk lol

Elliott Algarin

November 5, 2025 AT 05:41 AMIt’s funny how we all chase the idea of machines predicting markets.

But markets aren’t predictable - they’re chaotic.

AI doesn’t make them less so.

It just gives us the illusion of control.

And when the illusion breaks, we blame the tool instead of our own hunger for certainty.

This token isn’t broken - it’s just honest about what it is: a mirror for our desire to outsource risk.

Maybe the real AI here is the one inside us that believes in magic.

John Murphy

November 6, 2025 AT 23:49 PMthe 20 percent apy is the biggest red flag

no legitimate project pays that without real revenue

and if the burns aren’t on chain how do we know they’re happening

and why is there no github

and why does the team have zero online presence

and why is the market cap based on full supply

and why does the website look like it was made in 2017

and why does the discord have 12 members and 8 bots

just… why

Zach Crandall

November 7, 2025 AT 01:30 AMAs a Canadian investor with a fiduciary duty to my clients, I must state unequivocally that this token exhibits all the hallmarks of a speculative vehicle devoid of fundamental underpinnings. The absence of verifiable AI performance metrics, coupled with non-transparent tokenomics and zero liquidity, renders this offering incompatible with prudent financial practice. I would advise any rational actor to avoid exposure to this asset class entirely. The regulatory risk alone is prohibitive.

Akinyemi Akindele Winner

November 7, 2025 AT 07:10 AMyou people act like this is the first time someone sold smoke as AI

bro in Lagos we call this ‘Naija 4.0’ - you pay money to watch a screen blink and hope the gods of BNB smile

they don’t even have a whitepaper - just a WhatsApp group with 300 people screaming ‘TO THE MOON’

the only thing this AI predicts is how fast you’ll lose your money

but hey - at least it’s got a chatbot that says ‘good morning sir’

that’s more than my ex did

Patrick De Leon

November 8, 2025 AT 16:00 PMIrresponsible. Unregulated. Unaudited. Untraceable. This isn’t innovation - it’s financial vandalism. The Irish Financial Services Regulatory Authority would shut this down in 48 hours. The fact it exists at all is a global embarrassment. Anyone holding this is either a fool or a scammer. Either way - you’re part of the problem.

MANGESH NEEL

November 8, 2025 AT 23:02 PMTHIS IS A SCAM AND YOU ALL ARE FOOLED

THEY’RE USING YOUR MONEY TO PAY THE FIRST 50 PEOPLE WHO BOUGHT IT

THEY’RE NOT TRADING

THEY’RE NOT AI

THEY’RE JUST TAKING YOUR BNB AND LAUGHING

WHY DO YOU THINK THE PRICE HASN’T MOVED IN 6 MONTHS

BECAUSE NO ONE ELSE IS BUYING

THEY’RE JUST WAITING FOR THE NEXT GUY TO WALK IN

AND WHEN HE DOES THEY’LL VANISH

AND YOU’LL BE LEFT WITH A TOKEN THAT’S WORTH LESS THAN THE GAS FEES TO SELL IT

AND THEN YOU’LL COME HERE CRYING

AND I’LL BE HERE SAYING I TOLD YOU SO

Sean Huang

November 9, 2025 AT 14:57 PMThink about this - what if the whole AI prediction thing is just a front for a government surveillance operation?

Every time you stake AIC, you’re feeding your wallet data into a neural net that tracks your crypto behavior

Then they sell it to the NSA or the CCP

And the 20% APY? That’s not a reward - it’s bait.

They want you to connect your wallet so they can map your entire financial life.

And the ‘TraderGPT’? It’s not helping you trade - it’s learning your emotional triggers.

They’re not selling crypto.

They’re selling your privacy.

And you’re handing it to them for free.

Wake up.

They’re not trying to make you rich.

They’re trying to own you.

madhu belavadi

November 11, 2025 AT 05:50 AMlol i just checked the website again

the ‘AI predictions’ are just random numbers that change every 5 seconds

and the ‘news feed’ is just copied from coinmarketcap

and the chatbot says ‘i’m here to help’ no matter what you ask

imagine paying for this

imagine staking for this

imagine believing in this

imagine being this person

Dick Lane

November 12, 2025 AT 19:42 PMmy buddy bought 2k AIC last week

he said he made 15% in 3 days

then he checked the price today

it’s down 40%

he’s still holding

he says ‘the AI will turn it around’

bro… the AI doesn’t exist

you’re just holding a digital post-it note

Norman Woo

November 14, 2025 AT 09:38 AMwhat if the whole thing is a bot farm

all the ‘users’ on the discord are fake

the testimonials are ai generated

the dashboard is a fake screen

the ‘tradergpt’ is just a chatbot trained on crypto memes

and the token? just a script that shows a number that goes up when someone clicks buy

they don’t even need to own the blockchain

they just need you to believe

and that’s the real product

Serena Dean

November 16, 2025 AT 05:54 AMLook - I get it. You want to believe in something that makes trading easy.

But real AI tools don’t hide behind anonymous teams and fake volume.

They show their work.

They let you test them.

They have real teams with real resumes.

Don’t let FOMO blind you.

There are legit AI crypto projects out there - go find them.

You deserve better than a dashboard that looks like it was made in Paint.

James Young

November 16, 2025 AT 21:07 PMAnyone who thinks this is a good idea is a complete idiot. You’re not investing - you’re donating. The team is anonymous, the token has no liquidity, the AI is a lie, and the APY is a Ponzi. You’re not getting rich. You’re just funding someone else’s yacht. Stop being gullible. Go learn how to read a whitepaper. Or better yet - go trade Bitcoin like a grown-up.

Ali Korkor

November 17, 2025 AT 03:38 AMHey - if you’re new to crypto and saw this and thought ‘this could be my ticket’ - I get it.

But here’s the thing: real growth doesn’t come from hype.

It comes from transparency.

From code.

From track records.

From teams you can find on LinkedIn.

This? This is the opposite.

Don’t give your money to a mystery.

Give it to something that shows its work.

You’ll sleep better at night.

And you might even make money.