RAM Investment Value Calculator

Calculate how your investment in RAM would have performed from its peak of $3.85 (April 2021) to its current value of $0.011 (October 2024).

This tool demonstrates the dramatic 99.7% price drop of RAM, which is not a stablecoin despite its claims.

When you hear "stablecoin," you think of USDT, USDC, or DAI-coins that stay close to $1.00 no matter what. But Ramifi Protocol (RAM) claims to be one too. Only it doesn’t stay stable. Not even close. In fact, RAM is one of the most dramatic examples of a crypto project that promised one thing and delivered another-and then vanished from relevance.

What Ramifi Protocol (RAM) actually is

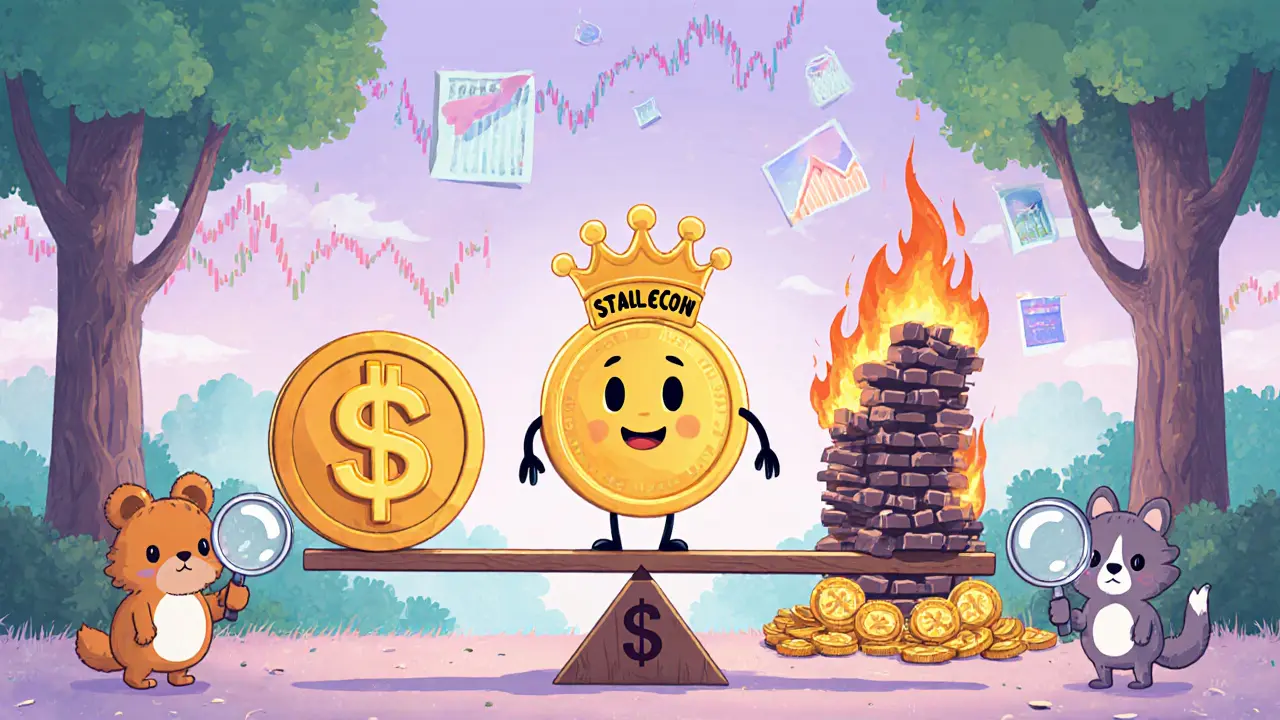

Ramifi Protocol is a cryptocurrency token called RAM, launched in early 2021 with the claim that it uses an algorithmic supply mechanism to fight USD inflation. Unlike traditional stablecoins backed by cash or reserves, RAM was supposed to adjust its supply automatically-printing more tokens when prices rose, burning them when they fell-to keep value steady.

It sounded smart on paper. But in practice, it failed. Instead of staying near $1, RAM spiked to $3.85 in April 2021, then collapsed. By October 2024, it was trading at $0.011. That’s a 99.7% drop from its peak. If you bought RAM at its highest, you’d need it to rise 350 times just to break even.

The total supply is fixed at 7,213,000 RAM tokens. Only 99,000 of those-about 1.37%-were ever sold to the public. The rest went to private investors, team wallets, and venture funds like Genblock Capital, Moonrock Capital, and x21 Digital. That means the vast majority of tokens were never available to regular users. And that’s just the start of the problems.

Why RAM isn’t a stablecoin

Real stablecoins stay within 0.5% of their target price. RAM swings wildly. In one week in October 2024, it moved between $0.01074 and $0.01427. That’s a 32.7% range. That’s not stability. That’s gambling.

And here’s the kicker: RAM’s algorithm never worked. There’s no evidence it ever adjusted supply meaningfully. No public data shows tokens being burned or minted in response to price changes. The entire mechanism appears theoretical-never tested, never verified. Meanwhile, its price behavior matches speculative meme coins, not stable assets.

Calling RAM a stablecoin is misleading. It’s not even close. Even CoinMarketCap users called it "a joke." One comment said it best: "You can’t fight inflation by dropping 99.7% in value."

Trading RAM: A nightmare of low liquidity

If you think you can buy RAM and sell it later, think again. Liquidity is razor-thin.

On Gate.io-the main exchange where RAM trades-the 24-hour volume is around $16,700. On PancakeSwap, it’s $76. That’s less than what some small-cap NFT collections trade in an hour.

What does that mean for you? Slippage. Orders take hours to fill. If you try to sell 1,000 RAM tokens, you might have to drop your price by 10% just to find a buyer. Traders report using limit orders with 5-10% buffers just to get filled. The order book depth at +2% is only $21. That’s not a market. That’s a ghost town.

Even the price charts are unreliable. CoinGecko shows RAM’s market cap as $5,150. Other sources say $102,710 (based on fully diluted valuation). Why the gap? Because no one knows how many tokens are actually circulating. The project doesn’t disclose it clearly. That’s a red flag for any serious investor.

Who’s behind Ramifi Protocol?

The team behind RAM never went public. No LinkedIn profiles. No interviews. No roadmap updates since 2021. The website is bare-bones-no whitepaper, no technical docs, no GitHub repo. You can’t even find a clear team photo or names.

The project raised $959,250 from investors like Genblock Capital and Lotus Capital. But none of them have spoken publicly about RAM since 2022. No press releases. No Twitter threads. No Discord server. Only a Telegram group with fewer than 500 members-and most of them are just checking prices, not discussing development.

Compare that to DAI, which has a public team, open-source code, and monthly governance votes. RAM has nothing. It’s a dead project wearing a dead label: "algorithmic stablecoin."

Price predictions? Don’t believe the hype

You’ll find websites claiming RAM will hit $0.03 by 2025. CoinCodex says it could rise 34% to $0.0336. Swapspace.co predicts $0.01973 in 2025 and $0.01973 again in 2030.

Here’s the truth: those predictions are based on zero fundamentals. They’re pulled from outdated technical indicators and wishful thinking. RAM’s trading volume is too low for any meaningful price movement. No new users are coming in. No partnerships. No integrations. No DeFi liquidity pools. No real-world use cases.

And yet, some bots still pump it. A few traders still buy it hoping for a miracle. But when a coin has been down 99.7% for three years and shows no sign of revival, it’s not a recovery-it’s a corpse.

Where RAM stands in the crypto world

As of October 2024, RAM ranks #4,771 on CoinMarketCap. Out of over 10,000 cryptocurrencies, it’s in the bottom 0.05%.

The entire stablecoin market is worth $153 billion. RAM’s market cap? Around $100,000. That’s 0.000002% of the total. You’d need to buy 50,000 RAM tokens to equal the value of one USDT.

It doesn’t compete with USDT or DAI. It doesn’t even compete with lesser-known stablecoins like FRAX or LUSD. RAM is invisible in the ecosystem. No wallets support it. No payment processors accept it. No DeFi apps list it as collateral. It exists only as a ticker on a few exchanges-barely traded, barely noticed.

Is RAM worth buying?

No.

If you’re looking for a stablecoin, stick with USDT, USDC, or DAI. They’re backed by real assets, audited, regulated, and used by millions.

If you’re looking for a speculative play, RAM has no momentum. No community. No development. No reason to believe it will ever rise again. The last time it moved significantly was in 2021. Since then, it’s been flatlining.

Even the people who bought it early have moved on. Reddit threads from August 2024 call it "another dead project from the 2021 bull run." One user wrote: "This token has been stagnant for years. I forgot I owned it until I saw the price again."

What happened to Ramifi Protocol?

It was a product of the 2021 crypto boom-a time when every project claimed to be "the next big thing." RAM rode the wave of algorithmic stablecoin hype, riding on the coattails of Terra’s UST before it collapsed.

But unlike UST, RAM never had a real economy behind it. No lending, no borrowing, no yield farming. No reason for anyone to hold it except speculation. And when the market turned, there was no demand left.

Today, RAM is a textbook case of a failed crypto project: high expectations, no execution, zero transparency, and no future. It’s not a coin. It’s a cautionary tale.

15 Comments

Chloe Jobson

October 27, 2025 AT 17:24 PMRAM was never a stablecoin. It was a meme dressed in whitepaper clothes. The algorithm? Pure fiction. The team? Ghosts. The liquidity? A graveyard.

Anyone who bought it after the peak deserves what they got.

Andrew Morgan

October 28, 2025 AT 01:26 AMbro i still have like 50k RAM in a wallet i forgot about

checked it last week and laughed so hard i cried

its like finding a lottery ticket from 2012 that expired

the only thing more dead than this coin is my hope in crypto sometimes

Michael Folorunsho

October 29, 2025 AT 11:43 AMIt’s pathetic. A so-called stablecoin that can’t even maintain 1% price consistency? This is why America’s crypto reputation is in the toilet. No regulation. No accountability. Just idiots throwing money at vaporware labeled as ‘innovation.’

Compare this to USDC - audited, transparent, regulated - and tell me why we even tolerate this garbage.

Roxanne Maxwell

October 30, 2025 AT 18:00 PMI remember when RAM was trending on Twitter in 2021. Everyone was so excited. I even bought a tiny bit out of curiosity.

Now I just feel sad for the people who lost so much. Not because they were dumb - because they believed in something that never had a chance.

Hope they moved on.

Jonathan Tanguay

November 1, 2025 AT 14:18 PMLook the whole algorithmic stablecoin thing was doomed from the start because nobody actually understands monetary policy or how supply and demand interact in real time without centralized backing

UST was a train wreck RAM was a bicycle with no brakes going down a hill made of glitter and lies

the fact that people still check the price like it's gonna pop back up is honestly terrifying

you think you're investing but you're just feeding a ghost

and don't even get me started on the fact that 98.6% of the supply was locked away by insiders who probably dumped it all in 2021 and vanished into the Bermuda Triangle of crypto anonymity

there's no whitepaper no github no team no roadmap just a website that looks like it was built in 2012 using dreamweaver

and yet somehow there are still bots pumping it because someone thinks this is a 'diamond hand opportunity'

if you're holding RAM right now you're not a degenerate you're a ghost haunting your own portfolio

Ayanda Ndoni

November 2, 2025 AT 23:53 PMyo i still got some RAM bro

why u hate on it so much

maybe it come back

my cousin in Lagos he say RAM gonna moon when africa adopt blockchain

he say its the future

i believe him

he got 3 phones and 2 crypto wallets

Elliott Algarin

November 3, 2025 AT 04:50 AMIt’s funny how we treat crypto like it’s a religion.

We assign meaning to tokens that have no intrinsic value.

RAM didn’t fail because the tech was bad.

It failed because we wanted to believe in something that could fix inflation without real work.

We were looking for magic.

And magic doesn’t exist.

Just math.

And math doesn’t care about your hopes.

John Murphy

November 3, 2025 AT 22:43 PMthe volume on gate.io is lower than my morning coffee order

and the price chart looks like a seizure

why does this still exist

who is even trading this

what are they thinking

just curious

Zach Crandall

November 4, 2025 AT 14:18 PMAs a Canadian investor with a professional background in financial compliance, I must emphasize that RAM represents a gross violation of fiduciary transparency standards.

Its lack of disclosure, absence of audit trails, and opaque token distribution constitute a material risk for any retail participant.

It is not merely a failed project - it is a regulatory red flag wrapped in a crypto whitepaper.

Akinyemi Akindele Winner

November 5, 2025 AT 06:37 AMRAM? More like RAMBO - went out with a bang then vanished like a Nigerian prince with your 50k Naira

they didn't build a stablecoin they built a confidence trick with a blockchain logo

and now it's just a digital ghost haunting the wallets of the gullible

but hey at least it's not a rug pull - it's a slow fade into oblivion

like a zombie that forgot it was dead

Patrick De Leon

November 5, 2025 AT 18:05 PMWhy are we still talking about this? It’s a dead asset. The market moved on. The devs disappeared. The community evaporated. It’s not a coin. It’s a footnote.

Stop pretending it has value. It doesn’t. It never did.

MANGESH NEEL

November 7, 2025 AT 13:42 PMYOU PEOPLE ARE SUCH LOSERS

RAM IS THE FUTURE

YOU JUST DON’T UNDERSTAND THE TECHNOLOGY

UST WAS A TRAP BUT RAM WAS A MASTERPIECE

THEY INTENTIONALLY DROPPED THE PRICE TO BUY BACK AT DISCOUNT

THEY’RE WAITING FOR THE NEXT CYCLE

YOU THINK YOU’RE SMART BUT YOU’RE JUST A SHEEP

THEY’RE HOLDING THE KEY TO THE NEXT 1000X

WAIT AND SEE WHEN THE WHALE COMES BACK

AND THEN YOU’LL BE CRYING ON THE SIDEWALK

WHILE I’M BUYING A MANSION IN SINGAPORE WITH MY RAM

Sean Huang

November 8, 2025 AT 02:19 AMDid you know RAM was secretly funded by a shadow group linked to the Federal Reserve’s covert digital currency experiments?

They didn’t want it to succeed - they wanted it to fail as a distraction.

Look at the timing - launched right after UST collapsed.

It was a controlled burn to discredit algorithmic stablecoins.

The real stablecoin is already out there - and it’s not USDT.

They’re using RAM to make us distrust innovation so they can push their own CBDC without resistance.

Check the blockchain timestamps - every major price drop coincides with Fed meetings.

It’s not a coin.

It’s a psyop.

And you’re all just pawns in the game.

:(

madhu belavadi

November 9, 2025 AT 21:47 PMwhy are we still talking about this

Dick Lane

November 10, 2025 AT 15:41 PMMy buddy bought RAM at $0.80 in 2021.

Now he’s got a wallet full of digital dust.

He still checks it every morning.

Like it’s gonna say hi.

I told him to just delete it.

He said it’s his emotional support crypto.

Guess some people need ghosts to feel alive.