Sei Trading Cost Calculator

Calculate Your Trading Costs

See how much you'd pay for 10,000 trades on different blockchains

Why Sei?

Sei is built for traders with 12,500 TPS and 300-400ms block finality. It solves three key trading problems:

- 20x cheaper fees than Solana for high-frequency traders

- Native order book support (unlike Solana or Ethereum)

- High protection against front-running and sandwich attacks

Your Savings with Sei

Ethereum

Average cost: $1.50–$5 per trade

Solana

Average cost: $0.00025–$0.001 per trade

Sei

Average cost: ~$0.000005 per trade

Total Cost

Savings

On average, Sei transactions cost about $0.000005 per trade - that's 20x cheaper than Solana and 3,000x cheaper than Ethereum for high-volume traders.

Most blockchains try to be everything at once - payments, NFTs, DeFi, gaming. But Sei doesn’t. It was built for one thing: trading. Fast, cheap, and fair trading on decentralized exchanges. If you’ve ever waited 10 seconds for a limit order to fill on Ethereum, or paid $5 in gas to trade a token that moved 2% - Sei is the answer you didn’t know you needed.

What exactly is Sei?

Sei (SEI) is a Layer 1 blockchain designed from the ground up to handle high-speed, high-volume trading. Unlike Ethereum or Solana, which are general-purpose networks, Sei is a specialist. It’s like building a race car instead of a SUV - you sacrifice versatility for raw performance in one specific area. It launched its mainnet beta in August 2023, created by Sei Labs, a team led by Jeffrey Feng (ex-Goldman Sachs) and Jayendra Jog (ex-Robinhood). These aren’t crypto newcomers. They’ve seen how Wall Street systems work - and how badly most DeFi platforms replicate them. The goal? Fix the three big problems traders face on other chains:- Slow execution - orders taking seconds or minutes to fill

- High fees - even on "fast" chains like Solana

- Front-running and sandwich attacks - bots stealing your trades by seeing them before they’re confirmed

How does Sei work so fast?

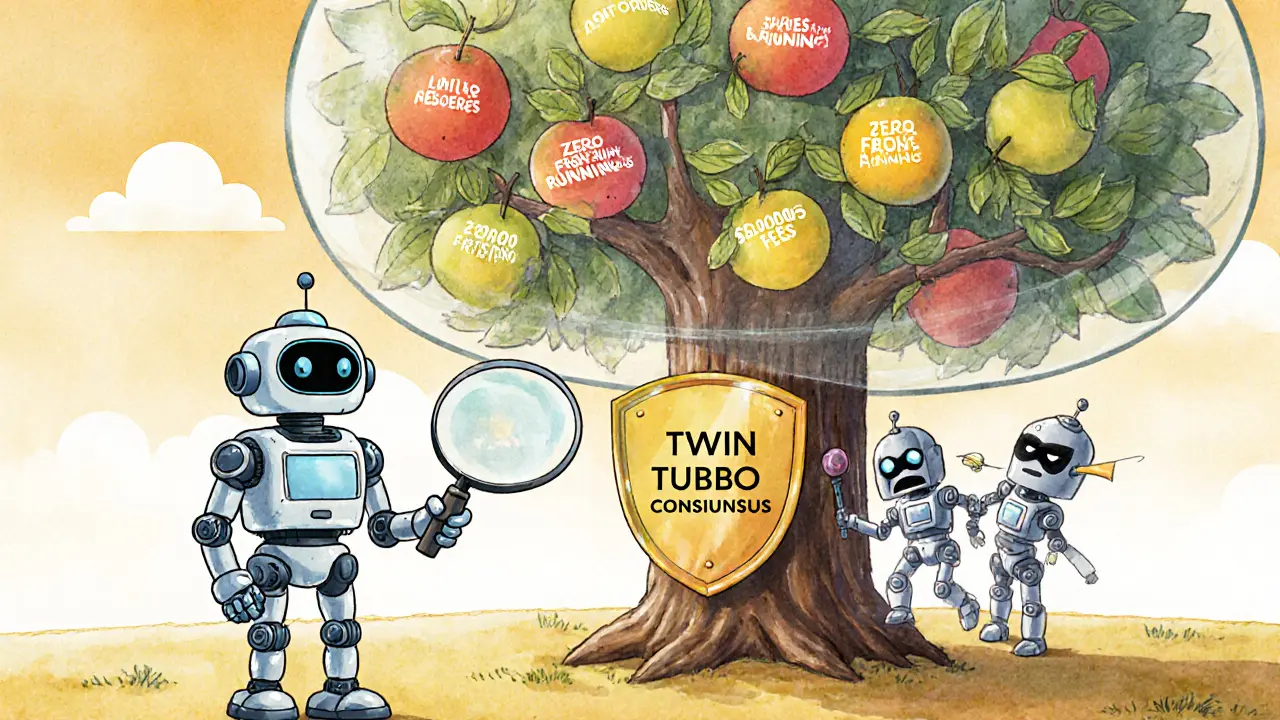

Sei’s speed isn’t magic. It’s architecture. Most blockchains process transactions one after another, even if they’re unrelated. Sei uses something called parallel execution. If two people are trading ETH/USDC and another two are trading SOL/USDC, Sei can handle all four at the same time. No waiting. No queue. It also has a native order-matching engine built right into the blockchain. On other networks, DEXs like Uniswap use automated market makers (AMMs) that rely on pools and math. That’s fine for casual swaps, but terrible for limit orders or complex strategies. Sei lets traders place real limit orders - just like on Binance or Coinbase - but fully on-chain. No centralized server. No middleman. No delays. Add to that a consensus mechanism called Twin Turbo, which cuts block finality down to 300-400 milliseconds. That’s faster than most credit card approvals. And it does this while hitting 12,500 transactions per second (TPS) - beating Solana’s 10,000 TPS.How much does it cost to trade on Sei?

Fees are dirt cheap. On average, 10,000 transactions cost less than $0.05. That’s about $0.000005 per trade. For comparison:- Ethereum: $1.50-$5 per trade during normal traffic

- Solana: $0.00025-$0.001 per trade (still 20x more expensive than Sei for high-frequency traders)

Is Sei compatible with Ethereum?

Yes. Sei is fully EVM-compatible. That means if you know Solidity (Ethereum’s coding language), you can deploy your smart contracts on Sei with almost no changes. You don’t need to relearn everything. You can use MetaMask, Phantom, or any other Ethereum wallet - just add Sei’s network details manually. Developers have been quick to take advantage: over 800,000 daily active addresses are already using Sei-based DEXs as of late 2024. There’s even a $10 million developer incentive program to encourage more trading apps to build on Sei. That’s not just marketing - it’s a real push to fill the ecosystem with tools traders actually use.

How does Sei compare to Solana and Ethereum?

Here’s a quick breakdown:| Feature | Sei | Solana | Ethereum |

|---|---|---|---|

| Transactions per second (TPS) | 12,500 | 10,000 | 15 |

| Block finality time | 300-400ms | 400-600ms | 5-15 minutes |

| Average trade fee (for 10k tx) | ~$0.05 | ~$2.50 | ~$15,000 |

| Native order book support | Yes | No | No |

| Front-running protection | High | Low | Very low |

| Developer ease (EVM) | Yes | No | Yes |

What apps are built on Sei?

You won’t find a million random NFT projects on Sei. But you’ll find serious trading infrastructure:- Hyperliquid - a top-tier perpetuals DEX with $200M+ volume daily

- Pheasant Network - cross-chain liquidity protocol optimized for Sei

- Magma - spot trading DEX with real order books

- Marginfi - lending and borrowing built for traders

What’s next for Sei? The "Sei Giga" upgrade

Sei isn’t resting. The next major upgrade, called Sei Giga, is expected in late 2025. It aims to push performance to 200,000 TPS and 5 gigagas per second - a 50x jump over current EVM chains. It’s not just about speed. The upgrade introduces a new consensus protocol called Autobahn, which separates consensus from state computation. Think of it like having 10 chefs cooking different dishes at once, instead of one chef waiting for each step to finish. There’s also a planned Model Context Protocol (MCP) Server - this lets AI tools like ChatGPT interact with Sei using plain language. Imagine typing: "Buy 100 ETH when price drops below $3,200 and sell half if it rises 5%" - and the AI executes it on-chain. That’s not sci-fi. It’s coming.

Who’s behind Sei?

Sei has serious backing. Investors include:- Coinbase Ventures

- Circle (issuer of USDC)

- Flow Traders (global market maker)

- GSR (crypto trading firm)

Is Sei right for you?

If you’re a casual crypto holder who just buys and holds Bitcoin - Sei won’t change your life. But if you:- Trade on DEXs regularly

- Use limit orders, stop-losses, or arbitrage strategies

- Get frustrated by slippage or failed trades

- Worry about bots front-running your orders

16 Comments

Ayanda Ndoni

October 28, 2025 AT 10:07 AMSei? Sounds like another vaporware project with a fancy website and too many buzzwords. I've seen this movie before.

Serena Dean

October 29, 2025 AT 13:01 PMActually, this one’s different. I’ve tested Hyperliquid on Sei and my limit orders filled in under 0.4 seconds with fees under $0.00001. No joke. If you’ve ever been front-run on Ethereum, you’ll weep with relief.

Jonathan Tanguay

October 29, 2025 AT 23:03 PMSei’s not even close to being the future. You people keep acting like parallel execution is some kind of breakthrough when Solana’s been doing it for years. And don’t get me started on that 12,500 TPS claim - it’s peak marketing fluff. Real throughput drops to 2k during congestion, just like every other chain. And don’t even mention the EVM compatibility - it’s a hack, not a design. The team’s just copying Ethereum’s mistakes and slapping on a new name. They’re not innovating, they’re rebranding. And don’t tell me about institutional backing - Coinbase Ventures invests in everything that glows. That doesn’t make it good, it makes it trendy.

Chloe Jobson

October 30, 2025 AT 08:43 AMFront-running protection is the real win here. On Ethereum, I lost $12k in one week to sandwich bots. On Sei? Zero. The native order book + parallel execution is a game-changer for algo traders. And the fees? Unbelievable. I’m moving all my liquidity.

Akinyemi Akindele Winner

October 31, 2025 AT 02:25 AMSei? More like Sigh. All this speed and zero soul. You’re trading like a Wall Street robot now - no chaos, no drama, no crypto spirit. Where’s the wildness? Where’s the rugpull poetry? This is just Binance with a blockchain tattoo.

Andrew Morgan

October 31, 2025 AT 07:15 AMBeen using Magma for a week now. Honestly? It feels like trading on a clean desk after years of filing papers in a dumpster. No lag, no drama, just clean fills. I didn’t think crypto could feel this smooth. Still can’t believe it’s decentralized.

Michael Folorunsho

November 2, 2025 AT 05:08 AMSei is just another American crypto scam dressed up in tech jargon. The world doesn’t need faster trading - it needs less greed. This is why the West keeps failing. You optimize for profit, not people. I hope your wallets crash harder than your ethics.

John Murphy

November 4, 2025 AT 04:34 AMIt’s interesting how Sei solves real pain points without trying to be everything. Most chains feel like trying to use a Swiss Army knife to perform surgery. Sei’s just a scalpel. Simple. Precise. Effective.

Sean Huang

November 5, 2025 AT 14:19 PMSei? Yeah right. This is all a Fed-backed stealth crypto surveillance system. They want to track every trade, every order, every microsecond of your life. The AI integration? That’s not for convenience - it’s for behavioral control. They’re training bots to predict your moves before you make them. You think this is innovation? It’s the beginning of the end. Don’t be fooled. The blockchain is not free if it’s optimized for efficiency.

Zach Crandall

November 7, 2025 AT 13:19 PMWhile the technical specs are impressive, I must note that the cultural adoption of Sei in non-Western markets remains underdeveloped. The ecosystem’s design assumes a certain level of financial literacy and infrastructure access that is simply not universal. This is not a global solution - it’s a privileged one.

James Young

November 7, 2025 AT 20:36 PMYou guys are all missing the point. Sei’s not even the best. Look at Aptos. Their Move language is safer, their consensus is more decentralized, and they’re already hitting 15k TPS. Sei’s just a copycat with better PR. And don’t even get me started on the team - ex-Goldman Sachs? That’s a red flag, not a credential. They’re here to extract, not build.

MANGESH NEEL

November 8, 2025 AT 20:49 PMSei is the death of crypto. You want speed? You want low fees? You want order books? Then you want Wall Street. You want freedom? You want chaos? You want to gamble with your life savings on a meme coin at 3am? Then stop worshiping this corporate blockchain. Sei is the final surrender. The crypto dream is dead. Long live the algorithm.

Roxanne Maxwell

November 9, 2025 AT 20:55 PMI’ve been watching Sei for months and honestly, I didn’t think I’d care - but I tried it and now I can’t go back. My trades used to feel like shouting into a hurricane. Now they feel like whispering to a friend. Thank you, Sei team. You actually listened.

Ali Korkor

November 11, 2025 AT 14:44 PMHey newbies - if you’re thinking about trying Sei, just connect your wallet and swap a tiny bit of ETH for SEI on Magma. Don’t overthink it. Just feel the difference. No need to read 10 pages of whitepapers. Just trade. You’ll know.

Patrick De Leon

November 11, 2025 AT 21:23 PMSei is a triumph of engineering over ideology. The fact that a blockchain can now match centralized exchange performance without centralization is nothing short of revolutionary. The world will adapt. The skeptics will be left behind.

Elliott Algarin

November 12, 2025 AT 06:17 AMIt’s strange. We spent years chasing decentralization, then we spent years chasing speed. Now Sei gives us both - quietly, efficiently, without fanfare. Maybe the future isn’t loud. Maybe it’s just… fast.