Crypto Exchange: How to Choose, Use, and Stay Safe on Crypto Platforms

When you use a crypto exchange, a platform where you buy, sell, or trade digital currencies like Bitcoin and Ethereum. Also known as cryptocurrency trading platform, it’s the gateway between your money and the blockchain world—but not all of them are built the same. Some are huge, regulated, and trusted by millions. Others have no real track record, hidden fees, or worse—no way to get your money back if something goes wrong.

What you need from a crypto exchange, a platform where you buy, sell, or trade digital currencies like Bitcoin and Ethereum. Also known as cryptocurrency trading platform, it’s the gateway between your money and the blockchain world—but not all of them are built the same. Some are huge, regulated, and trusted by millions. Others have no real track record, hidden fees, or worse—no way to get your money back if something goes wrong.

Regulations shape how these platforms operate. In the UK, AML rules, anti-money laundering requirements enforced by the Financial Conduct Authority. Also known as crypto compliance, they force exchanges to verify users and report suspicious activity. In Russia, you can own crypto but can’t use it to pay for coffee. In Turkey, you can trade Bitcoin but can’t buy pizza with it. These rules don’t just affect big companies—they change what’s possible for you. If you’re trading on a platform that ignores these rules, you’re taking a risk no reward is worth.

Security is another layer. Losing your seed phrase means losing your crypto forever—no support team can help you. That’s why your exchange matters. If you keep your coins on an exchange, you’re trusting them to protect your assets. But platforms like TWCX have zero verifiable info—no fees, no reviews, no security details. That’s not a platform. That’s a trap. Stick to exchanges with clear track records, transparent fees, and real user feedback.

Advanced tools like stop-loss orders, trailing stops, and OCO orders help you manage risk automatically. These aren’t just for pros—they’re for anyone who doesn’t want to stare at their screen 24/7. And while airdrops like BITICA COIN or SOLO might look like free money, most are gimmicks. Some are outright scams. Know the difference before you click.

What you’ll find below isn’t a list of top exchanges. It’s a collection of real stories: why volume dropped after new laws, how flash loans get hacked, why some tokens vanish overnight, and what happens when you lose your recovery phrase. These aren’t theory pieces. They’re lessons from people who’ve been there. Whether you’re new or experienced, this is the stuff no one tells you until it’s too late.

9 Feb 2026

SquadSwap v2 is a community-governed DEX on BNB Chain offering CEX-like tools with full decentralization. It rewards liquidity providers with 90% of fees but struggles with low trading volume and zero user reviews.

Continue reading...

7 Feb 2026

Binance.US offers low fees, high staking yields, and 180+ cryptocurrencies for U.S. traders. Learn its pros, cons, and how it stacks up against Coinbase and Kraken in 2026.

Continue reading...

21 Jan 2026

Adonis Exchange is a fast, niche crypto platform for trading emerging tokens and rapid listings. Low fees, no app, no insurance, and no regulation make it risky for beginners but useful for experienced traders and projects needing speed.

Continue reading...

22 Dec 2025

LiteBit.eu was a popular EU crypto broker that shut down in 2024. Learn why it failed, what happened to users' funds, and the best alternatives today for buying crypto with euros.

Continue reading...

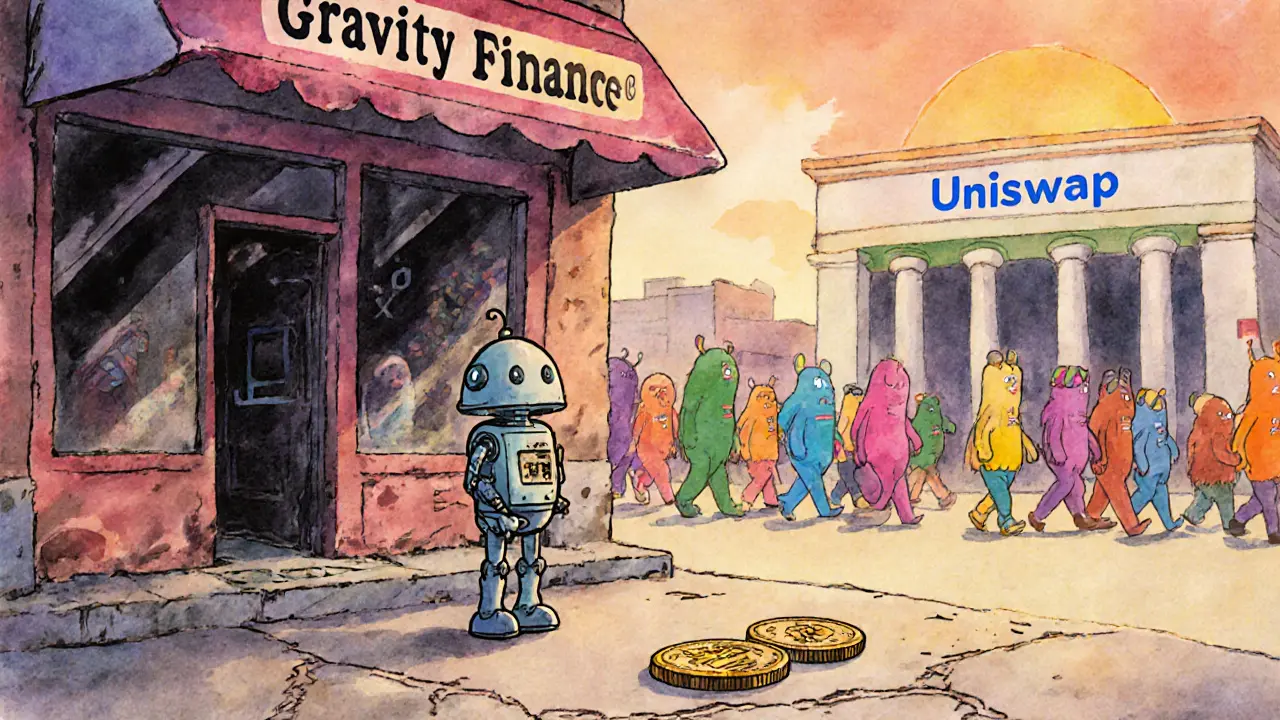

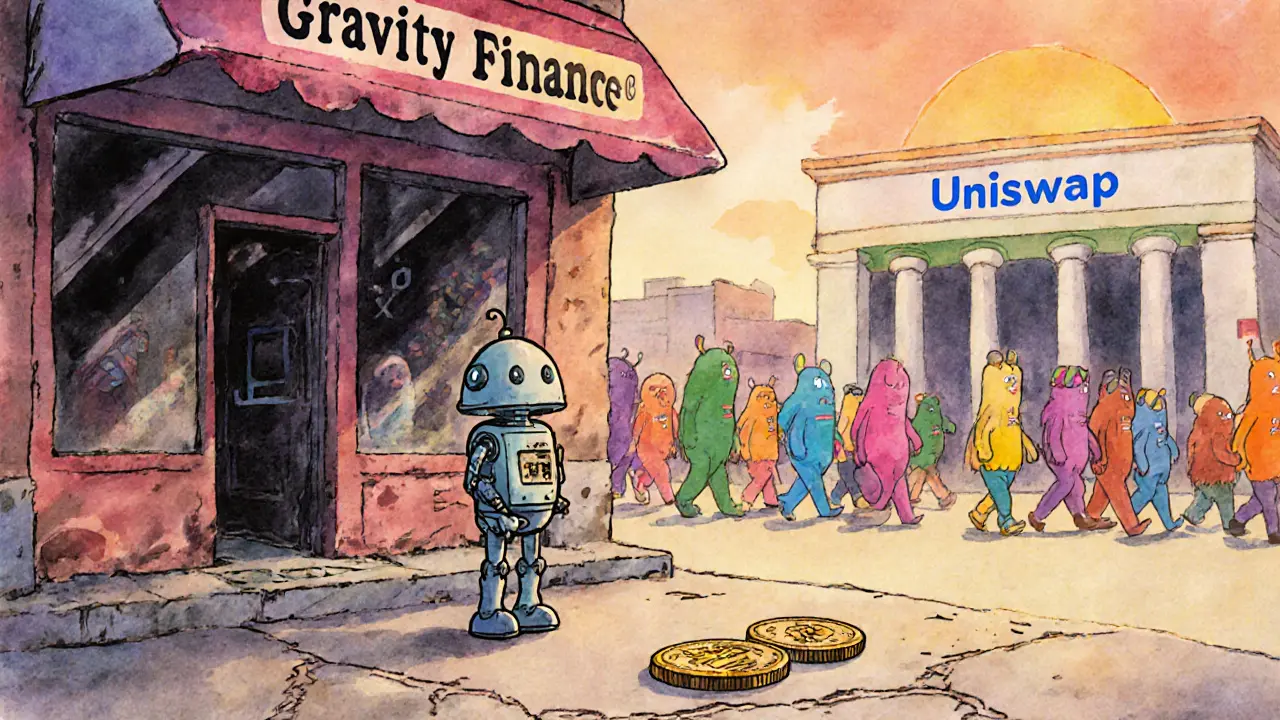

14 Nov 2025

Gravity Finance is a tiny, inactive decentralized exchange with minimal trading volume and no transparency. Learn why it's not worth your time or funds in 2025.

Continue reading...

3 Nov 2025

United Exchange claims to be a full-service crypto exchange, but lacks transparency, reviews, security details, and regulatory info. Learn why it's too risky to use and what safer alternatives exist in 2025.

Continue reading...

31 Oct 2025

MistSwap is a decentralized crypto exchange with multi-chain support but lacks transparency, user reviews, and verified security audits. Learn what it offers - and why you should proceed with extreme caution.

Continue reading...

15 Oct 2025

Compare the top U.S. crypto exchanges in 2025-Coinbase, Kraken, Crypto.com, Robinhood, and Binance US. See fees, security, features, and which one fits your trading style best.

Continue reading...

10 Oct 2025

ProBit Global is a no-KYC crypto exchange with 500+ altcoins, zero hacks since 2017, and fiat on-ramps. Ideal for privacy-focused traders hunting for low-cap gems not found on Binance or Coinbase.

Continue reading...

5 Sep 2025

Mercurity.Finance is a regulated crypto exchange focused on EU and Asian markets, offering strong compliance, secure trading, and fast cross-border settlements - ideal for businesses, not retail traders.

Continue reading...