DeFi Exchange: What It Is and Which Ones Actually Work in 2025

When you trade crypto on a DeFi exchange, a decentralized platform that lets users swap tokens directly from their wallets without a central company controlling the trade. Also known as a decentralized exchange, it removes banks, KYC forms, and hidden fees—putting control back in your hands. Unlike traditional platforms like CoinBene or MEXC, a true DeFi exchange runs on smart contracts. No one can freeze your funds, change the rules mid-trade, or disappear with your money. That’s the promise. But in 2025, most of them have failed.

There are only a handful of DeFi exchanges, platforms built on public blockchains that use automated market makers (AMMs) to match trades. Also known as AMMs, they rely on liquidity pools, reserves of paired tokens locked in code that enable instant swaps instead of order books. Uniswap, Aave, and PancakeSwap still work because they have real users, deep pools, and active development. Others? Serum Swap is dead. OpenSwap never existed. KongSwap has almost no liquidity. You’re not trading—you’re gambling on ghost systems.

The biggest risk isn’t hacking—it’s impermanent loss, the hidden cost of providing liquidity to DeFi pools when token prices shift. Many users lose money not because they got scammed, but because they didn’t understand how their own deposits moved in and out of pools. Tools to calculate this risk exist, but most beginners ignore them until it’s too late. And then there’s the flood of fake tokens labeled as "DeFi"—like KONG or NOODLE—that look real but have zero trading volume, no team, and no future.

What’s left in 2025? A few strong platforms that actually solve problems: swapping ETH for USDC without a middleman, earning yield on stablecoins without trusting a bank, or accessing new tokens the moment they launch. But the space is cleaner now. The hype is gone. The scams are exposed. What remains are the tools that work—built by teams who stick around, not those who vanish after a token drop.

Below, you’ll find real reviews of the DeFi exchanges that still matter, deep dives into the ones that died, and warnings about the fake ones pretending to be alive. No fluff. No promises of quick gains. Just what’s actually happening on-chain right now.

23 Nov 2025

VVS Finance is a low-traffic DeFi exchange on Cronos with a collapsed token price and no recent updates. Learn why it's not worth your money in 2025 - and what better alternatives exist.

Continue reading...

14 Nov 2025

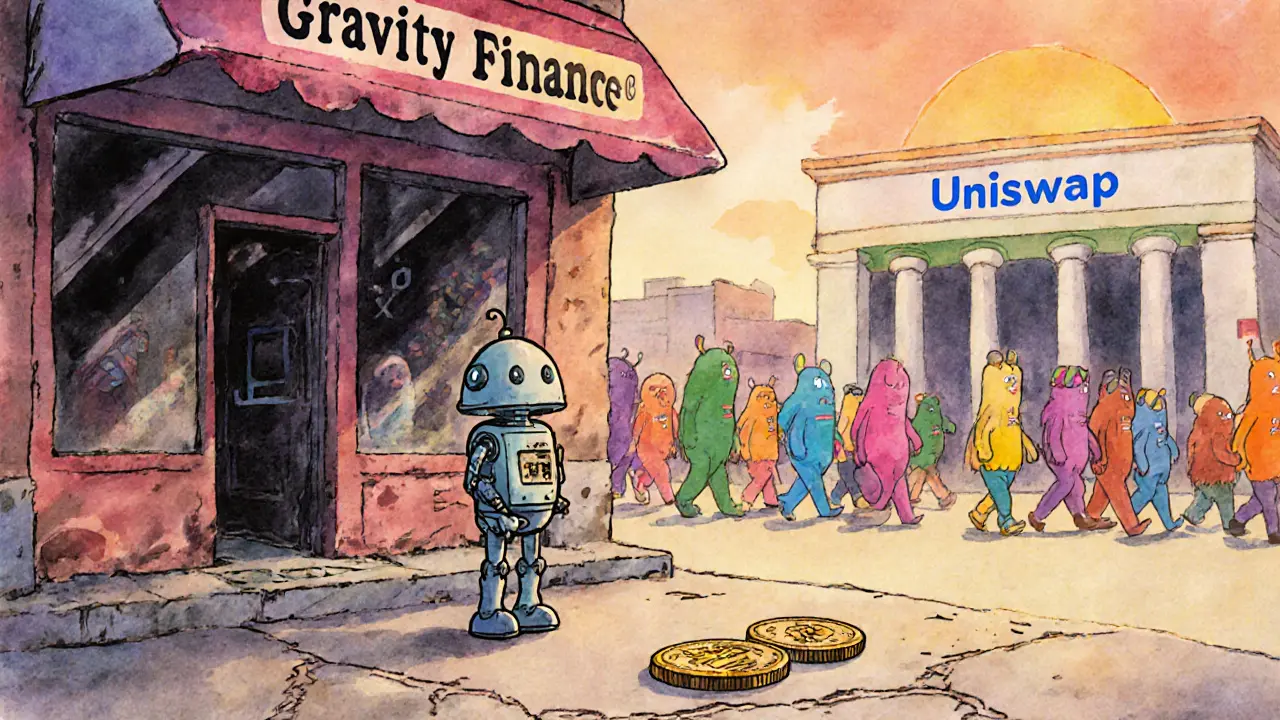

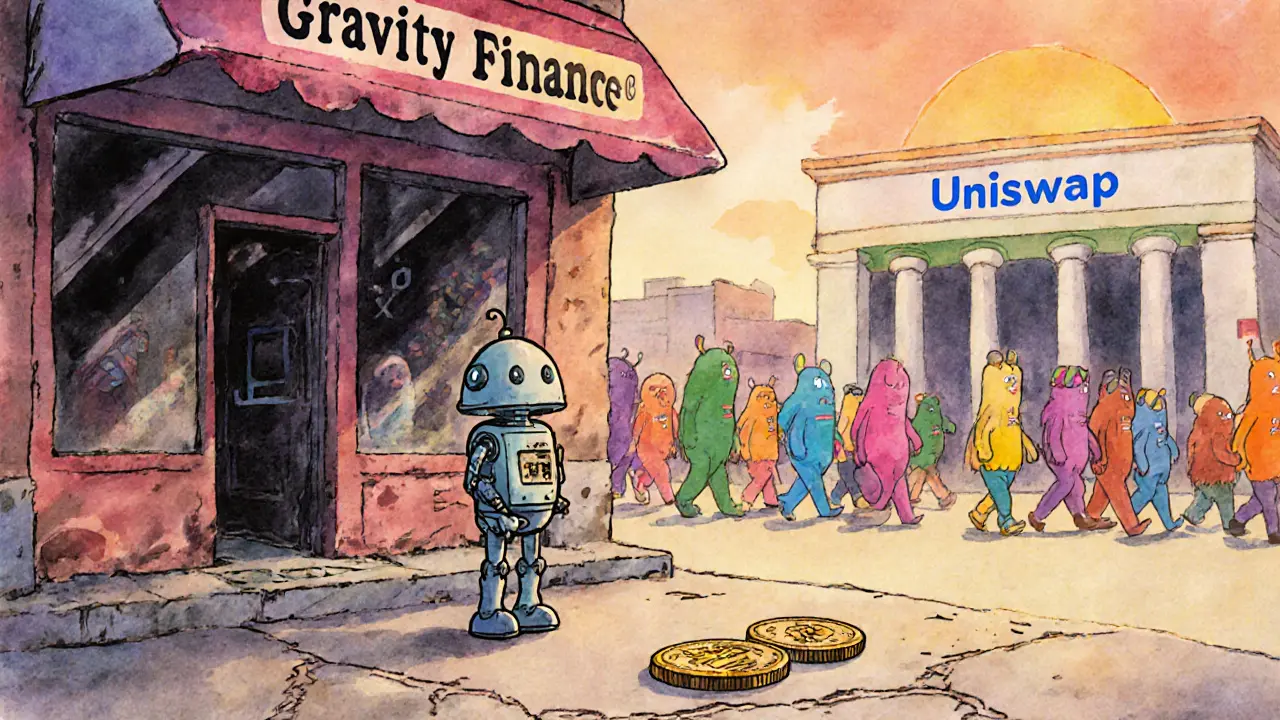

Gravity Finance is a tiny, inactive decentralized exchange with minimal trading volume and no transparency. Learn why it's not worth your time or funds in 2025.

Continue reading...