GFI Token: What It Is, Who’s Behind It, and Why You Should Be Careful

When you hear about GFI token, a cryptocurrency token with no public whitepaper, team, or blockchain presence. Also known as GFI coin, it’s one of dozens of tokens that pop up overnight with flashy promises but zero substance. Unlike real projects like Graphlinq Chain (GLQ), a no-code blockchain platform with clear utility and active users or Serenity (SERSH), a crypto project built for digital inheritance with real-world use, GFI token doesn’t solve a problem. It doesn’t have a website, GitHub, or even a Twitter account that’s been active in the last year. There’s no record of it being listed on any major exchange. And yet, people are still searching for it—often because they saw a fake airdrop claim or a Telegram group pushing it as the "next big thing."

Scams like GFI token rely on one thing: urgency. They create FOMO with fake price charts, fake testimonials, and fake claims of partnerships. You’ll see posts saying "GFI will hit $100 after listing on Binance"—but Binance doesn’t list tokens without due diligence. Real tokens like Noodle (NOODLE), a Solana meme coin with zero circulating supply and no team or Content Bitcoin (CTB), a coin with no code, no team, and no whitepaper at least have some traceable activity. GFI doesn’t even have that. It’s a ghost token. No blockchain explorer shows it. No wallet holds it. No exchange trades it. And if someone asks you to send crypto to claim GFI tokens, you’re being scammed. These aren’t investments—they’re traps. The same patterns show up in fake airdrops like TOKAU ETERNAL BOND, a non-existent project pretending to be from Tokyo AU or CBSN StakeHouse NFT, a fabricated claim tied to a real-looking but inactive network. They all look the same: high energy, zero proof.

What you’ll find below is a collection of real stories about tokens that looked promising but turned out to be empty. Some were abandoned. Some were scams. Some were just poorly built. And every single one of them teaches you how to spot the next GFI token before you lose money. These aren’t just warnings—they’re practical lessons from people who got burned. You’ll learn how to check if a token is real, how to read tokenomics without a PhD, and what to do when something sounds too good to be true. The crypto world moves fast. But the rules of trust haven’t changed. If you can’t find the team, the code, or the reason it exists, walk away.

14 Nov 2025

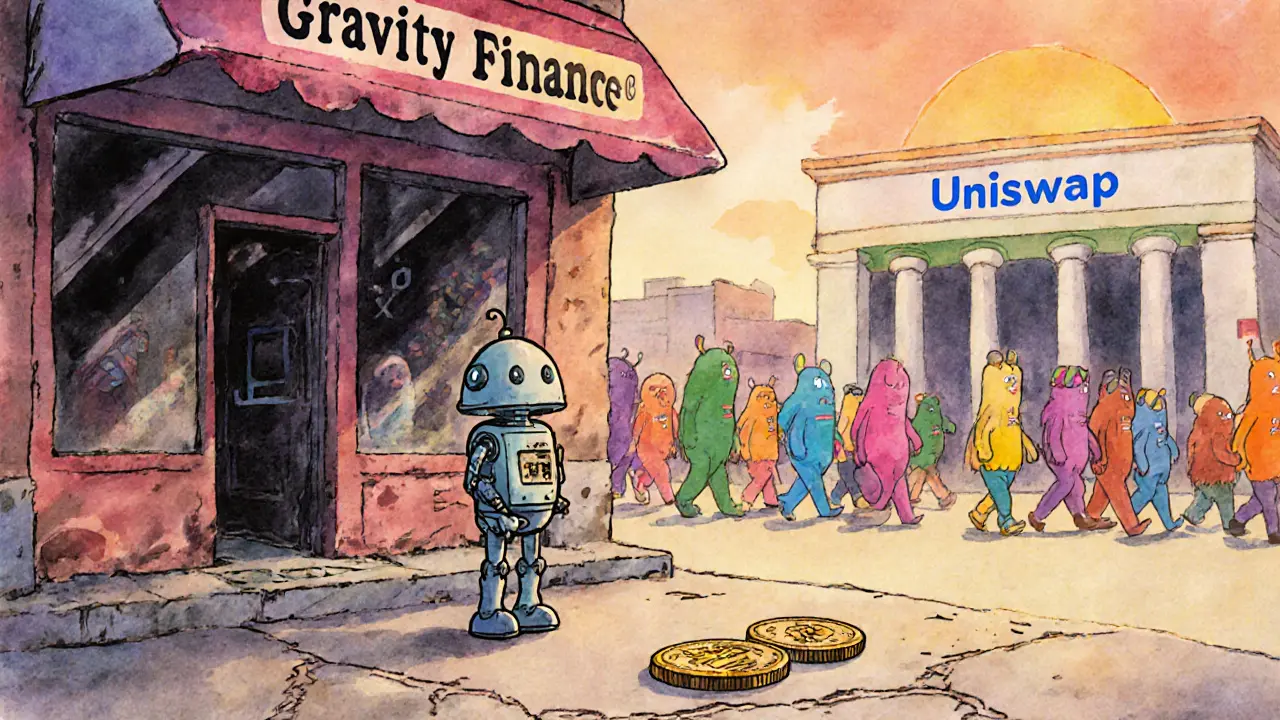

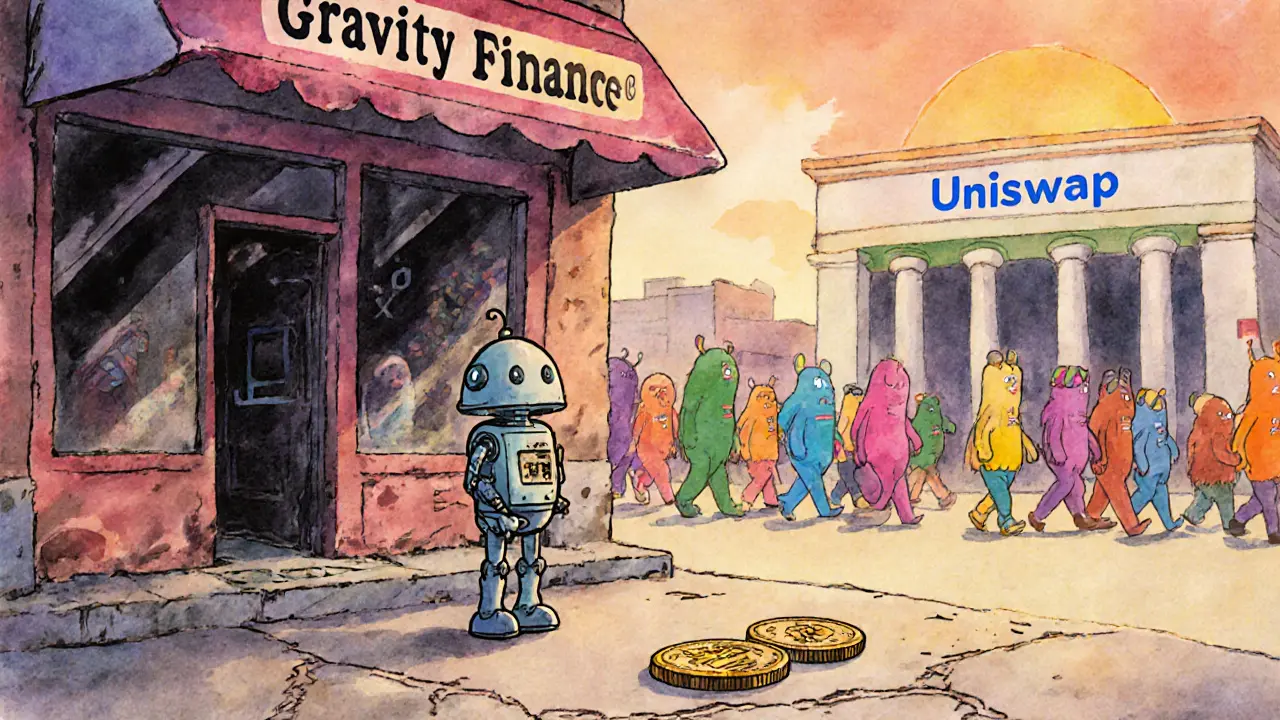

Gravity Finance is a tiny, inactive decentralized exchange with minimal trading volume and no transparency. Learn why it's not worth your time or funds in 2025.

Continue reading...