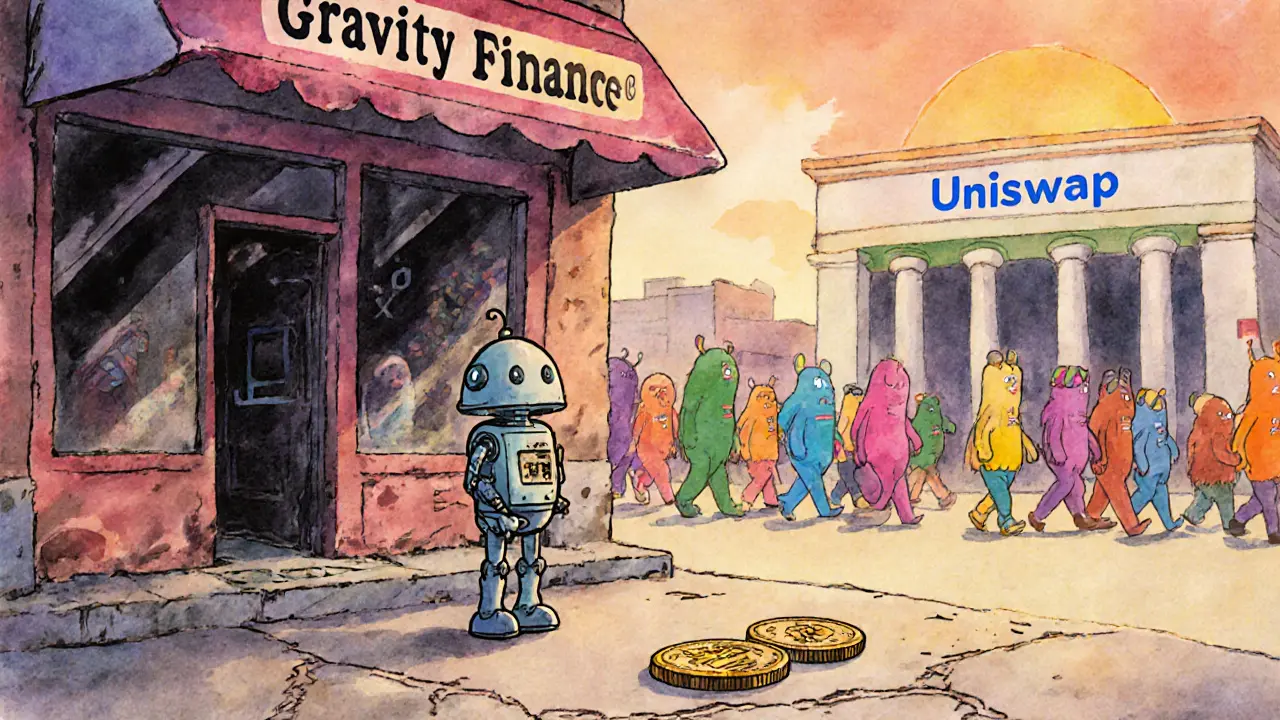

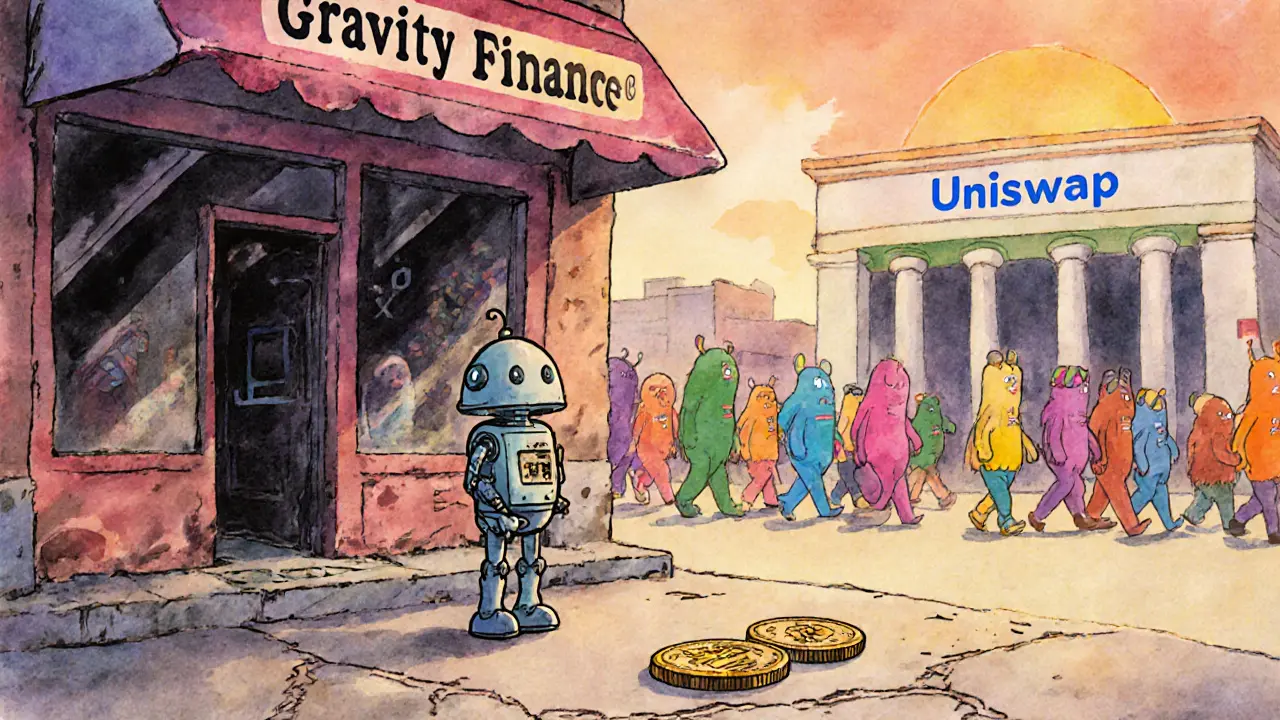

Gravity Finance: What It Is, Why It Mattered, and What Happened Next

When you hear Gravity Finance, a decentralized finance protocol that launched with high-yield farming rewards on the Binance Smart Chain. Also known as Grav Finance, it was one of those projects that looked too good to be true—and turned out to be exactly that. It promised users massive returns by locking up tokens in liquidity pools, with APYs hitting over 1,000% in its early days. People rushed in, drawn by the hype, the flashy website, and the promise of easy money. But behind the scenes, the smart contracts were opaque, the team anonymous, and the token supply dangerously concentrated. By mid-2021, the project collapsed in a matter of hours, wiping out millions in user funds. This wasn’t just a rug pull—it was a textbook case of how DeFi can go wrong when incentives are misaligned and accountability is absent.

What made Gravity Finance stand out wasn’t just its collapse, but how it mirrored other failed DeFi experiments. It relied on yield farming, a practice where users supply liquidity to decentralized exchanges in exchange for token rewards. Also known as liquidity mining, it was the engine driving Gravity’s growth. But without real utility or sustainable revenue, those rewards were just borrowed time. The same pattern shows up in dozens of projects: a new token, a flashy dashboard, a surge in TVL (total value locked), then silence. When the team stopped posting, the liquidity vanished, and the token price crashed to near zero. Users who didn’t exit early lost everything. This isn’t speculation—it’s history. And it’s happened again and again since.

Today, liquidity pool, a pool of tokens locked in a smart contract to enable trading on decentralized exchanges. Also known as AMM pools, they’re still the backbone of DeFi—but smarter investors know to ask harder questions. Who controls the keys? Is the code audited? Are the rewards backed by real fees or just new token issuance? Gravity Finance didn’t answer any of these. And that’s why it died. The posts below dive into similar cases: projects that vanished, tokens that lost all value, and the warning signs you can spot before it’s too late. You’ll find real stories of what happened to real people, not just theory. If you’ve ever wondered how a crypto project can look legitimate and still be a trap, this collection shows you exactly how it’s done—and how to avoid it.

14 Nov 2025

Gravity Finance is a tiny, inactive decentralized exchange with minimal trading volume and no transparency. Learn why it's not worth your time or funds in 2025.

Continue reading...