Dai Vault Calculator

How Dai Works

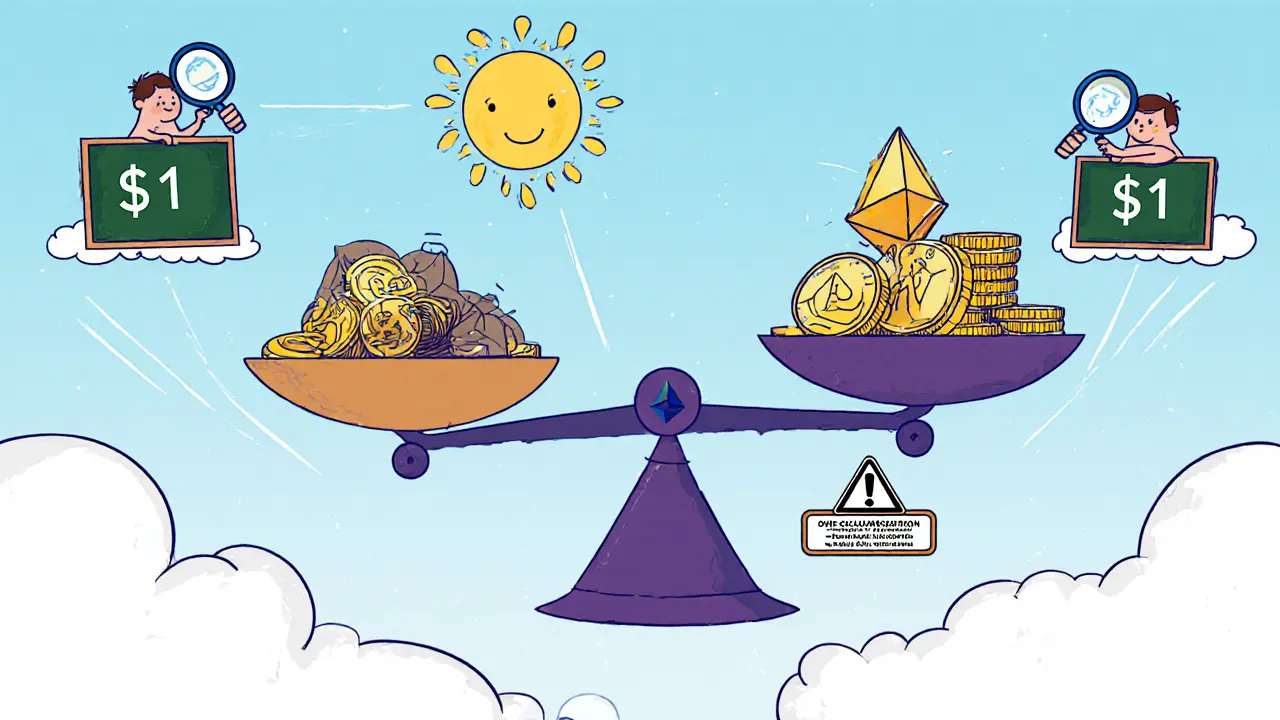

Dai requires over-collateralization. To generate $100 DAI, you need at least $150 in Ethereum (ETH) or other approved assets. The system automatically adjusts stability fees and collateral ratios to maintain the $1 peg.

Generate Dai

Results

Dai is a cryptocurrency that stays worth $1 - not because it’s backed by a bank, but because it’s locked inside smart contracts on the Ethereum blockchain. Unlike other stablecoins like USDT or USDC, which hold actual U.S. dollars in bank accounts, Dai is built entirely on crypto. It’s created when people lock up assets like Ethereum (ETH) into a digital vault and borrow DAI against them. This system, called the Maker Protocol, has been running since 2017 and is now governed by thousands of token holders in a decentralized organization called MakerDAO. No single company controls it. No central bank prints it. And yet, for over seven years, Dai has held its $1 value through market crashes, bank failures, and wild crypto swings.

How Dai Stays Worth $1 Without a Bank

Dai doesn’t rely on trust in a company. It relies on math and economics. To get Dai, you must deposit more crypto than the amount of DAI you want. For example, if you want $100 in DAI, you need to lock up at least $150 worth of Ethereum or other approved assets. That 50% buffer is called over-collateralization. It’s the safety net. If ETH drops 30%, your $150 collateral is still enough to cover $100 in DAI. If it drops too far - say, 40% in minutes during a panic - the system automatically sells part of your collateral to pay back the loan. You lose some of your ETH, but the DAI stays at $1.

This isn’t magic. It’s a feedback loop. When DAI trades below $1, the system lowers the borrowing fee (called the stability fee) to encourage more people to borrow DAI, increasing demand. When DAI trades above $1, the fee goes up, making it more expensive to borrow, which reduces supply. These adjustments happen automatically through smart contracts, without any human intervention.

What You Can Use Dai For

Dai isn’t just a store of value - it’s a working tool in decentralized finance (DeFi). You can use it to:

- Pay for goods and services on platforms that accept crypto, like Shopify merchants or decentralized marketplaces

- Lend it out on platforms like Aave or Compound to earn interest, often higher than traditional savings accounts

- Trade it on exchanges without risking price swings - perfect for moving between volatile coins without cashing out to fiat

- Use it as collateral to borrow other crypto assets

During the March 2023 U.S. banking crisis, when USD Coin (USDC) briefly dropped to 88 cents because its issuer held failed bank deposits, Dai stayed at $1. That’s when many users realized: if you don’t trust banks, Dai is the only stablecoin you can truly rely on.

How Dai Is Different From USDT and USDC

USDT and USDC are centralized. Tether and Circle (the companies behind them) hold U.S. dollars in banks. That means they can freeze your funds, get pressured by regulators, or go bankrupt if their reserves are mismanaged. In 2023, USDC’s depeg was a wake-up call. Dai’s entire backing is on-chain. You can verify every dollar’s worth of collateral in real time on Etherscan. No bank statements. No hidden assets. Just transparent, public smart contracts.

But there’s a trade-off. With USDC, you can withdraw your $1 as real cash anytime. With Dai, you can’t. You need to sell it on an exchange or swap it for ETH or another asset. That makes Dai less convenient for everyday use - but far more resilient in crises.

Who Controls Dai? (Spoiler: No One)

MakerDAO is a decentralized organization made up of people who hold MKR tokens. These token holders vote on changes: what assets can be used as collateral, what the borrowing fee should be, even how to respond to hacks. In 2024, they approved adding real-world assets like U.S. Treasury bonds as collateral - a first for a major DeFi protocol. This means Dai’s backing is no longer 100% crypto. About 28% of its total value now comes from low-risk, regulated assets. That’s a big shift, and it’s all decided by votes from thousands of participants around the world.

There’s no CEO. No headquarters. No customer service line. If something goes wrong, you can’t call support. You have to understand the system yourself - or use a trusted interface like Oasis.app or MakerDAO’s official portal.

The Risks of Using Dai

Dai isn’t risk-free. Here’s what can go wrong:

- Liquidation: If your collateral drops too fast, your vault gets sold off. One user lost $1,200 in ETH during a 12% price drop in 10 minutes because they didn’t have enough buffer or gas fees to react.

- Complexity: Setting up a vault, monitoring your collateral ratio, and paying stability fees takes time. New users often get overwhelmed.

- ETH dependence: Even with diversification, over 68% of Dai’s backing is still Ethereum. If ETH crashes hard, the whole system feels the pressure.

- Gas fees: On Ethereum, transaction costs can spike during high demand. If you’re trying to add collateral during a crash, you might pay $50 in gas just to save your position.

Experienced users recommend keeping your collateralization ratio above 200% during volatile times. That’s double the minimum. It’s not required - but it’s the difference between sleeping well and losing your assets.

How to Get Started With Dai

If you want to try Dai, here’s how:

- Buy Ethereum (ETH) on an exchange like Coinbase or Kraken.

- Connect your wallet (MetaMask, Rainbow, or similar) to Oasis.app or the official MakerDAO portal.

- Deposit ETH into a Vault. The system will show you how much DAI you can generate.

- Generate DAI. It appears in your wallet instantly.

- Monitor your collateral ratio. If it drops below 150%, you’ll get alerts. Add more ETH or repay DAI to stay safe.

- When you’re ready, repay your DAI + stability fee (around 1-5% per year) to unlock your collateral.

Most people spend their DAI within days - it’s designed for spending and trading, not hoarding. Only about 28% of DAI is held longer than 30 days, according to MakerDAO’s own data.

The Future of Dai

In 2024, MakerDAO completed its "Endgame" plan, splitting governance into five smaller groups to make decisions faster. They’ve added support for 9 blockchains, including Arbitrum and Optimism, making Dai cheaper and faster to use. By 2025, they plan to connect to 15 chains and integrate with traditional finance systems through regulated real-world asset partnerships.

Analysts are split. Standard Chartered predicts Dai will hit $10 billion in market cap by 2026. The Bank for International Settlements warns it could amplify crypto crashes. But one thing’s clear: Dai is the only stablecoin that proves you don’t need banks to create trust.

Is Dai Right for You?

Choose Dai if:

- You want a stablecoin that can’t be frozen or censored

- You’re active in DeFi and need a reliable trading pair

- You distrust centralized institutions

- You’re willing to learn how to manage collateral and gas fees

Avoid Dai if:

- You need to cash out to fiat quickly

- You don’t want to monitor your positions

- You expect customer service when things go wrong

Dai isn’t for everyone. But for those who value freedom over convenience, it’s the most powerful stablecoin ever built.

Is Dai really backed by $1 for every DAI?

Yes. Every DAI in circulation is backed by more than $1 worth of crypto assets locked in smart contracts. As of July 2024, the total value of collateral backing Dai was over $5.2 billion, while the total supply of DAI was $5.1 billion. The extra 20-30% is the safety buffer that prevents depegging during price drops.

Can Dai lose its $1 peg?

It has, briefly. During the March 2020 "Black Thursday" crash, ETH dropped 40% in minutes and caused some under-collateralized loans. DAI dipped to 95 cents for a few hours. But the system’s automatic auctions and fee adjustments quickly restored the peg. Since then, it’s held $1 through multiple bear markets, including the 2022 Terra collapse and 2023 bank failures.

Is Dai safe from government seizure?

Yes - as long as you hold it in your own wallet. Unlike USDC, which can be frozen by Circle or regulated by the U.S. government, Dai is decentralized. No single entity controls it. Regulators can’t shut it down. But if you hold Dai on an exchange like Coinbase, they can freeze your account. Always store Dai in a non-custodial wallet for full control.

What’s the difference between Dai and ETH?

ETH is volatile. Its price changes daily - sometimes by 10% or more. Dai is designed to stay at $1. You use ETH as collateral to create Dai. Think of ETH as the fuel and Dai as the stable currency you get from it. You can trade Dai for other assets without worrying about crypto swings.

Can I earn interest on Dai?

Yes. You can lend Dai on DeFi platforms like Aave or Compound and earn interest - often 3-8% APY. That’s higher than most savings accounts. But remember: lending crypto carries risks. If the platform gets hacked or the market crashes, you could lose your funds. Only lend what you can afford to lose.

12 Comments

Nabil ben Salah Nasri

November 1, 2025 AT 21:31 PMDai is the real deal 😊 I’ve used it for months now-no freezes, no surprises. Even when USDC dipped, Dai just sat there like a calm ninja. Love that it’s not tied to some bank’s balance sheet. Crypto’s future is here, and it’s decentralized.

Masechaba Setona

November 2, 2025 AT 13:06 PMOh please. 'Decentralized' is just a marketing word now. MakerDAO is controlled by a few whale wallets and a handful of DAO delegates who vote like corporate board members. The 'no one controls it' line is a fairy tale for newbies. Real decentralization would mean no voting at all-just code. But no, they added treasury bonds. That’s not innovation. That’s surrender.

Phyllis Nordquist

November 4, 2025 AT 11:58 AMWhile Masechaba raises a valid point about governance centralization, it's worth noting that MakerDAO’s on-chain transparency remains unparalleled. Every collateral ratio, every vote, every liquidation is publicly verifiable. The shift toward real-world assets is a pragmatic evolution-not a betrayal. It reduces ETH dependency and enhances systemic resilience. This is not centralization; it’s diversification with accountability.

Eric Redman

November 6, 2025 AT 07:35 AMHAHA okay but who actually uses this? I saw someone post a screenshot of their Dai balance and someone else replied 'cool, now send me 10 DAI for my crypto club membership' 😂 Like bro, you’re holding digital cash that you can't even withdraw to your bank without selling it. It’s like owning a gold bar in a bunker with no lockpick. Cool theory, terrible UX.

Jason Coe

November 7, 2025 AT 17:12 PMEric, you’re not wrong about the UX being clunky, but that’s the price of sovereignty. If you want convenience, use USDC and trust Circle. If you want to know your money can’t be seized by a regulator or frozen because some CEO got spooked by a tweet, then you deal with the gas fees and the collateral ratios. I’ve had my vault open since 2021. I’ve paid maybe $12 in gas total over three years. I’ve lost zero dollars to depeg. And I sleep better knowing my savings aren’t sitting in a bank that failed in March 2023. It’s not about being cool-it’s about being prepared.

Brett Benton

November 9, 2025 AT 09:01 AMYES. This is why I tell everyone: DAI isn’t for everyone, but if you’re even a little bit paranoid about banks or governments? It’s the only stablecoin that lets you sleep. I use it to trade between DeFi tokens. No more worrying about ETH crashing 20% while I’m at work. Just swap to DAI, chill, and come back. It’s like a financial airbag. Also, the interest on Aave is wild-8% APY? That’s more than my credit union pays on my savings account. And I didn’t even need to fill out a form.

David Roberts

November 9, 2025 AT 10:07 AMActually, the collateralization ratio is a mathematical artifact of risk modeling, not a feature. The 150% floor is arbitrary. The system relies on oracle feeds which are centralized. Chainlink is controlled by a consortium. So even if the smart contract is decentralized, the data source isn’t. And now they’re integrating Treasuries? That’s just moving the trust from banks to bond markets. You’re not escaping the system-you’re just rebranding it. The peg is only as strong as the least decentralized component.

Kaela Coren

November 10, 2025 AT 17:27 PMIt’s fascinating how the system self-corrects without human intervention. The stability fee adjustments are elegant in their simplicity. The fact that it survived Black Thursday and the 2022 bear market speaks to its robustness. I’ve studied the mechanism in detail, and it’s one of the few crypto systems that functions as intended under stress.

Monty Tran

November 11, 2025 AT 13:17 PMAnyone who says Dai is safe hasn’t read the MakerDAO docs. The governance vote in 2024 to add Treasuries was pushed through by 0.3% of voters. The rest were asleep. That’s not democracy. That’s a rigged system where whales write the rules. And if ETH crashes again? The whole thing collapses. You’re not safe. You’re just pretending to be.

Beth Devine

November 11, 2025 AT 21:26 PMFor anyone new to Dai: start small. Deposit 0.1 ETH, generate 100 DAI, watch your collateral ratio. Don’t over-leverage. Use Oasis.app-it’s beginner-friendly. And always keep extra ETH in your wallet for gas. You’ll thank yourself when the market dips. This isn’t gambling. It’s financial hygiene.

Brian McElfresh

November 13, 2025 AT 17:12 PMThey’re lying. The whole thing is a front. MakerDAO is secretly owned by the same people who run Circle. They just moved the money to Ethereum to avoid SEC scrutiny. That’s why they added Treasuries-so they can claim it’s 'hybrid' and dodge regulation. And don’t get me started on the gas fees. They’re designed to scare off the little guys so only hedge funds can play. It’s a pyramid scheme with a blockchain logo.

Hanna Kruizinga

November 15, 2025 AT 16:04 PMWhy bother? Just use USDC. It’s easier. And if the bank fails? So what? I’ll just move my money. I don’t need to be a crypto anarchist. I just want to pay my bills without losing 30% in a week. This whole 'trustless' thing sounds cool until you’re stuck paying $40 in gas to save $100.